Consumer credit and small loan companies account for a minor share of consumer credit granted to households

At the end of June 2021, the stock of loans granted by other financial institutions (OFIs) to Finnish households amounted to EUR 4.6 billion, consisting almost entirely of consumer credit. The average interest rate on the loan stock was 5.1%. However, interest rates vary significantly across the different lenders. Entities providing mainly vehicle finance account for the majority (79%) of loans granted by OFIs to households. Other entities belonging to the OFI sector and granting household loans include for example consumer credit and small loan companies, banks’ finance companies and pawnshops.

Loan receivables of consumer credit and small loan companies have decreased

The stock of loans granted by consumer credit and small loan companies, also known as payday lenders, stood at EUR 220 million at the end of June 2021. The loan stock is estimated to have decreased significantly since 2019. A 20% interest rate cap[1] on consumer credit entered into force in September 2019. All loans granted by consumer credit and small loan companies were unsecured. In June 2021, they accounted for a minor share (1%) of the total stock of household consumer credit. At the same time, the average interest rate on loans granted to households by consumer credit and small loan companies was 46.6%[2]. A third of the loan stock consisted of revolving credit lines.

In the second quarter of 2021, households drew down other loans than vehicle loans[3] from other financial institutions[4] in the amount of EUR 80 million. The average interest rate on these new drawdowns was 9.0%. Slightly less than a quarter of the new drawdowns was made from consumer credit and small loan companies.

Majority of vehicle loans granted from outside the credit institution sector

Finnish households drew down a total of EUR 670 million of new vehicle loans from OFIs during the second quarter of 2021. Vehicle loans drawn down from credit institutions during the same period amounted to EUR 470 million; hence, the total amount of vehicle loans drawn down in the second quarter of 2021 was EUR 1.1 billion. The agreed annual interest rate on new vehicle loans drawn down from OFIs in June 2021 (2.6%) was lower than the interest rate on vehicle loans from credit institutions (3%). However, the annual percentage rate of charge[5], which also includes other expenses, on vehicle loans granted by credit institutions was lower (4.7%) compared to those granted by OFIs. At the end of June 2021, the total stock of vehicle loans granted by OFIs and credit institutions amounted to EUR 7 billion. OFIs accounted for a slightly higher share (54%) of the vehicle loan stock than credit institutions. Vehicle loans make up approximately 30% of households’ total consumer credit.

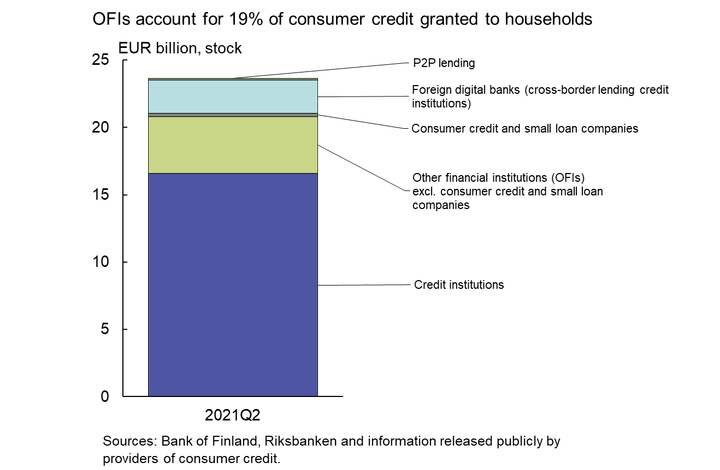

At the end of June 2021, the total stock of Finnish households’ consumer credit stood at EUR 23.6 billion. The total consumer credit stock is estimated not to have grown during the COVID-19 pandemic. Consumer credit granted by OFIs accounted for 19% of the total stock of household credit. The largest proportion (70%) of households’ consumer credit was granted by credit institutions operating in Finland.

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi,

Jaakko Suni, tel. +358 10 831 2402, email: jaakko.suni (at)bof.fi

The next Other financial institutions release will be published at the beginning of 2022.

[1] Certain consumer credit is currently subject to a temporary interest rate cap (10%) until the end of September 2021.

[2] Consumer credit agreements concluded before September 2019 are governed by previous interest rate cap regulation, under which the effective interest rate on consumer credit under EUR 2,000 may not exceed the reference interest rate under the Interest Act by more than 50 percentage points. This interest rate cap excludes credit larger than EUR 2,000.

[3] Excl. revolving credit lines.

[4] Excl. pawnshops.

[5] In the OFI data collection, effective annual interest rate refers to new drawdowns, while in banking statistics, it refers to new agreements.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Meri Obstbaum appointed Adviser to the Board of the Bank of Finland, and Kimmo Virolainen’s position as Adviser to the Board was renewed17.4.2024 15:00:00 EEST | Press release

The Board of the Bank of Finland has appointed Meri Obstbaum, DSc (Econ. & Bus. Adm.), and Kimmo Virolainen, DSc (Econ. & Bus. Adm.), as Advisers to the Board. These appointments are for a five-year term. Obstbaum will also head the Bank’s Monetary Policy Preparation Process. Virolainen will head the Bank’s International Economic Policy Process.

Meri Obstbaum förordnad till rådgivare åt Finlands Banks direktion, Kimmo Virolainen fortsätter som rådgivare åt direktionen17.4.2024 15:00:00 EEST | Tiedote

Finlands Banks direktion har förordnat pol.dr Meri Obstbaum och pol. dr Kimmo Virolainen till rådgivare åt direktionen. Förordnandena gäller för en period på fem år. Meri Obstbaum svarar också för processen för penningpolitisk beredning. Kimmo Virolainen är chef för processen för den internationella ekonomin.

Meri Obstbaum johtokunnan neuvonantajaksi ja Kimmo Virolainen jatkaa johtokunnan neuvonantajana17.4.2024 15:00:00 EEST | Tiedote

Suomen Pankin johtokunta on määrännyt neuvonantajikseen KTT Meri Obstbaumin ja KTT Kimmo Virolaisen. Tehtävät ovat viiden vuoden määräajaksi. Meri Obstbaumin vastuulla on samanaikaisesti rahapolitiikan valmisteluprosessi. Kimmo Virolainen toimii kansainvälisen talouden prosessin päällikkönä.

Bank of Finland Governor to attend IMF Spring Meeting17.4.2024 11:00:00 EEST | Press release

The Governor of the Bank of Finland, Olli Rehn will participate in the International Monetary Fund’s Spring Meeting in Washington DC, on 18–19 April 2024. Governor Rehn represents Finland on the Fund’s Board of Governors.

Finlands Banks chefdirektör deltar i IMF:s vårmöte17.4.2024 11:00:00 EEST | Tiedote

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) vårmöte som hålls i Washington D.C. 18–19 april 2024. Chefdirektör Rehn företräder Finland i valutafondens styrelse.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom