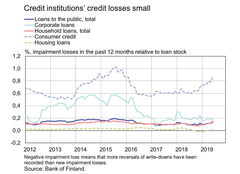

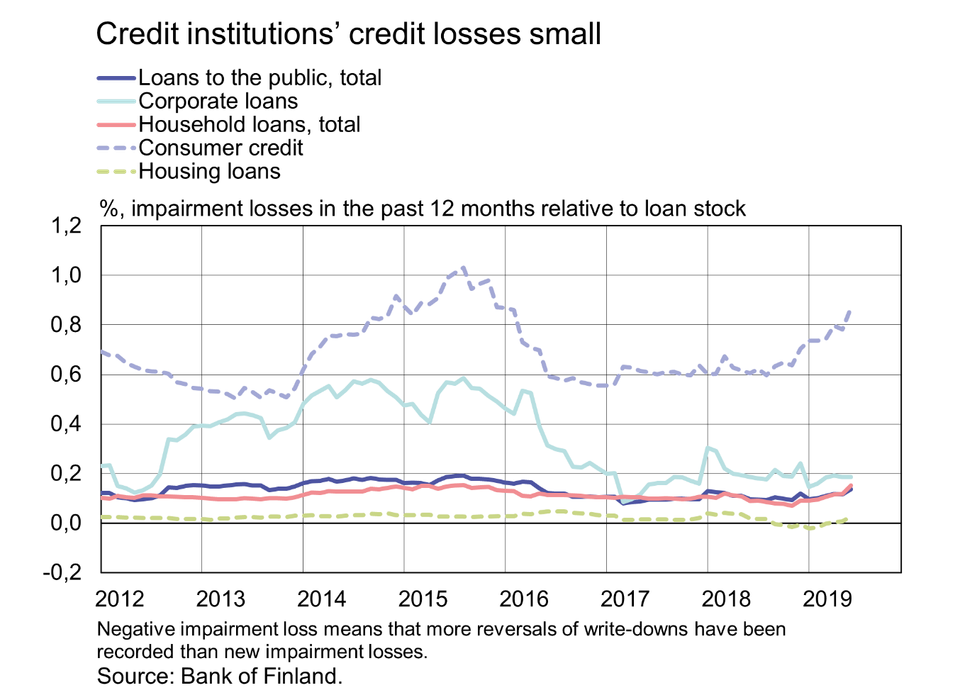

Credit institutions’ credit losses small

Credit institutions operating in Finland incurred EUR 363 million in impairments and credit losses[1] in the past 12 months on loans granted to the public. This corresponds to 0.14% of the total stock of loans. In early 2018, a new model was introduced for the recognition of impairment losses (in Finnish only), but, since then, their amount relative to the loan stock has changed only slightly.

Impairment losses on corporate loans in the past 12 months were slightly higher than on household loans (0.19% of the corporate loan stock). Impairment losses on corporate loans have, however, decreased on average in the past five years or so. Impairment losses incurred on household credit during the past 12 months, in turn, corresponded to 0.15% of the loan stock in June 2019. Notwithstanding the slight increase witnessed in the first half of 2019, impairment losses on household loans have remained virtually unchanged in recent years.

Of the stock of household credit, impairment losses have especially increased in the past 12 months on consumer credit. Impairment losses on consumer credit totalled EUR 141 million (0.87% of the loan stock) in the past 12 months, mostly comprising unsecured consumer credit and overdrafts and credit card credit. Still in June 2018, impairment losses for the past 12 months amounted to 0.60% of the loan stock. The 12-month total of impairment losses on secured consumer credit and housing loans has not exceeded 0.05% of the loan stock in this decade.

Loans

Households' new drawdowns of housing loans in June 2019 amounted to EUR 1.8 bn, which is slightly more than in the corresponding period a year earlier. At the end of June 2019, the stock of euro-denominated housing loans totalled EUR 98.9 bn and the annual growth rate of the stock was 2.0%. Household credit at end-June comprised EUR 16.1 bn in consumer credit and EUR 17.4 bn in other loans.

New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted in June to EUR 2.1 bn. The average interest rate on new corporate-loan drawdowns declined from May, to 2.18%. At the end of June, the stock of euro-denominated loans to non-financial corporations was EUR 88.0 bn, of which loans to housing corporations accounted for EUR 33.3 bn.

Deposits

The stock of household deposits at end-June totalled EUR 93.9 bn and the average interest rate on the deposits was 0.11%. Overnight deposits accounted for EUR 81.1 bn and deposits with agreed maturity for EUR 4.8 bn of the deposit stock. In June, households concluded EUR 0.2 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.34%.

The next news release will be published at 1 pm on 30 August 2019.

Related statistical data and ‑graphs are also available on the Bank of Finland website https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

Keywords

Contacts

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

Johanna Honkanen, tel. +358 9 183 2992, email: johanna.honkanen(at)bof.fi

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

BOFIT Forecast for China 2024–2026: Productivity gains key to China maintaining growth22.4.2024 13:04:52 EEST | Press release

The latest forecast from BOFIT, the Bank of Finland’s Institute for Emerging Economies, sees structural and cyclical factors bringing down economic growth over coming years. Growth is expected to slow to roughly 4 % this year and then to 3 % p.a. in 2025 and 2026. The lack of reliable Chinese statistical data makes detailed assessment of the situation challenging. China’s official figures show GDP rose by 5.2 % last year. Alternative calculations by BOFIT, however, suggest that GDP growth has underperformed official estimates in recent years. Economic growth in the first months of this year was fairly brisk (officially 5.3 % in the first quarter) thanks to strong industrial growth. No large changes to the outlook for economy overall have occurred since our October 2023 forecast. We continue to anticipate about 4 % growth this year. Growth is expected to slow to around 3 % in 2025 and 2026. The degraded quality of Chinese statistical reporting makes it increasingly difficult to evaluate

BOFITs prognos om utvecklingen av den kinesiska ekonomin för 2024–2026: för att upprätthålla den ekonomiska utvecklingen i Kina behövs ökad produktivitet22.4.2024 13:04:44 EEST | Tiedote

Finlands Banks forskningsinstitut för tillväxtmarknader förutspår en avmattning i den ekonomiska tillväxten i Kina under de närmaste åren på grund av både strukturella och cykliska faktorer. I år väntas tillväxten vara ca 4 % och stanna kring 3 % under 2025–2026. De statistiska problemen i Kina försvårar bedömningen av det ekonomiska läget. BNP-tillväxten i Kina var i fjol 5,2 % enligt den officiella statistiken. BOFIT bedömer att landets faktiska ekonomiska tillväxt under de senaste åren varit något långsammare än vad som anges officiellt. Den ekonomiska utvecklingen i början av året har varit relativt stark, pådriven av industrin, men ingen större förändring har skett i den samlade bilden av ekonomin i förhållande till den föregående prognosen. Enligt BOFITs prognos växer den kinesiska ekonomin ca 4 % i år, medan den ekonomiska tillväxten under 2025–2026 förutspås stanna kring 3 %. Kvaliteten på statistiken har delvis försämrats ytterligare, vilket försvårar bedömningen av det ekonom

BOFIT-ennuste Kiinan talouden kehityksestä vuosiksi 2024–2026: Kiinan talouskasvun ylläpitäminen edellyttäisi tuottavuuden parantamista22.4.2024 13:04:00 EEST | Tiedote

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT ennustaa Kiinan talouskasvun hidastuvan lähivuosina sekä rakenteellisten että suhdannetekijöiden takia. Tänä vuonna kasvun odotetaan olevan noin 4 prosenttia ja jäävän 3 prosentin paikkeille vuosina 2025–2026. Kiinan tilastojen ongelmat hankaloittavat taloustilanteen arvioimista. Kiinan bruttokansantuote kasvoi viime vuonna virallisten tilastojen mukaan 5,2 prosenttia. BOFITin arvion mukaan todellinen talouskasvu on viime vuosina jäänyt jonkin verran virallisesti ilmoitettua hitaammaksi. Alkuvuoden talouskehitys on ollut suhteellisen pirteää teollisuuden vetämänä. Talouden kokonaiskuvassa ei kuitenkaan ole tapahtunut aiempaan ennusteeseen verrattuna suurta muutosta. BOFIT ennustaa Kiinan talouden kasvavan noin 4 prosenttia kuluvana vuonna. Vuosina 2025–2026 kasvun ennustetaan jäävän 3 prosentin paikkeille. Tilastojen osin entisestään heikentynyt laatu vaikeuttaa taloustilanteen arviointia ja lisää ennusteen epävarmuutta. Kiinan ta

Medialle: BOFIT julkaisee Kiinan talouden ennusteen maanantaina 22.4.18.4.2024 10:15:15 EEST | Kutsu

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT julkaisee ennusteen Kiinan talouden kehityksestä maanantaina 22.4.2024 kello 13. Ennuste julkaistaan osoitteessa bofit.fi. Median edustajien on mahdollista saada ennuste embargolla maanantaina aamupäivällä. Pyydämme ilmoittautumaan embargojakelulistalle viimeistään maanantaina 22.4. klo 9.00. Ilmoittaudu embargojakelulistalle BOFIT julkaisee ennusteen Kiinan talouskehityksestä keväisin ja syksyisin. Lisätiedot: Suomen Pankin viestintä, media@bof.fi, p. 09 183 2101.

Meri Obstbaum appointed Adviser to the Board of the Bank of Finland, and Kimmo Virolainen’s position as Adviser to the Board was renewed17.4.2024 15:00:00 EEST | Press release

The Board of the Bank of Finland has appointed Meri Obstbaum, DSc (Econ. & Bus. Adm.), and Kimmo Virolainen, DSc (Econ. & Bus. Adm.), as Advisers to the Board. These appointments are for a five-year term. Obstbaum will also head the Bank’s Monetary Policy Preparation Process. Virolainen will head the Bank’s International Economic Policy Process.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom