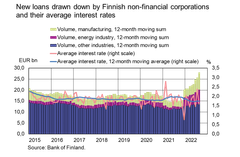

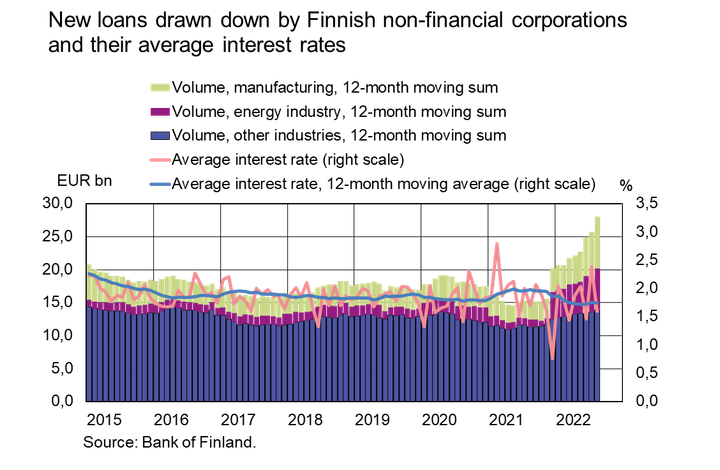

Exceptionally large volume of corporate loans drawn down

In August 2022, there was a large volume (EUR 3.3 bn) of new loans drawn to non-financial corporations[1] from credit institutions operating in Finland. The average interest rate on new drawdowns decreased from June, to stand at 1.59% in August, due to the decline of interest rates on large loans, that is, over a million euro. The volume of large loans drawn down in August was EUR 2.9 bn, accounting for 87% of all corporate loan drawdowns. The average interest rate on new large loans was 1.26% in August. The companies that took out new loans in August mainly operated in the manufacturing sectors.

The volume of corporate drawdowns in the last 12 months is exceptionally high (EUR 28 bn). The growth of new drawndowns was driven in particular by the funding need of energy and manufacturing companies. The moving 12-month sum grew by a total of EUR 12.9 bn from a year ago, energy companies accounting for EUR 5.3 bn and manufacturing companies for for EUR 5.1 bn.

At the end August 2022, the stock of loans granted by banks operating in Finland to non-financial corporations[2] amounted to EUR 64.5 bn. The corporate loan stock grew by EUR 1.8 bn in August 2022. Growth from a year ago amounted to EUR 7.2 bn, and the year-on-year growth rate was 13.2%. At the same time, non-performing loans as a share of the loan stock decreased. In August 2022, non-performing loans amounted to 1.6% of the loan stock, in contrast to 2.4% a year earlier.

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 1.5 bn in August 2022, which is EUR 288 mn less than in the same period a year earlier. 8.6% of the new housing loans were housing loans for investment property. At the end of August 2022, the stock of housing loans totalled EUR 107.9 bn, and the year-on-year growth rate was 2.3%. Investment properties accounted for 8.2% of the housing loan stock. At the end of August, Finnish households’ loan stock also included EUR 17.0 bn of consumer credit and EUR 18.2 bn of other loans.

Housing corporations drew down EUR 449 mn of new loans in August. The average interest rate on new loan drawdowns by housing corporations in August was 1.98%. At the end of August, the stock of loans granted to housing corporations stood at EUR 41.3 bn.

Deposits

At the end of August 2022, the total stock of Finnish households’ deposits was EUR 113.1 bn, and the average interest rate on these deposits was 0.03%. Overnight deposits accounted for EUR 104.1 bn and deposits with agreed maturity for EUR 2.1 bn of the total deposit stock. In August, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 70 mn. The average interest rate on these new term deposits was 1.14%.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 31 October 2022.

Related statistical data and ‑graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Excl. housing corporations.

[2] Excl. housing corporations.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Medialle: BOFIT julkaisee Kiinan talouden ennusteen maanantaina 22.4.18.4.2024 10:15:15 EEST | Kutsu

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT julkaisee ennusteen Kiinan talouden kehityksestä maanantaina 22.4.2024 kello 13. Ennuste julkaistaan osoitteessa bofit.fi. Median edustajien on mahdollista saada ennuste embargolla maanantaina aamupäivällä. Pyydämme ilmoittautumaan embargojakelulistalle viimeistään maanantaina 22.4. klo 9.00. Ilmoittaudu embargojakelulistalle BOFIT julkaisee ennusteen Kiinan talouskehityksestä keväisin ja syksyisin. Lisätiedot: Suomen Pankin viestintä, media@bof.fi, p. 09 183 2101.

Meri Obstbaum appointed Adviser to the Board of the Bank of Finland, and Kimmo Virolainen’s position as Adviser to the Board was renewed17.4.2024 15:00:00 EEST | Press release

The Board of the Bank of Finland has appointed Meri Obstbaum, DSc (Econ. & Bus. Adm.), and Kimmo Virolainen, DSc (Econ. & Bus. Adm.), as Advisers to the Board. These appointments are for a five-year term. Obstbaum will also head the Bank’s Monetary Policy Preparation Process. Virolainen will head the Bank’s International Economic Policy Process.

Meri Obstbaum förordnad till rådgivare åt Finlands Banks direktion, Kimmo Virolainen fortsätter som rådgivare åt direktionen17.4.2024 15:00:00 EEST | Tiedote

Finlands Banks direktion har förordnat pol.dr Meri Obstbaum och pol. dr Kimmo Virolainen till rådgivare åt direktionen. Förordnandena gäller för en period på fem år. Meri Obstbaum svarar också för processen för penningpolitisk beredning. Kimmo Virolainen är chef för processen för den internationella ekonomin.

Meri Obstbaum johtokunnan neuvonantajaksi ja Kimmo Virolainen jatkaa johtokunnan neuvonantajana17.4.2024 15:00:00 EEST | Tiedote

Suomen Pankin johtokunta on määrännyt neuvonantajikseen KTT Meri Obstbaumin ja KTT Kimmo Virolaisen. Tehtävät ovat viiden vuoden määräajaksi. Meri Obstbaumin vastuulla on samanaikaisesti rahapolitiikan valmisteluprosessi. Kimmo Virolainen toimii kansainvälisen talouden prosessin päällikkönä.

Bank of Finland Governor to attend IMF Spring Meeting17.4.2024 11:00:00 EEST | Press release

The Governor of the Bank of Finland, Olli Rehn will participate in the International Monetary Fund’s Spring Meeting in Washington DC, on 18–19 April 2024. Governor Rehn represents Finland on the Fund’s Board of Governors.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom