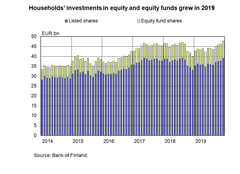

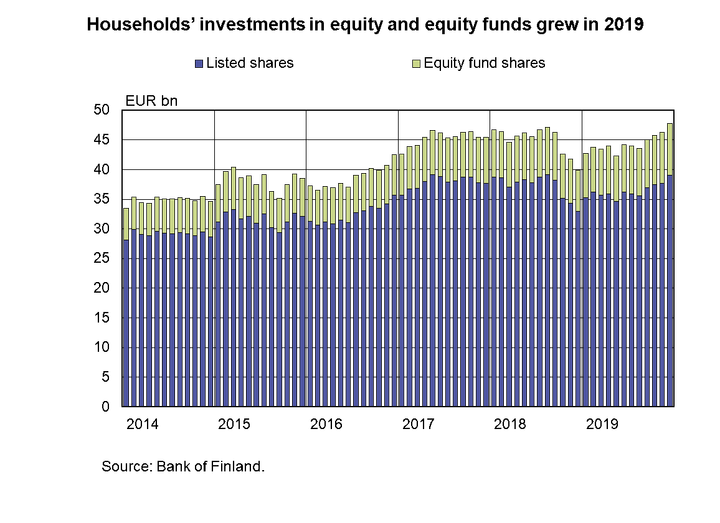

Households’ investments in equity and equity funds grew in 2019

The largest monthly increase in households’ shareholdings in 2019 took place in January, when the holdings increased by EUR 2.3 billion. In December 2019, the value of shareholdings increased by EUR 1.4 billion and households sold more shares than they bought, in net terms EUR –0.1 billion.

In spite of the appreciation of equity investments in 2019 and the investment of new capital, households’ listed shareholdings remain at a slightly lower level than in August 2018 or May 2017, when they amounted to EUR 39.1 billion.

In addition to direct equity holdings, Finnish households have indirect holdings in listed shares through investment funds. At the end of December 2019, households held investments worth EUR 8.8 billion in equity funds[1] registered in Finland. Equity fund investments increased by EUR 1.8 billion in 2019. The growth is mainly explained by positive equity market performance. In addition, households made more subscriptions to equity funds than redemptions from them in 2019, EUR 0.2 billion in net terms. Households also have indirect equity holdings for example through mixed funds. A significant proportion of households’ indirect equity holdings through investment funds are in foreign listed shares.

Households’ assets are also channelled to investment funds and thereby to shares through unit-linked insurance policies made with insurance companies. Households had an estimated EUR 10 billion invested in equity funds and EUR 0.8 billion directly in listed shares through unit-linked insurance policies.

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published at 1 pm on 14 May 2020.

[1] UCITS funds.Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

BOFIT Forecast for China 2024–2026: Productivity gains key to China maintaining growth22.4.2024 13:04:52 EEST | Press release

The latest forecast from BOFIT, the Bank of Finland’s Institute for Emerging Economies, sees structural and cyclical factors bringing down economic growth over coming years. Growth is expected to slow to roughly 4 % this year and then to 3 % p.a. in 2025 and 2026. The lack of reliable Chinese statistical data makes detailed assessment of the situation challenging. China’s official figures show GDP rose by 5.2 % last year. Alternative calculations by BOFIT, however, suggest that GDP growth has underperformed official estimates in recent years. Economic growth in the first months of this year was fairly brisk (officially 5.3 % in the first quarter) thanks to strong industrial growth. No large changes to the outlook for economy overall have occurred since our October 2023 forecast. We continue to anticipate about 4 % growth this year. Growth is expected to slow to around 3 % in 2025 and 2026. The degraded quality of Chinese statistical reporting makes it increasingly difficult to evaluate

BOFITs prognos om utvecklingen av den kinesiska ekonomin för 2024–2026: för att upprätthålla den ekonomiska utvecklingen i Kina behövs ökad produktivitet22.4.2024 13:04:44 EEST | Tiedote

Finlands Banks forskningsinstitut för tillväxtmarknader förutspår en avmattning i den ekonomiska tillväxten i Kina under de närmaste åren på grund av både strukturella och cykliska faktorer. I år väntas tillväxten vara ca 4 % och stanna kring 3 % under 2025–2026. De statistiska problemen i Kina försvårar bedömningen av det ekonomiska läget. BNP-tillväxten i Kina var i fjol 5,2 % enligt den officiella statistiken. BOFIT bedömer att landets faktiska ekonomiska tillväxt under de senaste åren varit något långsammare än vad som anges officiellt. Den ekonomiska utvecklingen i början av året har varit relativt stark, pådriven av industrin, men ingen större förändring har skett i den samlade bilden av ekonomin i förhållande till den föregående prognosen. Enligt BOFITs prognos växer den kinesiska ekonomin ca 4 % i år, medan den ekonomiska tillväxten under 2025–2026 förutspås stanna kring 3 %. Kvaliteten på statistiken har delvis försämrats ytterligare, vilket försvårar bedömningen av det ekonom

BOFIT-ennuste Kiinan talouden kehityksestä vuosiksi 2024–2026: Kiinan talouskasvun ylläpitäminen edellyttäisi tuottavuuden parantamista22.4.2024 13:04:00 EEST | Tiedote

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT ennustaa Kiinan talouskasvun hidastuvan lähivuosina sekä rakenteellisten että suhdannetekijöiden takia. Tänä vuonna kasvun odotetaan olevan noin 4 prosenttia ja jäävän 3 prosentin paikkeille vuosina 2025–2026. Kiinan tilastojen ongelmat hankaloittavat taloustilanteen arvioimista. Kiinan bruttokansantuote kasvoi viime vuonna virallisten tilastojen mukaan 5,2 prosenttia. BOFITin arvion mukaan todellinen talouskasvu on viime vuosina jäänyt jonkin verran virallisesti ilmoitettua hitaammaksi. Alkuvuoden talouskehitys on ollut suhteellisen pirteää teollisuuden vetämänä. Talouden kokonaiskuvassa ei kuitenkaan ole tapahtunut aiempaan ennusteeseen verrattuna suurta muutosta. BOFIT ennustaa Kiinan talouden kasvavan noin 4 prosenttia kuluvana vuonna. Vuosina 2025–2026 kasvun ennustetaan jäävän 3 prosentin paikkeille. Tilastojen osin entisestään heikentynyt laatu vaikeuttaa taloustilanteen arviointia ja lisää ennusteen epävarmuutta. Kiinan ta

Medialle: BOFIT julkaisee Kiinan talouden ennusteen maanantaina 22.4.18.4.2024 10:15:15 EEST | Kutsu

Suomen Pankin nousevien talouksien tutkimuslaitos BOFIT julkaisee ennusteen Kiinan talouden kehityksestä maanantaina 22.4.2024 kello 13. Ennuste julkaistaan osoitteessa bofit.fi. Median edustajien on mahdollista saada ennuste embargolla maanantaina aamupäivällä. Pyydämme ilmoittautumaan embargojakelulistalle viimeistään maanantaina 22.4. klo 9.00. Ilmoittaudu embargojakelulistalle BOFIT julkaisee ennusteen Kiinan talouskehityksestä keväisin ja syksyisin. Lisätiedot: Suomen Pankin viestintä, media@bof.fi, p. 09 183 2101.

Meri Obstbaum appointed Adviser to the Board of the Bank of Finland, and Kimmo Virolainen’s position as Adviser to the Board was renewed17.4.2024 15:00:00 EEST | Press release

The Board of the Bank of Finland has appointed Meri Obstbaum, DSc (Econ. & Bus. Adm.), and Kimmo Virolainen, DSc (Econ. & Bus. Adm.), as Advisers to the Board. These appointments are for a five-year term. Obstbaum will also head the Bank’s Monetary Policy Preparation Process. Virolainen will head the Bank’s International Economic Policy Process.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom