Ilmarinen’s Interim Report 1 January to 30 September 2022: Premiums written growing strongly, return on investments negative, solvency remained good

As a result of the negative return on investment operations, the total result for January–September fell to EUR -4.8 (2.9) billion.

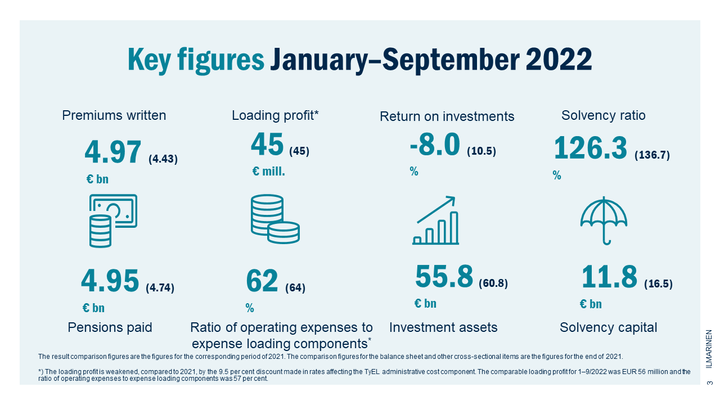

Premiums written rose by as much as 12 per cent to EUR 5.0 (4.4) billion thanks to strong growth in payrolls and the 0.45 percentage point increase made in TyEL contributions. EUR 4.9 (4.7) billion was paid in pensions.

Net customer acquisition was EUR 159 (230) million and customer retention was 97.7 (97.9) per cent.

Loading profit was EUR 45 (45) million and the ratio of operating expenses to expense loading components improved to 62 (64) per cent, despite the 9.5 per cent reduction in the expense loading rate. Operating expenses financed using loading income fell by EUR 7 million to EUR 73 (81) million.

Solvency capital was EUR 11.8 (16.5) billion and the solvency ratio was 126.3 (136.7) per cent.

Outlook: Ilmarinen’s premiums written are expected to grow in 2022, due to higher payrolls and the 0.45 percentage point increase in the TyEL contribution. Loading income will decrease as a result of the lowering of the premium rate in the insurance contribution’s administrative cost component. The loading profit is nevertheless expected to grow thanks to increasing cost-effectiveness.

President and CEO Jouko Pölönen:

This year has been a very challenging one on the investment markets due to accelerating inflation, central banks’ tightening monetary policy and the war begun by Russia. Ilmarinen’s return on investments in January–September was -8 per cent, i.e. EUR 4.9 billion negative. Solvency remained at a good level despite the challenging market situation, premiums written grew strongly and cost-effectiveness improved.

Stock prices fell extensively across all main market areas, interest rates continued to rise and credit risk margins widened. The return on equity investments in Ilmarinen’s investment portfolio was -12.8 per cent and the return on fixed income investments was -5.7 per cent. The return on real estate investments was 4.0 per cent, but rising interest rates are also putting downward pressure on real estate valuations. The return on other investments was -3.3 per cent. The long-term average nominal return on investments was 5.7 per cent, corresponding to a 3.9 per cent average annual real return since 1997. The solvency ratio remained good at 126.3 per cent and the solvency capital was EUR 11.8 billion. The solvency buffers built up through long-term funding and investing protect pension assets during market volatility.

Premiums written grew by as much as 12 per cent to EUR 5.0 billion. Behind the strong growth is the almost 10 per cent increase in the payroll of employees insured with Ilmarinen and the 0.45 percentage point increase made in the pension contribution. The fixed-term increase is used to collect back the temporary discount made in employers’ insurance contributions during the Covid crisis. The number of employees in the companies belonging to Ilmarinen’s business cycle index increased by +3.9 per cent year-on-year during January–September. Employment recovery has been strong especially in the hospitality and restaurant sector and in staff leasing services, which suffered from the Covid crisis.

We paid EUR 4.9 billion in pensions to around 454,000 pensioners. Due to the high inflation, an exceptional 6.8 per cent index increment will be applied to current pensions at the turn of the year. Pensioners will benefit from the increment if their pension has begun this year, at the latest at the start of December. The increment also applies to partial early old-age pension, for which the number of applications grew by more than 80 per cent year-on-year in September. During October, the number of applications has grown even faster. Old-age pension applications have also increased.

The loading profit for January–September was EUR 45 million and the ratio of operating expenses to expense loading components, measuring cost-effectiveness, improved to 62 per cent. Operating expenses financed using loading income came to EUR 73 million, i.e. EUR 7 million less year-on-year.

As a responsible real estate investor, Ilmarinen is taking the exceptional energy market situation into account in its operations. The temperature in the business premises owned by Ilmarinen will be lowered by 1–2 degrees and premises that are used less will have their temperature adjusted to the minimum level. We will additionally optimise ventilation systems and reduce lighting. The measures are expected to achieve more than 3,200 megawatt-hours in energy savings annually.

Alongside climate change, biodiversity loss impacts the economy and thus also investment operations. We published a Biodiversity Roadmap, which describes the steps through which we increase understanding of the impacts of biodiversity loss, analyse the investment portfolio’s impacts on and risk exposures to biodiversity, identify measures and ways to make a difference, and develop our reporting.

The Finnish Financial Supervisory Authority (FIN-FSA) completed a multi-year process, which was a thorough look into Ilmarinen’s disability risk management. There was no need for an administrative sanction and we are pleased that the case has now been closed also on the part of FIN-FSA. There is no legal regulation concerning the management of disability risk, and some of the guidelines provided by FIN-FSA have been open to various interpretations. It is important to Ilmarinen that our operations comply with regulations and that we can help our customers prevent disability. Each disability pension prevented is not only important on a human level but also benefits employers, society and the pension system.

In October, the Finnish Centre for Pensions released updated long-term calculations of the development of statutory pension expenditure, the level of benefits and financing. According to the Finnish Centre for Pensions, the long-term outlook for financing pensions has improved from the previous projection made in 2019 due to good return on investments. A low birth rate and decline in the number of working-age people continue to present a challenge to the financing of the pension system and the entire welfare state.

Read more:

Ilmarinen's Interim Report 1 January to 30 September 2022 (pdf)

Contacts

Liina AulinEVP, Communications and Corporate Responsibility

Tel:+ 358 40 770 9400liina.aulin@ilmarinen.fiJouko PölönenPresident and CEO

Tel:+358 50 1282jouko.polonen@ilmarinen.fiMikko MursulaDeputy CEO, CIO

Tel:+358 50 380 3016mikko.mursula@ilmarinen.fiImages

About Ilmarinen

Ilmarinen’s task is to ensure that our customers receive the pension they earned from employment. We promote a better working life and thus help our customers succeed. In total, we are responsible for the pension cover of some 1,1 million people. We have investment assets of over EUR 55 billion to cover pension liabilities. For more information, please visit: www.ilmarinen.fi.

Subscribe to releases from Ilmarinen

Subscribe to all the latest releases from Ilmarinen by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Ilmarinen

Työkyvyttömyydessä iso vaihtelu toimialoittain – uusi indeksi tarjoaa ennusteita ja tilannetietoa24.4.2024 10:39:32 EEST | Tiedote

Työkyvyttömyyseläkkeiden määrässä on jopa nelinkertainen ero eri toimialojen välillä. Fyysisesti kuormittavilla aloilla työuraa uhkaavat todennäköisemmin tuki- ja liikuntaelinten sairaudet, kun taas asiantuntija-aloilla mielenterveyden häiriöt ovat yleisin syy pysyvään työkyvyttömyyteen. Tiedot selviävät Ilmarisen uudesta työkyvyttömyyseläkeindeksistä.

Mediakutsu: Ilmarisen tulosinfo ja markkinanäkymät 26.4. klo 1424.4.2024 08:25:49 EEST | Tiedote

Ilmarinen julkistaa tuloksensa ajalta 1.1.–31.3.2024. Median edustajat ovat tervetulleita tulosinfoon perjantaina 26.4. klo 14 Ilmarisen toimitalossa (Porkkalankatu 1, Ruoholahti, Helsinki) ja etäyhteydellä verkossa.

Mediakutsu: Ilmarisen tulosinfo ja markkinanäkymät 26.4. klo 1422.4.2024 09:04:58 EEST | Tiedote

Ilmarinen julkistaa tuloksensa ajalta 1.1.–31.3.2024. Median edustajat ovat tervetulleita tulosinfoon perjantaina 26.4. klo 14 Ilmarisen toimitalossa (Porkkalankatu 1, Ruoholahti, Helsinki) ja etäyhteydellä verkossa.

Ilmarisen uudistettu suhdanneindeksi: Työntekijämäärän lasku voimistui15.4.2024 12:25:04 EEST | Tiedote

Työntekijämäärä laski maaliskuussa Ilmarisen suhdanneindeksiin kuuluvissa yrityksissä -2,9 prosenttia vuoden takaiseen verrattuna. Seuratuista toimialoista eniten laskivat henkilöstövuokraus sekä rakentaminen. Alueellisesti tarkasteltuna työntekijämäärä laski joka puolella Suomea. Uudistettuun suhdanneindeksiin mukaan laskettavat toimialat kattavat nyt valtaosan yksityisestä sektorista.

Mediakutsu: Ilmarisen tulosinfo ja markkinanäkymät 26.4. klo 1415.4.2024 09:18:39 EEST | Tiedote

Ilmarinen julkistaa tuloksensa ajalta 1.1.–31.3.2024. Median edustajat ovat tervetulleita tulosinfoon perjantaina 26.4. klo 14 Ilmarisen toimitalossa (Porkkalankatu 1, Ruoholahti, Helsinki) ja etäyhteydellä verkossa.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom