Number of card payments resumed growth in 2021

During the first year of the COVID-19 pandemic, the growth of the number of card transactions came to a halt, but growth resumed in 2021. In 2021, a total of 1.9 billion card payments were made using Finnish payment cards, that is, 5% more than in 2020. The aggregate value of card payments grew 9.2% from 2020 to stand at EUR 57.0 billion in 2021.

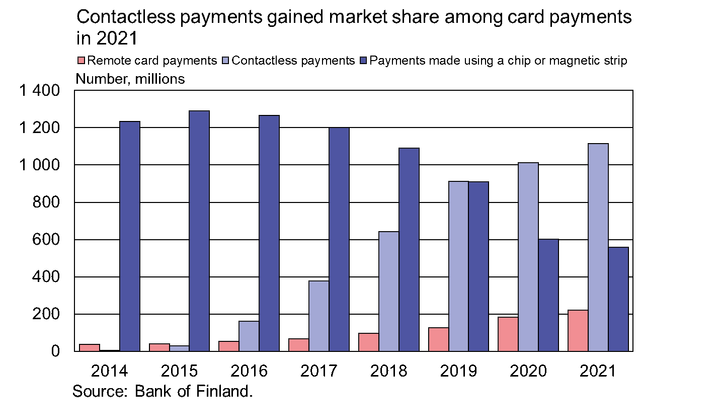

The evolution of methods used in card payments continued: contactless payments became increasingly widespread in 2021, and they accounted for 59% of the total number of card payment transactions. The average value of contactless payments rose 3.6% from 2020 to stand at EUR 15.20 in 2021. [1] In 2021, the average value of contactless payments (EUR 16.9 billion) was 14% higher than a year earlier.

Remote card payment continued to gain ground in 2021. A total of to 221 million card payments were initiated on a computer or mobile device, with an aggregate value of EUR 7.8 billion. In 2021, the number of these transactions grew by 21% and their overall value by 26% from the previous year.

More and more payments, both contactless and remote, were initiated using a mobile device. The aggregate value of card payments initiated by a mobile application almost tripled from 2020 to stand EUR 2.7 billion in 2021.

The number of card payments made using a microchip or magnetic strip decreased further. In 2021, the number of such card payments decreased 7% from 2020. However, in terms of aggregate value, they continued to be the largest type of card payments in 2021, amounting to EUR 32.2 billion, or 56% of all card payments.

In 2021, the impact of the COVID-19 pandemic was still evident in card payments made abroad. The value of card payments made at foreign points-of-sale was 67% lower than before the pandemic in 2019.

The number and aggregate value of cash withdrawals continued to decline in 2021. ATM cash withdrawals made domestically using Finnish cards decreased by 14%, and their total value declined by 15% from 2020. Cash withdrawals at vendor POS terminals and bank branches also decreased. The value of cash withdrawals made abroad using cards decreased 17% from the previous year.

In 2021, a total of 1.2 billion credit transfers were made from Finnish accounts, 9% more than in 2020. The aggregate value of credit transfers (EUR 2,945 billion) grew 4% from the previous year.

Payment statistics are being reformed

The figures discussed in this news release have been published in table and chart format in the new payment statistics dashboard. The payment statistics for 2021 are the last payment statistics collected at the annual level. Going forward, payment statistics will be collected quarterly and semi-annually.

For further information, please contact:

Tia Kurtti, tel. +358 9 183 2043, tia.kurtti(at)bof.fi

Anssi Heinonen, tel. +358 9 183 2368, anssi.heinonen(at)bof.fi

[1] EUR 50 is the maximum amount currently accepted by the European Banking Authority for a contactless payment using an individual payment card. Amounts exceeding the contactless payment threshold always require the card to be inserted into the reader of the card terminal.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Meri Obstbaum appointed Adviser to the Board of the Bank of Finland, and Kimmo Virolainen’s position as Adviser to the Board was renewed17.4.2024 15:00:00 EEST | Press release

The Board of the Bank of Finland has appointed Meri Obstbaum, DSc (Econ. & Bus. Adm.), and Kimmo Virolainen, DSc (Econ. & Bus. Adm.), as Advisers to the Board. These appointments are for a five-year term. Obstbaum will also head the Bank’s Monetary Policy Preparation Process. Virolainen will head the Bank’s International Economic Policy Process.

Meri Obstbaum förordnad till rådgivare åt Finlands Banks direktion, Kimmo Virolainen fortsätter som rådgivare åt direktionen17.4.2024 15:00:00 EEST | Tiedote

Finlands Banks direktion har förordnat pol.dr Meri Obstbaum och pol. dr Kimmo Virolainen till rådgivare åt direktionen. Förordnandena gäller för en period på fem år. Meri Obstbaum svarar också för processen för penningpolitisk beredning. Kimmo Virolainen är chef för processen för den internationella ekonomin.

Meri Obstbaum johtokunnan neuvonantajaksi ja Kimmo Virolainen jatkaa johtokunnan neuvonantajana17.4.2024 15:00:00 EEST | Tiedote

Suomen Pankin johtokunta on määrännyt neuvonantajikseen KTT Meri Obstbaumin ja KTT Kimmo Virolaisen. Tehtävät ovat viiden vuoden määräajaksi. Meri Obstbaumin vastuulla on samanaikaisesti rahapolitiikan valmisteluprosessi. Kimmo Virolainen toimii kansainvälisen talouden prosessin päällikkönä.

Bank of Finland Governor to attend IMF Spring Meeting17.4.2024 11:00:00 EEST | Press release

The Governor of the Bank of Finland, Olli Rehn will participate in the International Monetary Fund’s Spring Meeting in Washington DC, on 18–19 April 2024. Governor Rehn represents Finland on the Fund’s Board of Governors.

Finlands Banks chefdirektör deltar i IMF:s vårmöte17.4.2024 11:00:00 EEST | Tiedote

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) vårmöte som hålls i Washington D.C. 18–19 april 2024. Chefdirektör Rehn företräder Finland i valutafondens styrelse.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom