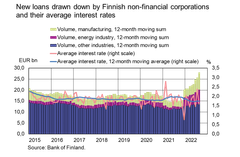

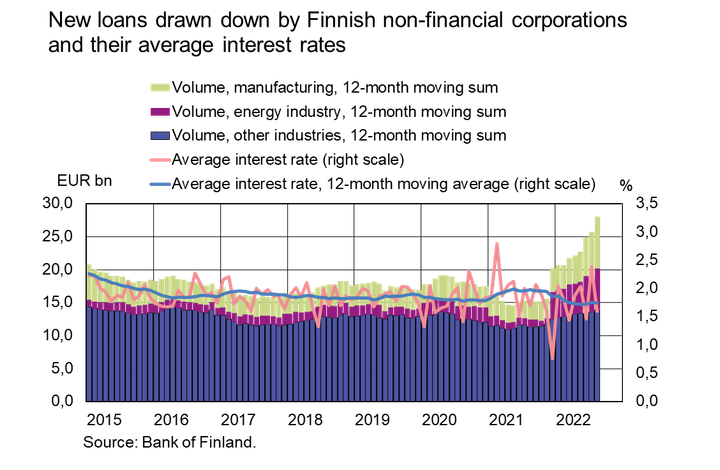

Exceptionally large volume of corporate loans drawn down

In August 2022, there was a large volume (EUR 3.3 bn) of new loans drawn to non-financial corporations[1] from credit institutions operating in Finland. The average interest rate on new drawdowns decreased from June, to stand at 1.59% in August, due to the decline of interest rates on large loans, that is, over a million euro. The volume of large loans drawn down in August was EUR 2.9 bn, accounting for 87% of all corporate loan drawdowns. The average interest rate on new large loans was 1.26% in August. The companies that took out new loans in August mainly operated in the manufacturing sectors.

The volume of corporate drawdowns in the last 12 months is exceptionally high (EUR 28 bn). The growth of new drawndowns was driven in particular by the funding need of energy and manufacturing companies. The moving 12-month sum grew by a total of EUR 12.9 bn from a year ago, energy companies accounting for EUR 5.3 bn and manufacturing companies for for EUR 5.1 bn.

At the end August 2022, the stock of loans granted by banks operating in Finland to non-financial corporations[2] amounted to EUR 64.5 bn. The corporate loan stock grew by EUR 1.8 bn in August 2022. Growth from a year ago amounted to EUR 7.2 bn, and the year-on-year growth rate was 13.2%. At the same time, non-performing loans as a share of the loan stock decreased. In August 2022, non-performing loans amounted to 1.6% of the loan stock, in contrast to 2.4% a year earlier.

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 1.5 bn in August 2022, which is EUR 288 mn less than in the same period a year earlier. 8.6% of the new housing loans were housing loans for investment property. At the end of August 2022, the stock of housing loans totalled EUR 107.9 bn, and the year-on-year growth rate was 2.3%. Investment properties accounted for 8.2% of the housing loan stock. At the end of August, Finnish households’ loan stock also included EUR 17.0 bn of consumer credit and EUR 18.2 bn of other loans.

Housing corporations drew down EUR 449 mn of new loans in August. The average interest rate on new loan drawdowns by housing corporations in August was 1.98%. At the end of August, the stock of loans granted to housing corporations stood at EUR 41.3 bn.

Deposits

At the end of August 2022, the total stock of Finnish households’ deposits was EUR 113.1 bn, and the average interest rate on these deposits was 0.03%. Overnight deposits accounted for EUR 104.1 bn and deposits with agreed maturity for EUR 2.1 bn of the total deposit stock. In August, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 70 mn. The average interest rate on these new term deposits was 1.14%.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 31 October 2022.

Related statistical data and ‑graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Excl. housing corporations.

[2] Excl. housing corporations.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

MUISTUTUS: Kutsu medialle Suomen Pankin tiedotustilaisuuteen 21.5. rahoitusjärjestelmän vakaudesta19.5.2025 11:45:58 EEST | Kutsu

Miten Suomen rahoitusjärjestelmän toimintaympäristö on kehittynyt? Vaikuttaako hallinnon vaihtuminen Yhdysvalloissa arvioon rahoitusjärjestelmän vakaudesta? Miten suomalaiset yritykset kestävät toistuvien kriisien toimintaympäristössä? Mitä uutta positiivinen luottotietorekisteri kertoo asuntovelallisista?

Kutsu medialle: Suomen Pankin tiedotustilaisuus 21.5. rahoitusjärjestelmän vakaudesta15.5.2025 14:11:56 EEST | Kutsu

Miten Suomen rahoitusjärjestelmän toimintaympäristö on kehittynyt? Vaikuttaako hallinnon vaihtuminen Yhdysvalloissa arvioon rahoitusjärjestelmän vakaudesta? Miten suomalaiset yritykset kestävät toistuvien kriisien toimintaympäristössä? Mitä uutta positiivinen luottotietorekisteri kertoo asuntovelallisista?

En inhemsk lösning för omedelbara betalningar skulle öka funktionssäkerheten och konsumenternas valfrihet8.5.2025 11:30:00 EEST | Pressmeddelande

Finländarna måste ha tillgång till förmånliga, mångsidiga och tillförlitliga betalningssätt som fungerar säkert också under exceptionella omständigheter. En lösning för omedelbara betalningar som baserar sig på kontoöverföringar i real tid skulle öka vår förmåga att hantera systemen för betalning och erbjuda konsumenterna ett välkommet alternativ.

Kotimainen pikamaksamisen ratkaisu lisäisi toimintavarmuutta ja kuluttajien valinnanvapautta8.5.2025 11:30:00 EEST | Tiedote

Suomalaisilla tulee olla käytössään edullisia, monipuolisia ja luotettavia maksutapoja, jotka toimivat turvallisesti myös poikkeustilanteissa. Reaaliaikaisiin tilisiirtoihin perustuva pikamaksuratkaisu lisäisi kykyämme hallita maksamisessa käytettyjä järjestelmiä ja tarjoaisi kuluttajille tervetulleen vaihtoehdon.

A Finnish instant payment solution would improve resilience and consumer choice8.5.2025 11:30:00 EEST | Press release

People must have access in Finland to inexpensive, versatile and reliable methods of payment and these must function securely even in exceptional situations. An instant payment solution based on real-time credit transfers would enhance our ability to govern the systems used in making payments and would offer consumers greater choice.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom