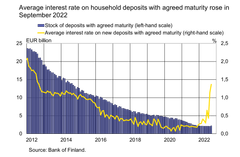

Average interest rate on new household deposits with agreed maturity rose in September

The average interest rate on household deposits with agreed maturity has risen in recent months. In September 2022, the average interest rate was 1.37%, compared with 0.19% in September 2021. The average interest rate on these deposits has last been higher in 2012.

New agreements made on deposits with agreed maturity in September 2022 totalled EUR 240 million, an increase of EUR 170 million on August 2022 and on September last year. Most of the new agreements (71%) were with a maturity of up to 1 year.

As interest rates paid on deposits with agreed maturity have fallen, the popularity of the deposits has also decreased almost uninterruptedly over the past decade. At the end of September 2022, agreed maturity deposits accounted for only 2%, or EUR 2.2 billion, of assets held by households in deposit accounts.

Now that interest rates have risen, there is a slight increase already discernible in the popularity of deposits with agreed maturity. In September 2022, the stock of these deposits grew by over EUR 100 million month-on-month. Year-on-year, however, the deposit stock contracted by 9.5%, but the pace of contraction has moderated notably.

The annual growth rate of the aggregate stock of household deposits (EUR 113.6 billion) has slowed significantly. In September 2022, the growth rate was 3.7%, after having been over 7% a year earlier. Of assets held by households in deposit accounts, 92%, or EUR 104.5 billion, was held in transaction accounts[1]. The average interest rate on transaction accounts was 0.03% in September.

Loans

Finnish households drew down EUR 1.6 billion of new housing loans in September 2022, a decline of EUR 410 million year-on-year. Of the total, EUR 127 million was investment property loans. The average interest rate on new housing loans rose from August, to 2.75%. At the end of September 2022, the stock of housing loans totalled EUR 107.7 billion, and the annual growth rate of the loan stock was 1.6%. Investment property loans accounted for EUR 8.8 billion of the housing loan stock. Of the stock of all loans to Finnish households at the end of September, consumer credit totalled EUR 17.0 billion and other loans, EUR 18.3 billion.

Finnish non-financial corporations drew down new corporate loans in the amount of EUR 3.6 billion in September, of which loans to housing corporations accounted for EUR 790 million. The average interest rate on the new drawdowns rose from August, to 2.48%. At the end of September, the stock of loans granted to Finnish non-financial corporations stood at EUR 106.0 billion, of which EUR 41.5 billion was to housing corporations.

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 30 November 2022.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Transaction accounts are overnight deposits repayable on demand. In addition to daily transaction accounts, they include other household accounts which do not have withdrawal restrictions but only enable cash withdrawals or which can only be used via another account.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Invitation to the media: Bank of Finland and SUERF Conference on Monetary Policy Implementation: Old Wisdoms and New Trends6.6.2025 11:03:21 EEST | Kutsu

Dear journalist, You are invited to participate in the morning session of the Bank of Finland and SUERF Conference on Monetary Policy Implementation on Wednesday 11 June 2025 at the Bank of Finland auditorium (Rauhankatu 19, Helsinki). Kindly find the programme below. Please note that all times listed in the conference schedule are in Finnish local time (UTC+3 EEST). Please register by 10 June 2025 at 15.00 by using link below: Register here ----- Programme Time: Wednesday, 11 June 2025 Place: Bank of Finland Auditorium, address: Rauhankatu 19, Helsinki 8.50 Welcome Mika Pösö, Bank of Finland 9.00 Keynote speech: It's a new dawn, it's a new day, it's a new life for monetary policy implementation – Are we feeling good? Tuomas Välimäki, Member of the Board, Bank of Finland 9.30 Keynote speech: Learning by Doing Victoria Saporta, Executive Director of the Markets Directorate, Bank of England 10.00–10.20 Keynote Q&A The conference is only in person attendance. Please note, that only pre-re

MUISTUTUS: Kutsu medialle Suomen Pankin tiedotustilaisuuteen 10.6. Suomen talouden näkymistä6.6.2025 10:15:08 EEST | Kutsu

Miten kauppapolitiikan kiristyminen ja kansainvälinen epävarmuus vaikuttavat Suomen ja euroalueen talousnäkymiin? Mitkä ovat elpymisen esteet? Pysyykö työttömyys Suomessa edelleen korkealla tasolla vai voiko työllisyystilanne kehittyä parempaan suuntaan?

Kontantuttagen minskade under den senare hälften av 2024 i alla uttagsställen6.6.2025 10:00:00 EEST | Pressmeddelande

Under andra halvan av 2024 minskade kontantuttagen i uttagsautomater, på bankkontoren och i butikernas kassor gjorda av kunder till finländska betaltjänstleverantörer med 6,1 % räk-nat i euro jämfört med motsvarande tid året innan.

Käteisnostojen määrät pienenivät vuoden 2024 loppupuoliskolla kaikilla nostopaikoilla6.6.2025 10:00:00 EEST | Tiedote

Suomalaisten maksupalveluntarjoajien asiakkaat nostivat pankkiautomaateilla, pankkikonttoreissa ja kauppojen kassoilla euromääräisesti 6,1 % vähemmän käteistä vuoden 2024 toisella puoliskolla kuin vastaavaan aikaan edellisvuonna.

Cash withdrawal volumes declined in the second half of 2024 across all types of withdrawal locations6.6.2025 10:00:00 EEST | Press release

In H2/2024, Finnish payment service providers’ (PSP) customers withdrew 6.1% less cash in euro terms at automated teller machines (ATMs), bank branches and point-of-sale (POS) terminals, compared to the same period last year.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom