Almost a fifth of households’ consumer credit originated by OFIs

In the last quarter of 2022, households drew down EUR 80 million of unsecured consumer credit from other financial institutions (OFIs),[1] which was a little more than in the corresponding period a year earlier. The average agreed annual interest rate on new unsecured consumer credit was 9.3%. Almost a quarter of the consumer credit was drawn down from consumer credit and small-loan companies. The average interest rate on these drawdowns was 20%.

The stock of consumer credit originated by consumer credit and small-loan companies, also known as payday lenders, decreased, and the average interest rate declined in 2022.[2] At the end of December 2022, the stock of consumer granted by consumer credit and small-loan companies to Finnish households stood at EUR 154 million, with an average interest rate of 35%. Payday lenders’ stock of consumer credit has contracted significantly since 2018, when payday lenders had an estimated EUR 700 million of loan receivables from households. In September 2019, a 20%-interest rate cap on consumer credit entered into force, after which some of the companies granting small loans have discontinued either the extension of new loans or their activities altogether. The contraction of the loan stock also reflects the sale of loans off balance sheets.

Other financial institutions originate the majority of vehicle loans

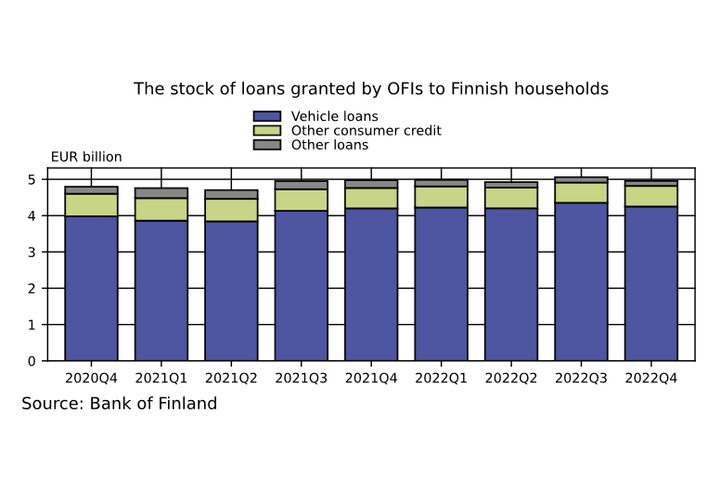

The aggregate stock of consumer credit granted by OFIs was EUR 4.9 billion at the end of 2022. Consumer credit granted by OFIs account for 19% of households’ total stock of credit (EUR 25.1 billion). The majority (68%) of households’ consumer credit has been originated by banks (credit institutions).

The majority (88%) of consumer credit originated by OFIs consisted of vehicle loans.

At present, vehicle loans constitute a more important part of OFIs’ business than before. As regards market share measured as a proportion of the loan stock, at the end of December 2022, OFIs accounted for 56% and banks for 44% of all vehicle loans (EUR 7.6 billion).

Finnish households drew down a total of EUR 1 billion of new vehicle loans from OFIs during the last quarter of 2022. The amount of vehicle loans drawn down from credit institutions in the same period was EUR 375 million. Hence, the total amount of vehicle loans drawn down in the last quarter of 2022 was EUR 1.4 billion. The agreed annual interest rate (3.4%) on new vehicle loans drawn down from OFIs in the last quarter of 2022 was lower than the interest rate on vehicle loans from credit institutions (4.7%). Likewise, the effective annual interest rate, which also includes other expenses,[3]on vehicle loans granted by OFIs was lower (5.5%) in comparison to similar loans granted by banks (6.8%).

For further information, please contact:

Tommi Salenius, tel. +358 09 183 2156, email: tommi.salenius(at)bof.fi

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi

The next Other financial institutions release will be published in autumn 2023.

[1] Excl. pawnshops.

[2] At the end of 2021, the stock stood at EUR 214 million and the average interest rate was over 40%.

[3] In the OFI data collection, effective annual interest rate refers to new drawdowns, while in banking statistics, it refers to new agreements.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Internationella valutafonden ger ut en landrapport om Finlands ekonomi19.1.2026 10:10:00 EET | Nyheter

Internationella valutafonden (IMF) har slutfört sin årliga utvärdering av det ekonomiska läget och de ekonomiska utsikterna för Finland. Utvärderingen grundar sig på diskussioner som IMF:s delegation i oktober-november 2025 förde i Finland med myndigheter, forskningsinstitut, privata finansinstitut, arbetsmarknadsparter och andra instanser. Den nu utgivna rapporten representerar IMF:s experters bedömningar och åsikter och den godkändes av IMF:s direktion den 9 januari 2026.

Kansainvälinen valuuttarahasto julkaisee maaraportin Suomen taloudesta19.1.2026 10:10:00 EET | Uutinen

Kansainvälinen valuuttarahasto (IMF) on saanut päätökseen vuosittaisen arvionsa Suomen talouden tilasta ja näkymistä. Arvio perustuu keskusteluihin, joita Suomessa loka-marraskuussa 2025 vieraillut IMF:n asiantuntijaryhmä kävi viranomaisten, tutkimuslaitosten, yksityisten rahoituslaitosten, työmarkkinaosapuolten ja muiden tahojen kanssa. Nyt julkaistu raportti edustaa IMF:n asiantuntijoiden arvioita ja näkemyksiä, ja se hyväksyttiin IMF:n johtokunnassa 9.1.2026.

Finlands Bank har ställt upp nya klimatetappmål för investeringsverksamheten och uppdaterat sina principer för ansvarsfulla investeringar16.1.2026 10:00:00 EET | Nyheter

Finlands Banks direktion har fattat beslut om nya klimatetappmål som styr bankens investeringsverksamhet mot nettonollutsläpp senast 2050. De uppdaterade målen ligger i linje med tidigare uppnådda etappmål, som var vägledande för verksamheten fram till 2025.

Suomen Pankki asetti sijoitustoiminnalle uudet ilmastovälitavoitteet ja päivitti vastuullisen sijoittamisen periaatteet16.1.2026 10:00:00 EET | Uutinen

Suomen Pankin johtokunta on päättänyt uusista ilmastovälitavoitteista, jotka ohjaavat pankin sijoitustoimintaa kohti hiilineutraalisuutta viimeistään vuoteen 2050 mennessä. Päivitys jatkaa aiempien välitavoitteiden linjaa, jotka saavutettuina ohjasivat toimintaa vuoden 2025 loppuun saakka.

Bank of Finland sets new interim climate targets for its investment activities and updates its responsible investment principles16.1.2026 10:00:00 EET | News

The Bank of Finland Board has adopted new interim climate targets to guide its investment activities towards carbon neutrality by 2050 at the latest. This update continues the approach of the previous interim targets, which guided activities up to the close of 2025 and which have been attained.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom