Ilmarinen’s Interim Report 1 January to 30 June 2023: Return on investments rose to 3.7 per cent, solvency strengthened and cost-effectiveness continued to improve

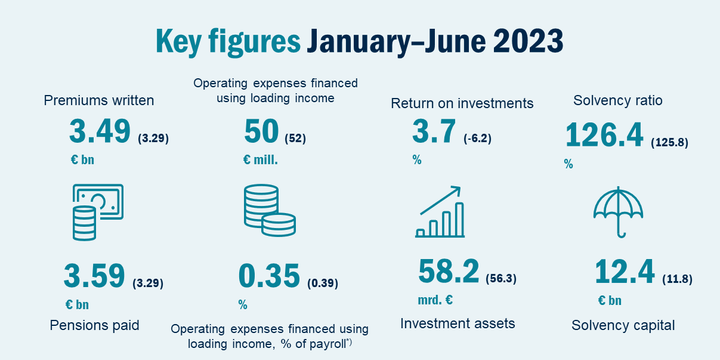

The return on Ilmarinen’s investment portfolio was 3.7 (-6.2) per cent, i.e. EUR 2.1 billion. The market value of investments grew to EUR 58.2 (56.3) billion. The long-term average return on investments was 5.8 per cent as of 1997. This corresponds to an annual real return of 3.8 per cent.

- Thanks to the good performance of investment activities, the total result for January–June grew to EUR 0.6 (-3.4) billion.

- Premiums written grew by 6 per cent to EUR 3.5 (3.3) billion. EUR 3.6 (3.3) billion was paid in pensions.

- Net customer acquisition was EUR 70 (91) million and rolling customer retention for the previous 12 months was 96.4 (97.1) per cent.

- Operating expenses financed using loading income decreased by three per cent to EUR 50 (52) million and were 0.35 (0.39) per cent of the TyEL payroll and YEL income of the insured.

- Solvency capital increased to EUR 12.4 (11.8) billion, and the solvency ratio strengthened to 126.4 (125.8) per cent.

- Outlook: Ilmarinen’s premiums written are expected to grow on the back of payroll growth, but the growth pace is expected to slow down from the previous year.

The interim report result comparison figures are the figures for the corresponding period of 2022. Unless otherwise indicated, the comparison figures for the balance sheet and other cross-sectional items are the figures for the end of 2022.

President and CEO Jouko Pölönen’s review:

“Ilmarinen’s return on investments rose to 3.7 per cent, solvency strengthened and cost-effectiveness continued to improve despite the high inflation and uncertain economic development.

The investment markets showed positive performance in the first half of the year, even though central banks have continued their key interest rate hikes and a fast rise in interest rates has created challenges and increasing financial costs for indebted households, companies and the leveraged real estate sector, for instance. Inflation and global economic growth have slowed, as a result of which the markets forecast an end to key interest rate hikes by the end of the year. The continued strong employment and payroll development have supported demand especially in the service sectors and generated a belief that inflation will be curbed without a deeper downturn. The capital markets’ performance varied by region and sector in the first half of the year. Stock prices rose in the United States, especially driven by major tech companies, and the rise was also strong in Europe, although stock price performance was negative in Finland.

In January–June, Ilmarinen’s return on investments rose to 3.7 per cent, i.e. to EUR 2.1 billion, thanks to the strong performance of the equity markets and fixed income and credit risk investment returns. The long-term average nominal return on investments was 5.8 per cent, corresponding to a 3.8 per cent average annual real return since 1997. The solvency ratio rose to 126.4 per cent and solvency capital to EUR 12.4 billion. The solvency buffers built up through long-term funding and investing protect pension assets against market volatility.

Premiums written grew by 6 per cent to EUR 3,493 million, following the increase in the payroll for employees insured with Ilmarinen. The number of employees in the companies belonging to Ilmarinen’s business cycle index increased by 1.3 per cent year-on-year during January–June. Employment development appears, however, to be decelerating as the number of employees began to fall at a rate of 0.3 per cent in June for the first time in more than two years. We paid EUR 3,594 million in pensions to around 455,000 pensioners.

The cost-effectiveness of Ilmarinen’s operations improved further. Last year, we became the most cost-effective company in the industry, measured by the ratio of operating expenses to expense loading components. In January–June, the operating expenses financed using loading income decreased by 3 per cent to EUR 50 million and were 0.35 per cent of the payroll and YEL income. Earnings-related pension companies started applying company-specific expense loading rates as of the beginning of the year. Following this change, our customers will see the benefits of improved cost-effectiveness directly in their insurance contributions.

An adequate level and coverage of pensions, intergenerational fairness, and sustainable financing are included in the new Government Programme as earnings-related pension policy targets. The significance of investment returns from the perspective of the sustainability of long-term financing of the pension system highlights why the solvency framework for earnings-related companies must be reshaped so as to enable them to seek better long-term returns.

The Finnish welfare society and earnings-related pension system are especially challenged by the decline in the working age population and weakening of the age dependency ratio. Increasing labour immigration is necessary for Finland’s economy and the pension system. Many sectors require more workforce, and in order to attract it, Finland must be an open society that is safe for all and where discrimination is not tolerated. At the same time, it is extremely important to take care of employees’ work ability and competence development. We cannot afford to let almost 20,000 people leave working life prematurely on disability pension. Working life requires flexibility to gain employment for those with partial work ability and also allow the many pensioners willing to work to take on part-time employment. Current and future pensioners have massive labour potential to make up for the growing deficit in working age population caused by a historically low birth rate.”

Read more:

Ilmarinen's Interim Report 1 January to 30 June 2023 (pdf)

Attachments (pdf)

Yhteyshenkilöt

Jouko PölönenPresident and CEO

Puh:+358 50 1282jouko.polonen@ilmarinen.fiMikko MursulaDeputy CEO, CIO

Puh:+358 50 380 3016mikko.mursula@ilmarinen.fiKaisa Ala-LaurilaEVP, Communications and Corporate Responsibility

Puh:+358 407779212kaisa.ala-laurila@ilmarinen.fiIlmarinen’s task is to ensure that our customers receive the pension they earned from employment. We promote a better working life and thus help our customers succeed. In total, we are responsible for the pension cover of some 1,1 million people. We have investment assets of over EUR 58 billion to cover pension liabilities. For more information, please visit: www.ilmarinen.fi.

Tilaa tiedotteet sähköpostiisi

Haluatko tietää asioista ensimmäisten joukossa? Kun tilaat tiedotteemme, saat ne sähköpostiisi välittömästi julkaisuhetkellä. Tilauksen voit halutessasi perua milloin tahansa.

Lue lisää julkaisijalta Ilmarinen

Kutsu kesätoimittajille: Saanko koskaan eläkettä? – tervetuloa Ilmarisen aamiaistilaisuuteen 6.6.20258.5.2025 12:11:38 EEST | Tiedote

Karkaako eläkeikä, saanko koskaan eläkettä? Miksi mielenterveyssyyt vievät yhä nuorempia pois työelämästä? Kesätoimittaja, tule tapamaan Ilmarisen väkeä ja päivitä tietosi eläkkeistä, työkyvystä sekä työurista perjantaina 6.6.2025. Luvassa on myös ideoita juttuaiheiksi!

Ilmarisen toimitusjohtaja vaihtuu5.5.2025 07:49:48 EEST | Tiedote

Työeläkeyhtiö Ilmarisen toimitusjohtaja Jouko Pölönen on ilmoittanut jättävänsä yhtiön ja siirtyvänsä uusiin tehtäviin yhtiön ulkopuolelle. Uuden toimitusjohtajan haku käynnistyy heti.

Växthusgasutsläppen från Ilmarinens pensionsinvesteringar minskade avsevärt30.4.2025 15:43:13 EEST | Tiedote

Kolintensiteten i arbetspensionsbolaget Ilmarinens noterade placeringar minskade betydligt jämfört med 2020. Detta framgår av Ilmarinens första lagstadgade hållbarhetsrapport. – Vi har systematiskt vidtagit åtgärder enligt vår klimatfärdplan och detta har burit frukt, säger Karoliina Lindroos, Ilmarinens direktör för ansvarsfulla placeringar.

Greenhouse gas emissions of Ilmarinen’s pension investments decreased significantly30.4.2025 15:40:22 EEST | Tiedote

The carbon intensity of Ilmarinen’s listed investments decreased significantly from 2020. This is reflected in Ilmarinen’s first statutory sustainability report. “We have systematically implemented measures in line with our climate roadmap, and this has produced results,” says Karoliina Lindroos, Head of Responsible Investments at Ilmarinen.

The first quarter in Ilmarinen: Return on investments was 0.2 per cent, solvency was strong, and cost-effectiveness improved25.4.2025 13:08:57 EEST | Tiedote

Ilmarinen’s return on investments was 0.2 per cent, investment assets EUR 63.1 billion and solvency capital EUR 13.7 billion. Strong solvency enables the long-term investment of pension assets in an unstable market situation undermined by the trade war.

Uutishuoneessa voit lukea tiedotteitamme ja muuta julkaisemaamme materiaalia. Löydät sieltä niin yhteyshenkilöidemme tiedot kuin vapaasti julkaistavissa olevia kuvia ja videoita. Uutishuoneessa voit nähdä myös sosiaalisen median sisältöjä. Kaikki tiedotepalvelussa julkaistu materiaali on vapaasti median käytettävissä.

Tutustu uutishuoneeseemme