Popularity of higher-interest deposits increased

In the wake of rising interest rates, Finnish households have moved1 their funds to higher-interest deposit accounts. In the course of 2023, households moved EUR 7.3 of their funds to deposit accounts with an agreed maturity and a little over EUR 2 billion to investment deposit accounts2. Overall, however, the household deposit stock3 (EUR 108.7 billion) contracted by over EUR 3 billion, as the amount in overnight deposit accounts4 decreased by EUR 12.4 billion over the same period.

Despite the decrease, the most (65%) of households’ deposits are still in overnight deposit accounts (incl. transaction accounts). At the end of 2023, EUR 70.6 billion of households’ deposits were overnight, EUR 10.9 billion with an agreed maturity and EUR 27.2 billion investment deposits.

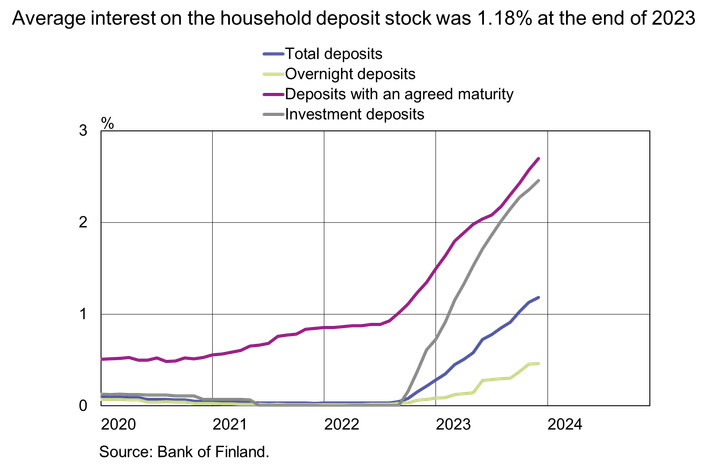

As the level of interest rates has risen, the interest rate differentials between different types of deposit accounts have widened. The average interest on households’ agreed-maturity and investment deposits has risen rapidly. At the end of December 2023, the average interest on the stock of deposits with an agreed maturity was 2.70%, and the average interest on the investment deposit stock was 2.46%. Meanwhile, the average interest on the overnight deposit stock has also risen, to stand at 0.46% at the end of December.

In end-December 2023, the average interest rate on the aggregate household deposit stock was 1.18%, as opposed to 0.21% a year earlier. The average interest on the household deposit stock has not been any higher since 2009.

The average interest on new deposit agreements with an agreed maturity concluded by households declined slightly from November 2023 to 3.42% in December. Until then, the average interest rate on new deposits with an agreed maturity had risen without an interruption since July 2022. In Finland, the average interest on new agreed-maturity deposits in December was slightly higher than in the euro area on average. In December 2023, the average interest on new agreed-maturity deposits in the euro area was 3.29%, also showing a slight decline from November.

For further information, please contact:

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

- Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 8 May 2024.

1 In net terms.

2 Investment deposits are deposits redeemable at notice. They do not have an agreed maturity date (unlike deposits with an agreed maturity), but they have a notice period, during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts without a period of notice or agreed maturity, but which have restrictive drawing provisions.

3 Several deposits subject to restrictive drawing provisions were reclassified for statistical purposes from overnight deposits to investment deposits. This change increased the volume of investment deposits and reduced overnight deposits. The historical data has been revised as of October 2022. For more detailed information on reclassifications concerning deposits, see (link).

4 Includes transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kutsu medialle: Suomen Pankin tiedotustilaisuus 12.9.2025 rahapolitiikasta ja euroalueen talouden näkymistä5.9.2025 11:23:15 EEST | Kutsu

Mitkä ovat euroalueen talouden näkymät tuoreiden rahapoliittisten päätösten valossa? Miltä inflaatio näyttää? Millä tavalla geopoliittinen tilanne vaikuttaa Euroopan talouskasvuun ja työllisyyteen? Millainen vaikutus puolustusmenojen kasvulla on talouteen?

Det totala värdet av kontaktlösa betalningar större än kortbetalningarna med chip i april-juni 20254.9.2025 10:00:00 EEST | Pressmeddelande

Under andra kvartalet 2025 gjordes med finländska betalkort sammanlagt 652 miljoner kortbetalningar, vilket var 3 % fler kortbetalningar än vid motsvarande tid ett år tidigare. Det totala värdet av de kontaktlösa betalningarna ökade från året innan med 23 %.

Lähimaksujen kokonaisarvo sirulla tehtyjä korttimaksuja suurempi huhti-kesäkuussa 20254.9.2025 10:00:00 EEST | Tiedote

Vuoden 2025 toisella neljänneksellä suomalaisilla maksukorteilla tehtiin yhteensä 652 milj. korttimaksua, mikä oli 3 % enemmän kuin vuosi sitten vastaavana aikana. Lähimaksujen kokonaisarvo kasvoi edellisvuodesta 23 %.

Total value of contactless payments surpassed chip-based card payments in April–June 20254.9.2025 10:00:00 EEST | Press release

In the second quarter of 2025, Finnish payment cards were used for a total of 652 million card payments, an increase of 3% compared with the same period in the previous year. The aggregate value of contactless payments rose by 23% year on year.

Genomsnittsräntorna på konsumtionskrediter beviljade av övriga finansinstitut har sjunkit4.9.2025 10:00:00 EEST | Pressmeddelande

Under det andra kvartalet 2025 utbetalades nya konsumtionskrediter utan säkerhet[1] från övriga finansinstitut till ett värde av 67 miljoner euro, vilket är 40 % mer än vid motsvarande tid för ett år sedan. Den överenskomna årliga räntan på nya konsumtionskrediter utan säkerhet var 8,03 % och den effektiva räntan 12,52 %, då den överenskomna årliga räntan vid motsvarande tid för ett år sedan var 8,71 % och den effektiva räntan 13,50 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom