Drawdowns of student loans decreased in January year on year

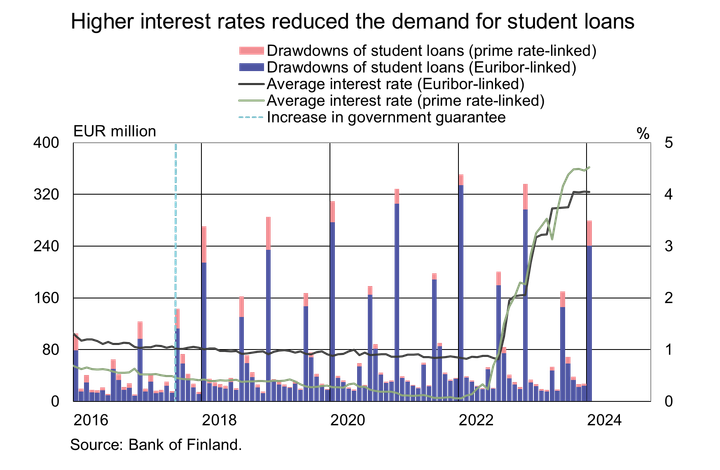

In January 2024,1 drawdowns of student loans totalled EUR 279 million, representing a decline of 17% on the corresponding period last year. This was the lowest level of new student loan drawdowns in January since 2018. The average interest rate on student loans drawn down in January 2024 was 4.46%, which was 2.22 percentage points higher than in January last year. This is the highest average interest rate on new student loan drawdowns since November 2008.

Euribor-linked loans accounted for 86% of all student loan drawdowns, and the average interest rate on these loans was 4.52%. Banks’ own reference rates have become more popular in new student loan drawdowns. In January 2024, 14% of new student loan drawdowns were linked to prime rates, or banks’ own reference rates, as opposed to 5% in January 2022. The average interest rate on new drawdowns linked to banks’ own reference rates (4.04%) was slightly lower than that on Euribor-linked ones.

The rapid growth of the student loan stock has levelled off. At the end of January 2024, the stock of student loans amounted to EUR 6.2 billion, and its annual growth rate was 4.0%. The last period with slower year-on-year growth was September 2011. While the stock has grown rapidly in recent years, the annual growth rate has been in a stable decline due to decreasing drawdowns and student loan compensations paid by Kela.2 The stock of student loans has more than doubled since the student aid reform in 2017. In addition to the larger loan instalments following the reform, the student loan stock has also been boosted by an increase in the number of borrowers.3

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 0.8 billion in January 2024, which is EUR 40 million less than in the same period a year earlier. Buy-to-let mortgages accounted for EUR 90 million of the new housing loan drawdowns. The average interest rate on new housing loans decreased from December, to stand at 4.36% in January. At the end of January 2024, the housing loan stock totalled EUR 106.4 billion, and its year-on-year growth amounted to -1.5%. Buy-to-let mortgages accounted for EUR 8.6 billion of the housing loan stock. At the end of January, Finnish households’ loan stock included EUR 17.8 billion of consumer credit and EUR 17.7 billion of other loans.

In January, Finnish non-financial corporations drew down new4 loans worth EUR 1.8 billion, including EUR 490 million of housing corporation loans. The average interest rate on new corporate-loan drawdowns rose from December, to 5.58%. At the end of January, the stock of loans granted to Finnish non-financial corporations stood at EUR 107.1 billion, whereof housing corporation loans accounted for EUR 44.0 billion.

Deposits

At the end of April 2024, Finnish households’ aggregate deposit stock totalled EUR 108.2 billion, and the average interest rate on these deposits was 1.25%. Overnight deposits accounted for EUR 68.8 billion and deposits with agreed maturity for EUR 11.6 billion of the total deposit stock. In January, Finnish households made new agreements on deposits with agreed maturity in the amount of EUR 1,470 million, at an average interest rate of 3.40%.

For further information, please contact:

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

- Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 2 April 2024.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics2/.

1 The spring semester loan instalment became available for drawdown in January.

2 In 2022, student loan compensations approximately EUR 87.8 million, and in 2015–2021 they totalled approximately EUR 226.5 million (in Finnish).

3 According to statistics published by the National Pensions Institute Kela, the number of persons with student debt amounted to 525,000 during the academic year 2022–2023, whereas the number was 63,000 lower three years earlier.

4 Excl. overdrafts and credit card credit.

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Eurosystemets penningpolitiska beslut18.7.2024 15:25:00 EEST | Uutinen

ECB:s pressmeddelande 18 juli 2024 ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade. Inkommande uppgifter ger i stort sett stöd åt ECB-rådets tidigare bedömning av inflationsutsikterna på medellång sikt. Även om vissa mått på underliggande inflation tickade upp i maj, beroende på engångsfaktorer, var de flesta mått antingen stabila eller sjönk i juni. I linje med förväntningarna har inflationseffekten av lönetillväxt dämpats av vinster. Penningpolitiken håller finansieringsförhållandena restriktiva. Samtidigt är det inhemska pristrycket fortsatt högt, tjänsteinflationen förhöjd och den totala inflationen lär sannolikt ligga kvar över målet en bra bit in på nästa år. ECB-rådet är fast beslutet att säkerställa att inflationen inom rimlig tid återgår till 2-procentsmålet på medellång sikt. Styrräntorna kommer att hållas tillräckligt restriktiva under så lång tid som behövs för att uppnå detta mål. ECB-rådet kommer att fortsätta att följa ett databeroende tillvägagångssät

ECB Monetary policy decisions18.7.2024 15:25:00 EEST | News

ECB press release 18 July 2024 The Governing Council today decided to keep the three key ECB interest rates unchanged. The incoming information broadly supports the Governing Council’s previous assessment of the medium-term inflation outlook. While some measures of underlying inflation ticked up in May owing to one-off factors, most measures were either stable or edged down in June. In line with expectations, the inflationary impact of high wage growth has been buffered by profits. Monetary policy is keeping financing conditions restrictive. At the same time, domestic price pressures are still high, services inflation is elevated and headline inflation is likely to remain above the target well into next year. The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and

EKP:n rahapoliittisia päätöksiä18.7.2024 15:25:00 EEST | Uutinen

EKP:n lehdistötiedote 18.7.2024 EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan. Tuoreimmat tiedot tukevat yleisesti EKP:n neuvoston aiempaa arviota keskipitkän aikavälin inflaationäkymistä. Vaikka jotkin pohjainflaation mittarit nousivat toukokuussa kertaluonteisten tekijöiden vuoksi, valtaosa mittareista pysyi ennallaan tai laski kesäkuussa. Palkkojen nopean nousun vaikutusta inflaatioon on odotusten mukaisesti vaimennettu voitoilla. Rahoitusolot ovat kireät rahapolitiikan vuoksi. Euroalueen sisäiset hintapaineet ovat edelleen korkeat, palvelujen hintainflaatio on nopeaa ja kokonaisinflaatio pysynee tavoitetta nopeampana vielä hyvän aikaa ensi vuoden puolellakin. EKP:n neuvosto pyrkii määrätietoisesti varmistamaan, että keskipitkän aikavälin inflaatiovauhti palautuu kohtuullisessa ajassa kahden prosentin tavoitteen mukaiseksi. Tavoitteen saavuttamiseksi ohjauskorot pidetään riittävän rajoittavina niin kauan kuin on tarpeen. EKP:n neuvosto määrittää rajoittavuude

Bank of Finland conference discussed monetary policy decision-making and implementation in low and high inflation environments28.6.2024 11:12:55 EEST | News

Going forward, the monetary policy strategy should be designed in a way that ensures price stability in the face of great uncertainty. This will require it to be flexible enough to work well in different environments and react to new and unknown shocks, Bank of Finland Governor Olli Rehn stressed on Wednesday at an international monetary policy conference organised by the Bank of Finland in Helsinki.

Suomen Pankin konferenssissa keskusteltiin rahapolitiikan päätöksenteosta sekä toimeenpanosta hitaan ja nopean inflaation kausina28.6.2024 11:12:51 EEST | Uutinen

Rahapolitiikan strategia tulee jatkossa suunnitella siten, että se varmistaa hintavakauden myös suuren epävarmuuden vallitessa. Tämä edellyttää strategialta riittävää joustavuutta, jotta se toimii hyvin eri ympäristöissä ja vastaa uusiin ja ennalta arvaamattomiin häiriöihin, Suomen Pankin pääjohtaja Olli Rehn painotti keskiviikkona Suomen Pankin järjestämässä kansainvälisessä rahapolitiikkakonferenssissa Helsingissä.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom