The general housing allowance will decrease in 2024 – the entitlement criteria for unemployment benefits also to become more strict

There will be several cuts and other changes to Kela’s unemployment benefits and the general housing allowance in 2024. There will also be changes to the housing costs that can be recognised under the social assistance scheme. Customers can use Kela’s calculators to estimate how the changes will affect their situation.

Parliament has approved cuts and other changes to the social security benefits provided by Kela. Most of the changes will take effect on 1 April 2024.

All the changes will come into effect automatically, so customers do not have to contact Kela because of them.

Entitlement criteria for unemployment benefits more strict

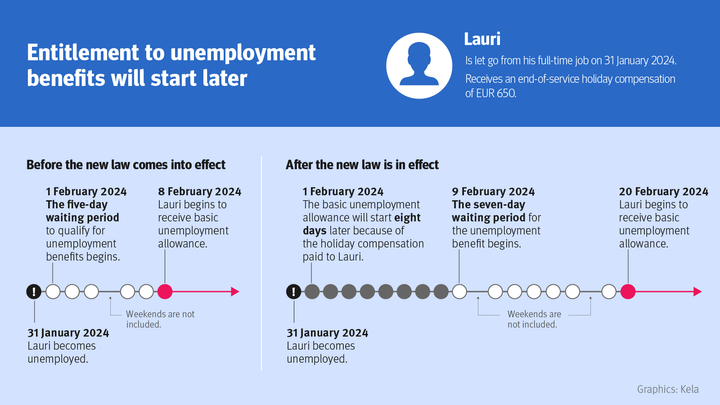

Changes were implemented to the unemployment benefits on 1 January 2024. The changes affect the start date of the unemployment benefit. The entitlement to unemployment benefits now starts later than before because the waiting period for the unemployment benefits was extended from 5 days to 7 days. A periodisation for the holiday compensation in connection with the unemployment benefits was also introduced.

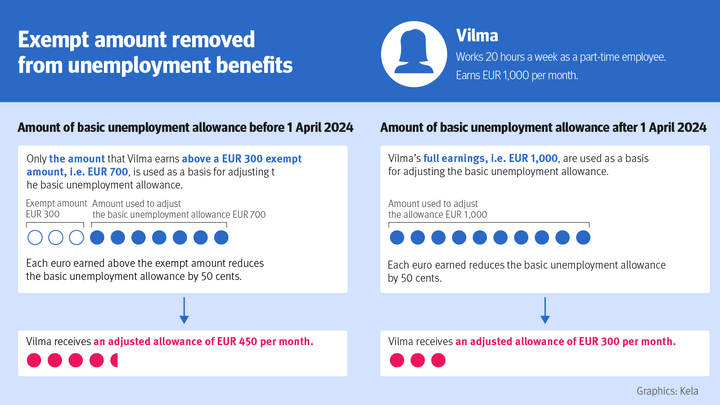

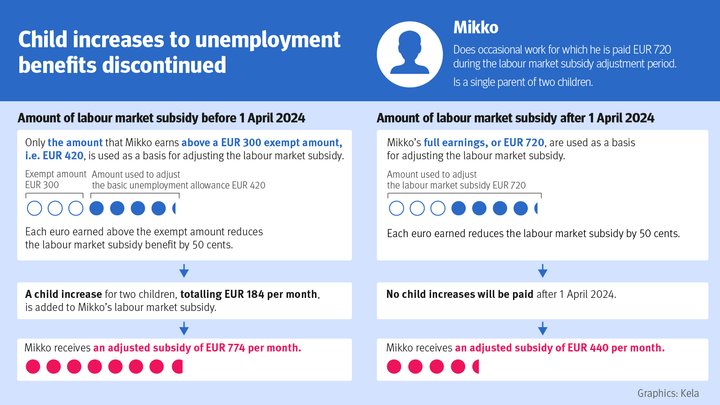

The exempt amount of EUR 300 and the child increases in connection with the unemployment benefits will also soon be discontinued. These changes will take effect on 1 April 2024. Kela will thus still pay child increases for the days of unemployment in March.

There will also be changes to the work requirement for wage-earners. The work requirement will be extended from the current approximately six months to 12 months, and the work requirement will be based on the amount of the wage or salary instead of the number of weekly working hours. These changes to the work requirement will take effect on 2 September 2024.

Learn more about the changes to the unemployment benefits and see examples.

On an annual level, the abolishment of the child increases to the unemployment benefits will concern approximately 100,000 persons. The abolishment of the exempt amount in connection with the unemployment benefits will affect persons who work part-time or do incidental work and who receive adjusted unemployment benefit. Last year approximately 76,000 recipients of unemployment benefits earned more than EUR 300 per month.

Customers can use the calculator for unemployment benefits to estimate how the cuts will affect their situation. The changes that will take effect on 1 April 2024 will be updated in the calculators in March 2024. The calculator gives an estimate of the new amount of the benefit when 1 April 2024 or a later date is selected as the start date.

General housing allowance reduced

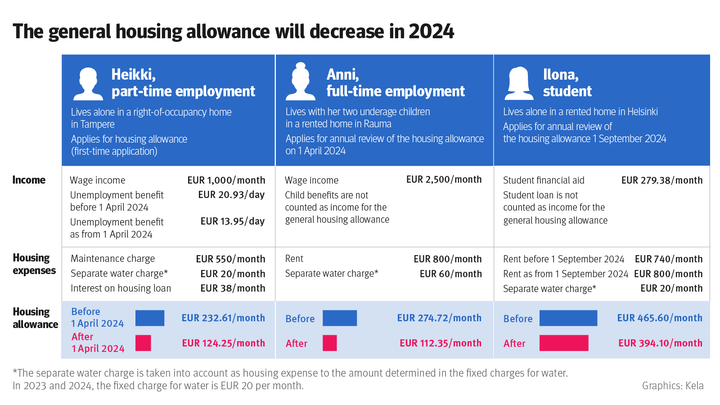

There will be cuts to the general housing allowance. The percentage of the housing costs that are compensated through the general housing allowance will be reduced and the basic deductible will increase, and this will reduce the amount of the general housing allowance.

The earnings deduction to the general housing allowance will also be discontinued. The deduction has been EUR 300 per month.

The maximum amount of housing costs that is taken into account in Helsinki will decrease when municipality categories 1 and 2 for determining the maximum housing costs taken into account for the general housing allowance are merged and the maximum housing costs are determined according to the current municipality category 2. This means that Helsinki and the rest of the municipalities in the Greater Helsinki Area will be in the same category. The change will mean a reduction in the general housing allowance for nearly all recipient households in Helsinki.

General housing allowance will also no longer be available for owner-occupied housing as from the beginning of 2025. The change does not apply to right-of-occupancy or part-ownership homes. General housing allowance will continue to be available for such homes.

However, in the case of right-of-occupancy homes, interest payments on housing loans will no longer be recognised as housing costs. The change will take effect from the beginning of 2025.

The changes do not apply to the housing allowance for pensioners.

Learn more about the changes to the general housing allowance and see examples.

Most of the changes to the general housing allowance will take effect on 1 April 2024. The situation of the household determines when the changes will reduce the amount of the housing allowance that the household receives.

If the household is granted general housing allowance for the first time, the changes will reduce the amount of housing allowance that the household receives starting 1 April 2024.

If general housing allowance has been granted before 1 April 2024, the changes will reduce the amount of the housing allowance that the household receives when the household the next time has to apply for a review of the housing allowance.

Learn more about when you must apply for a review of the housing allowance.

The legislative changes to the general housing allowance apply to all recipients of general housing allowance. A total of 404,662 households were active recipients of general housing allowance at the end of 2023. Of these households, 41 percent, i.e. 167,740 households, were student households.

Customers can use the calculator for general housing allowance to estimate how the cuts will affect their situation. The changes that will take effect on 1 April 2024 have been updated in the calculator. The calculator gives an estimate of the new amount of the benefit when 1 April 2024 or a later date is selected as the start date.

The basic social assistance compensates for the cuts in the general housing allowance and the unemployment benefits for those with the lowest incomes. According to Kela’s calculations, the number of households receiving basic social assistance will increase by approximately 25,000 households in 2024.

Customers can use the calculator for social assistance to estimate whether they are eligible for basic social assistance.

Change to housing costs recognised under the social assistance scheme

A change related to housing costs in connection with the basic social assistance will also take effect on 1 April 2024. There are municipality-specific maximum limits for the amount of housing costs that can be recognised under the social assistance scheme. Henceforth, Kela cannot accept that the maximum limits are exceeded even by the slightest amount without special grounds. These special grounds will now be laid down by law.

If the customer cannot refer to any special grounds, Kela will give the customer 3 months to find more affordable housing. The time limit can be extended if the customer, despite his or her best efforts, cannot find more affordable housing in his or her place of residence. The customer can always continue to live in his or her current home, as long as the customer pays the amount of the housing costs that exceeds the maximum limit for the housing costs recognised under the social assistance scheme himself or herself.

Media inquiries

Changes to the social security benefits provided by Kela in general:

Pasi Pajula, Head of the Centre of Expertise, tel. 020 634 4218

Mia Helle, Head of the Benefits and Services Planning Unit, tel. 020 634 3480

Unemployment benefits:

Antti Ristimäki, Legal Counsel, tel. 020 634 2194

General housing allowance:

Mirja Peltonen, Senior Coordinator, tel. 020 635 9713

Rita Lääkkölä, Legal Counsel, tel. 020 634 2057

Social assistance:

Marja-Leena Valkonen, Benefits Manager, tel. 020 634 3382

Venla Hietala, Senior Coordinator, tel. 050 346 4201

Keywords

Links

Kela has a responsibility to provide basic support in life’s ups and downs to everyone covered by the Finnish social security system.

Alternative languages

Subscribe to releases from Kela

Subscribe to all the latest releases from Kela by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Kela

Kelan Ylöjärven palvelupisteen aukioloaika muuttuu24.7.2024 09:00:00 EEST | Tiedote

Aukioloaika muuttuu Ylöjärven palvelupisteessä 6.8. alkaen. Jatkossa neuvontaa saa ajanvarauksella tiistaisin.

Kela bálvalanbáiki Soađegilis fárre15.7.2024 10:06:26 EEST | Tiedote

Soađegili bálvalanbáiki fárre 29.7. čujuhussii Ostoskuja 1.

Kelan palvelupiste Sodankylässä muuttaa15.7.2024 10:05:51 EEST | Tiedote

Sodankylän palvelupiste muuttaa 29.7. osoitteeseen Ostoskuja 1.

MittKanta håller öppet hela sommaren – här våra tips till semesterfirare11.7.2024 06:30:00 EEST | Tiedote

Finlands mest använda digitala tjänst inom social- och hälsovården, MittKanta, står till tjänst i hälso- och sjukvårdsärenden också under semesterperioden. Med hjälp av Kanta-tjänsterna följer viktiga uppgifter med dig från ett välfärdsområde till ett annat och till och med utomlands. Läs om hur vi betjänar semesterfirare.

OmaKanta on auki koko kesän – tässä vinkkimme lomalaiselle11.7.2024 06:30:00 EEST | Tiedote

Suomen käytetyin sosiaali- ja terveydenhuollon asiointipalvelu OmaKanta palvelee terveysasioissa lomakaudellakin. Tärkeät tiedot kulkevat mukanasi hyvinvointialueelta toiselle ja jopa ulkomaille Kanta-palvelujen avulla. Lue, miten palvelemme lomalaista.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom