Ilmarinen’s return on investments 3.2 per cent and efficiency improved further

The return on Ilmarinen’s investments in January–March was 3.2 per cent. The company’s cost-effectiveness improved further as premiums written grew and the operating expenses necessary for providing pension security fell. “We have successfully continued implementing Ilmarinen’s strategy and improved our productivity significantly over the past six years,” says Ilmarinen’s CEO Jouko Pölönen.

The driver of the 3.2 per cent return on the investment portfolio was the listed equity market, where positive performance focused on the technology sector. Higher market interest rates dampened fixed income investment returns. Central banks are expected to start cutting key interest rates during the year, but in Q1, rate cut expectations moderated and bets on their timing were dialled back. The long-term average return since 1997 was 5.8 per cent. The market value of investments was EUR 60.5 billion.

Digitalisation and process development underlying the productivity leap

Ilmarinen’s cost-effectiveness improved further, as premiums written grew 2 per cent and operating expenses financed using loading income fell 2 per cent, which was 0.35 per cent of the TyEL payroll and YEL income of the insured. In January–March, we paid approximately EUR 1,885 million in pensions to around 450,000 pensioners.

“Over the past six years, Ilmarinen has successfully reduced the annual costs for managing pension insurance by a third, or close to EUR 50 million, for our more than 1.1 million customers. At the same time, premiums written have grown 34 per cent. Pensions are part of public social security and we want to continuously manage them even more effectively,” says Jouko Pölönen.

Underlying the productivity leap is the extremely successful merger with Etera in 2018 and the repatriation of the resulting synergy benefits. The key factors for improving profitability have been the development of digital service processes and building a culture of continuous improvement. Our customers see the benefits of improved cost-effectiveness directly in their insurance contributions.

Weakening employment is reflected in Ilmarinen’s business cycle index

Employment has weakened since last summer and the political strikes in Q1 added to the economic and employment challenges. The number of employees in the companies belonging to Ilmarinen’s business cycle index fell by 2.5 per cent year-on-year during January–March.

“Employment weakened in all sectors and most of all in staff leasing and construction. From a geographical viewpoint, the number of employees fell in all parts of Finland. Growth and improvement in productivity are needed to turn public debt around. When employment weakens, productivity development gains all the more importance. Utilising digitalisation, automation and AI in the continuous development of processes is essential,” Pölönen explains.

Higher long-term returns are needed for pension assets

The pension reform will be prepared in accordance with the Government Programme with key labour market organisations in tripartite negotiations by the end of January 2025. The goal is to ensure the financial sustainability of the pension system and to secure an adequate level of benefits. The amendments must strengthen public finances in the long term by approximately 0.4 percentage points in relation to the GDP, representing some one billion euros.

“As the working age population declines, among other things due to a low birth rate, the return on investments will play a greater role in ensuring the financial sustainability of the pension system. Increasing the return on investments is in fact the most effective way to improve the pension system’s financial and social sustainability. The solvency framework should be reshaped so as to enable pension companies to seek better long-term returns,” Pölönen says.

Ilmarinen’s January–March 2024 development in brief

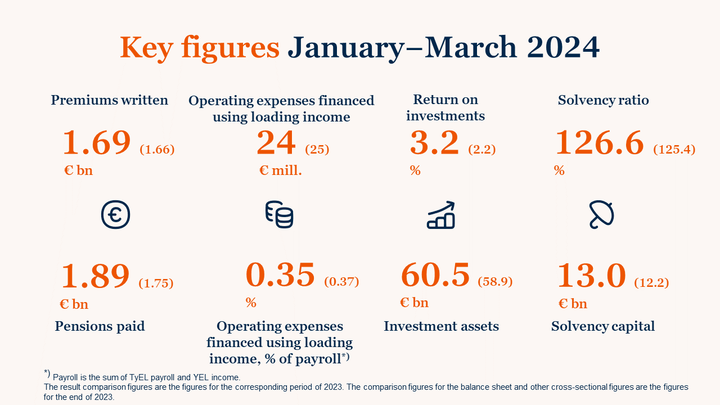

- The return on Ilmarinen’s investment portfolio was 3.2 (2.2) per cent, or EUR 1.9 billion. The market value of investments grew to EUR 60.5 (58.9) billion. The long-term average return on investments was 5.8 per cent as of 1997. This corresponds to an annual real return of 3.8 per cent.

- The total result rose to EUR 778 (407) million.

- Premiums written rose by 2 per cent to EUR 1,690 (1,660) million. Pensions paid rose by 8 per cent to EUR 1,885 (1,754) million.

- Net customer acquisition was EUR 29 (70) million and rolling customer retention for the previous 12 months was 96.3 (97.1) per cent.

- Operating expenses financed using loading income decreased 2 per cent to EUR 24 (25) million and were 0.35 (0.37) per cent of the TyEL payroll and YEL income of the insured.

- Solvency capital increased to EUR 13.0 (12.2) billion, and the solvency ratio strengthened to 126.6 (125.4) per cent.

- Future prospects: Ilmarinen’s premiums written are expected to grow as the earnings level rises.

Read more:

Yhteyshenkilöt

Jouko PölönenPresident and CEO

Puh:+358 50 1282jouko.polonen@ilmarinen.fiKaisa Ala-LaurilaEVP, Communications and Corporate Responsibility

Puh:+358 407779212kaisa.ala-laurila@ilmarinen.fiMikko MursulaDeputy CEO, CIO

Puh:+358 50 380 3016mikko.mursula@ilmarinen.fiKuvat

Tietoja julkaisijasta

Ilmarinen’s task is to ensure that our customers receive the pension they earned from employment. We promote a better working life and thus help our customers succeed. In total, we are responsible for the pension cover of some 1,1 million people. We have investment assets of close to EUR 60 billion to cover pension liabilities. For more information, please visit: www.ilmarinen.fi

Tilaa tiedotteet sähköpostiisi

Haluatko tietää asioista ensimmäisten joukossa? Kun tilaat tiedotteemme, saat ne sähköpostiisi välittömästi julkaisuhetkellä. Tilauksen voit halutessasi perua milloin tahansa.

Lue lisää julkaisijalta Ilmarinen

Ilmarinens placeringsavkastning var 3,2 procent och effektiviteten förbättrades ytterligare26.4.2024 14:05:36 EEST | Tiedote

Avkastningen på arbetspensionsbolaget Ilmarinens placeringar var i januari–mars 3,2 procent. Bolagets kostnadseffektivitet förbättrades ytterligare då premieinkomsten ökade och de omkostnader som behövs för verkställande av pensionsskyddet minskade. – Vi har fortsatt att framgångsrikt genomföra Ilmarinens strategi och i betydande grad utökat vår lönsamhet under de senaste sex åren, konstaterar Ilmarinens verkställande direktör Jouko Pölönen.

Ilmarisen sijoitustuotto 3,2 prosenttia, ja tehokkuus parani edelleen26.4.2024 14:02:56 EEST | Tiedote

Työeläkeyhtiö Ilmarisen sijoitusten tuotto oli tammi–maaliskuussa 3,2 prosenttia. Yhtiön kustannustehokkuus parani edelleen vakuutusmaksutulon kasvaessa ja eläketurvan tuottamiseen tarvittavien hoitokulujen laskiessa. – Olemme jatkaneet menestyksekkäästi Ilmarisen strategian toteuttamista ja kasvattaneet tuottavuuttamme viimeisten kuuden vuoden aikana merkittävästi, toteaa Ilmarisen toimitusjohtaja Jouko Pölönen.

Työkyvyttömyydessä iso vaihtelu toimialoittain – uusi indeksi tarjoaa ennusteita ja tilannetietoa24.4.2024 10:39:32 EEST | Tiedote

Työkyvyttömyyseläkkeiden määrässä on jopa nelinkertainen ero eri toimialojen välillä. Fyysisesti kuormittavilla aloilla työuraa uhkaavat todennäköisemmin tuki- ja liikuntaelinten sairaudet, kun taas asiantuntija-aloilla mielenterveyden häiriöt ovat yleisin syy pysyvään työkyvyttömyyteen. Tiedot selviävät Ilmarisen uudesta työkyvyttömyyseläkeindeksistä.

Mediakutsu: Ilmarisen tulosinfo ja markkinanäkymät 26.4. klo 1424.4.2024 08:25:49 EEST | Tiedote

Ilmarinen julkistaa tuloksensa ajalta 1.1.–31.3.2024. Median edustajat ovat tervetulleita tulosinfoon perjantaina 26.4. klo 14 Ilmarisen toimitalossa (Porkkalankatu 1, Ruoholahti, Helsinki) ja etäyhteydellä verkossa.

Mediakutsu: Ilmarisen tulosinfo ja markkinanäkymät 26.4. klo 1422.4.2024 09:04:58 EEST | Tiedote

Ilmarinen julkistaa tuloksensa ajalta 1.1.–31.3.2024. Median edustajat ovat tervetulleita tulosinfoon perjantaina 26.4. klo 14 Ilmarisen toimitalossa (Porkkalankatu 1, Ruoholahti, Helsinki) ja etäyhteydellä verkossa.

Uutishuoneessa voit lukea tiedotteitamme ja muuta julkaisemaamme materiaalia. Löydät sieltä niin yhteyshenkilöidemme tiedot kuin vapaasti julkaistavissa olevia kuvia ja videoita. Uutishuoneessa voit nähdä myös sosiaalisen median sisältöjä. Kaikki tiedotepalvelussa julkaistu materiaali on vapaasti median käytettävissä.

Tutustu uutishuoneeseemme