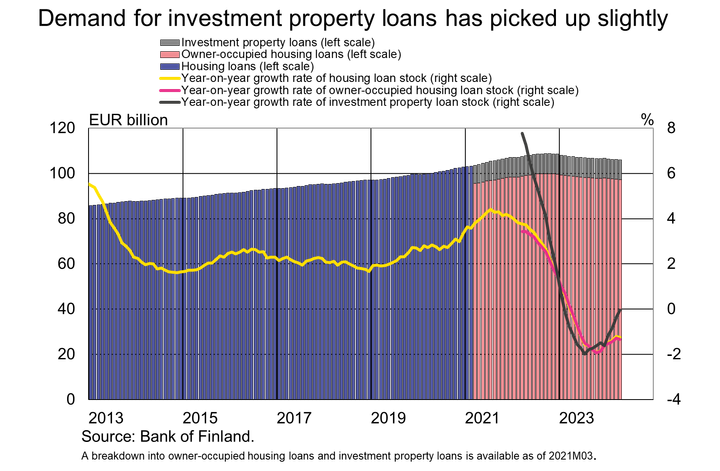

Demand for investment property loans has picked up slightly

Drawdowns of new investment property loans in March–April 2024 totalled EUR 210 million, an increase of 14% year on year. However, the drawdowns were still clearly lower than in the same period in 2021 and 2022. While the drawdown volume has increased from 2023, the annual rate of change of households’ investment property loan stock (EUR 8.7 billion) was 0.0% in April 2024, as opposed to 1.1% a year earlier. In month-on-month terms, the stock of investment property loans has now grown for four months in a row.

The year-on-year contraction of the household loan stock as a whole (EUR 106.0 billion) continued ( 1.2%) as the owner-occupied housing loan stock (EUR 97.3 billion) contracted by 1.3%. The stock of owner-occupied housing loans contracted reflecting decreased drawdown volumes. Drawdowns of new housing loans in July 2024 totalled EUR 1.9 bn, a decline of 8% on the corresponding month last year.

Overall, drawdowns of housing loans remained exceptionally low in April 2024. In April, drawdowns of housing loans amounted to EUR 1.1 billion, which was 7% more than a year earlier but 28% less than the April average for 2011–2022. In 2023, April had fewer working days than in 2024 due to Easter, which had an impact on the amount drawn down. According to the imputed seasonally-adjusted figures reflecting the number of working days and the timing of Easter, housing loan drawdowns in April 2024 came in lower than in the previous year.

The average interest rate on new housing loans (4.36%) has remained almost unchanged year-to-date in 2024. In April 2024, the average interest rate on new investment property loans was 4.53% and on owner-occupied housing loans 4.34%. The rise of the average interest on housing loan stock (4.08%) has also stopped in early 2024, having remained unchanged since the end of December 2023. In April 2024, the average interest rate on the stock of owner-occupied housing loans was 4.06% and on the stock of investment property loans 4.28%.

Loans

At the end of April 2024, Finnish households’ loan stock comprised EUR 17.8 billion in consumer credit and EUR 17.5 billion in other loans.

Drawdowns of new loans by Finnish non-financial corporations amounted to EUR 2.1 billion, with loans to housing corporations’ loans accounting for EUR 680 million. The average interest rate on new corporate loan drawdowns rose from March, to stand at 5.47%. At the end of April, the stock of loans granted to Finnish non-financial corporations was EUR 107.4 billion, whereof loans to housing corporations accounted for EUR 44.3 billion.

Deposits

At the end of April 2024, the aggregate stock of Finnish households’ deposits totalled EUR 109.0 billion, and the average interest rate on these deposits was 1.34%. Overnight deposits accounted for EUR 67.3 billion and deposits with agreed maturity for EUR 13.2 billion of the total deposit stock. In April, Finnish households made EUR 1.2 billion of new deposit agreements with an agreed maturity, at an average interest rate of 3.52%.

Further information:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 28 June 2024.

Related statistical data and graphs are also available on the Bank of Finland website: . https://www.suomenpankki.fi/en/statistics2/.

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kutsu medialle: Suomen Pankin tiedotustilaisuus 12.9.2025 rahapolitiikasta ja euroalueen talouden näkymistä5.9.2025 11:23:15 EEST | Kutsu

Mitkä ovat euroalueen talouden näkymät tuoreiden rahapoliittisten päätösten valossa? Miltä inflaatio näyttää? Millä tavalla geopoliittinen tilanne vaikuttaa Euroopan talouskasvuun ja työllisyyteen? Millainen vaikutus puolustusmenojen kasvulla on talouteen?

Det totala värdet av kontaktlösa betalningar större än kortbetalningarna med chip i april-juni 20254.9.2025 10:00:00 EEST | Pressmeddelande

Under andra kvartalet 2025 gjordes med finländska betalkort sammanlagt 652 miljoner kortbetalningar, vilket var 3 % fler kortbetalningar än vid motsvarande tid ett år tidigare. Det totala värdet av de kontaktlösa betalningarna ökade från året innan med 23 %.

Lähimaksujen kokonaisarvo sirulla tehtyjä korttimaksuja suurempi huhti-kesäkuussa 20254.9.2025 10:00:00 EEST | Tiedote

Vuoden 2025 toisella neljänneksellä suomalaisilla maksukorteilla tehtiin yhteensä 652 milj. korttimaksua, mikä oli 3 % enemmän kuin vuosi sitten vastaavana aikana. Lähimaksujen kokonaisarvo kasvoi edellisvuodesta 23 %.

Total value of contactless payments surpassed chip-based card payments in April–June 20254.9.2025 10:00:00 EEST | Press release

In the second quarter of 2025, Finnish payment cards were used for a total of 652 million card payments, an increase of 3% compared with the same period in the previous year. The aggregate value of contactless payments rose by 23% year on year.

Genomsnittsräntorna på konsumtionskrediter beviljade av övriga finansinstitut har sjunkit4.9.2025 10:00:00 EEST | Pressmeddelande

Under det andra kvartalet 2025 utbetalades nya konsumtionskrediter utan säkerhet[1] från övriga finansinstitut till ett värde av 67 miljoner euro, vilket är 40 % mer än vid motsvarande tid för ett år sedan. Den överenskomna årliga räntan på nya konsumtionskrediter utan säkerhet var 8,03 % och den effektiva räntan 12,52 %, då den överenskomna årliga räntan vid motsvarande tid för ett år sedan var 8,71 % och den effektiva räntan 13,50 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom