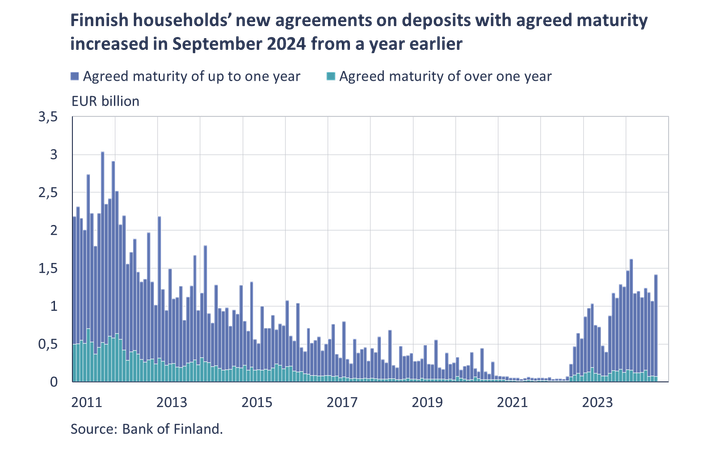

Deposits with agreed maturity increased in September from a year earlier

In September 2024, Finnish households concluded a higher number of new agreements on deposits with agreed maturity than a year earlier. New agreements totalled EUR 1.4 billion, an increase of EUR 0.2 billion from September 2023. The increase was also reflected in the stock of these deposits (EUR 14.9 billion), which grew in September at an annual rate of 64.5%. The growth rate was nevertheless slower than in the previous month.

The majority of households’ deposits with agreed maturity are with a maturity of up to one year. In September 2024, new deposits of this maturity type accounted for 95% of all new agreements on deposits with agreed maturity – the largest share in monthly terms in the history of the data series. Of the stock of agreed maturity deposits, 65% are with a maturity of up to 1 year and 35% with a maturity of over 1 year.

The interest rates on households’ new agreements on deposits with agreed maturity have declined for three months. In September 2024, the average interest rate was 3.29%, compared with the near-term peak of 3.56% recorded in June. With falling market rates, the interest rates on deposits with longer maturities have fallen below those on deposits with shorter ones. In September, the interest rate on new deposits with an agreed maturity of up to one year was 3.3% and on deposits with an agreed maturity of over one year 3.23%. The average interest rate on the stock of agreed maturity deposits also fell slightly in September, to 3.19%.

Households usually conclude a higher number of agreements on deposits with agreed maturity when these are remunerated at higher interest rates. However, the most recent interest rates peaks have not fuelled agreed maturity deposits as in the past. In the history of the data series, the largest monthly volume of new agreed maturity deposits has been in October 2008, when households[1] made EUR 6.5 billion worth of new agreements in this deposit category, with an interest rate of 5.04%. The stock of agreed maturity deposits also reached its all-time peak during the same period, standing 73% above the September 2024 level, at EUR 25.7 billion. However, along with agreed maturity deposits, various types of deposits that are redeemable at notice have also become more common. In September, the stock of these deposits stood at EUR 29.0 billion, and the average interest rate on the deposit stock was 2.36%.

Loans

Finnish households drew down new housing loans in September 2024 to a total of EUR 1.1 billion, the same as in September a year earlier. Of the total, buy-to-let mortgages accounted for EUR 110 million. The average interest rate on new housing loans fell from August, to 3.71%. At the end of September 2024, the stock of housing loans stood at EUR 105.8 billion, and the annual growth rate of the loan stock was a negative -0.8%. Buy-to-let mortgages accounted for EUR 8.7 billion of the housing loan stock. At the end of September, Finnish households’ loan stock comprised EUR 17.9 billion in consumer credit and EUR 17.6 billion in other loans.

Drawdowns of new loans[2] by Finnish non-financial corporations in September totalled EUR 2.3 billion, of which EUR 410 million was to housing corporations. The average interest rate on the new drawdowns was down on August, at 4.83%. At the end of September, the stock of loans granted to Finnish non-financial corporations stood at EUR 108.1 billion, of which loans to housing corporations accounted for EUR 44.9 billion.

Deposits

At the end of September 2024, the stock of Finnish households’ deposits stood at EUR 110.7 billion, at an average interest rate of 1.33%. Overnight deposits accounted for EUR 66.8 billion of the deposit stock.

For further information, please contact:

Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 29 November 2024.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

[1] The figures for 2008 also include data on non-profit institutions serving households. However, these volumes have been relatively low compared with new agreements by households.

[2] Excl. overdrafts and credit card credit.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

Reference rate and penalty interest rates for 1 January – 30 June 202622.12.2025 13:30:00 EET | Press release

The reference rate under section 12 of the Interest Act (633/1982) for the period 1 January – 30 June 2026 is 2.5 %. The penalty interest rate for the same period is 9.5 % pa (under section 4 of the Act, the reference rate plus seven percentage points). The penalty interest rate applicable to commercial contracts is 10.5 % pa (under section 4 a of the Act, the reference rate plus eight percentage points).

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom