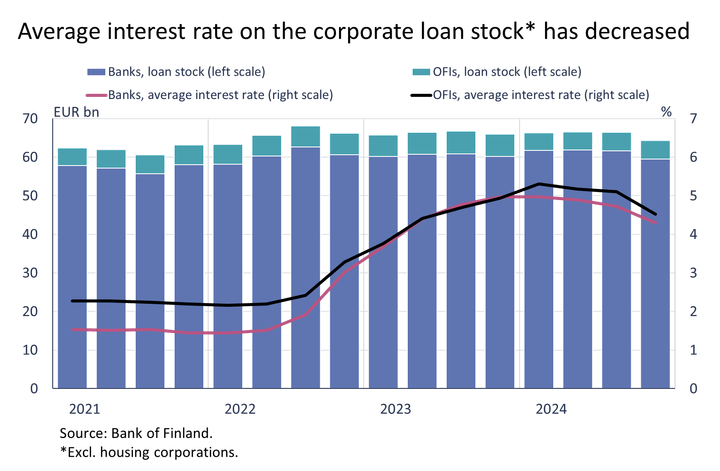

Interest rates on corporate loans have declined

In the fourth quarter of 2024, Finnish non-financial corporations drew down over EUR 1 billion of new corporate loans[1] from other financial institutions (OFIs). The average interest rate on these loans was 7.4%, as opposed to 8.5% in the same period a year earlier. The most common type of new corporate loan drawn from OFIs was factoring, amounting to EUR 400 million. The average interest rate on factoring credit[2] (11.9%) was also considerably higher than that on conventional corporate loans (5.3%), for instance. In the fourth quarter of 2024, the average interest rate on new corporate loans[3] granted by banks (credit institutions) was 4.7 %, as opposed to 5.8% in the same period a year earlier. New corporate loans drawn down from banks in the fourth quarter of 2024 amounted to EUR 6.3 billion. Conventional corporate loans made up the most, EUR 5.2 billion, of the different types of loans drawn down from banks.

Developments in Euribor rates have an impact on the interest rates on corporate loans in Finland. In the fourth quarter of 2024, 47% of new corporate loans granted by OFIs and 82% of those granted by banks were linked to Euribor rates. Meanwhile, 39% of loans granted by OFIs and 16% of those granted by banks had fixed interest rates.

At the end of 2024, the stock of loans granted by OFIs to Finnish non-financial corporations stood at EUR 5.0 billion, with an average interest rate of 4.5%[4], in contrast to 4.9% a year earlier. Euribor-linked loans accounted for 75% of the loan stock, while the second-most common (21%) type was a fixed-interest loan. The most common type of loan was finance leasing (EUR 3.0 billion), followed by conventional corporate loans (EUR 1.8 billion). The average interest rate on the stock of corporate loans granted by banks[5] (EUR 61.3 billion) declined during the year by 0.7 percentage points, to stand at 4.3% at the end of 2024. Looking at the stock of corporate loans granted by banks, Euribor-linked loans accounted for an even higher share (83%) of the stock of loans granted by banks, in comparison with the stock of corporate loans granted by OFIs. Fixed-rate loans made up 13% of the corporate loans granted by banks.

The annual rate of growth of corporate loans granted by OFIs was 4.0% at the end of 2024. Meanwhile, the stock of corporate loans granted by banks contracted by -2.9% year-on-year. At the end of 2024, OFIs had granted the most loans to the energy and industrial sectors – totalling slightly over half of their total corporate loan stock. Banks had granted the most loans to the real estate sector, followed by the industrial and energy sectors.

For further information, please contact:

- Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

- Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

The next news release on other financial institutions will be published on 5 June 2025.

Published data from the OFI data collection can be found on the Bank of Finland’s website behind this link.

[1] Excl. overdrafts, card credit and non-recourse factoring.

[2] Excl. non-recourse factoring.

[3] Excl. housing corporations.

[4] Excl. non-recourse factoring. Non-recourse is a form of factoring finance where the financial institution bears the entire credit loss risk stemming from purchased sales receivables.

[5] Excl. housing corporations.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Eurosystemets penningpolitiska beslut18.12.2025 15:23:32 EET | Beslut

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade.

EKP:n rahapoliittisia päätöksiä18.12.2025 15:23:32 EET | Päätös

EKP:n neuvosto päättää euroalueen rahapolitiikasta. EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan.

Kutsu medialle: Suomen Pankin tiedotustilaisuus 19.12.2025 Suomen talouden näkymistä17.12.2025 09:00:00 EET | Kutsu

Elpyykö Suomen talous? Miten kauppasota ja maailmantilanteeseen liittyvä epävarmuus vaikuttaa talouskehitykseemme? Mitkä ovat julkisen talouden näkymät?

Aleksi Grym blir avdelningschef för Finlands Banks betalningssystemsavdelning16.12.2025 16:42:15 EET | Pressmeddelande

Pol.lic., ekon. mag. Aleksi Grym har utnämnts till avdelningschef för Finlands Banks betalningssystemsavdelning från och med den 1 mars 2026. Utnämningen gäller för en period på fem år.

Aleksi Grym maksujärjestelmät-osaston osastopäälliköksi16.12.2025 16:42:15 EET | Tiedote

Suomen Pankin maksujärjestelmät-osaston osastopäälliköksi on nimitetty VTL, KTM Aleksi Grym. Nimitys on tehty viiden vuoden määräajaksi 1.3.2026 alkaen.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom