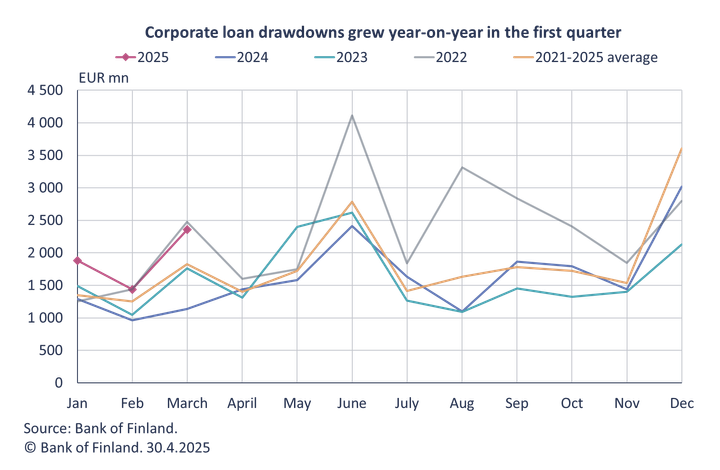

Corporate loan drawdowns picked up from last year

30.4.2025 10:00:00 EEST | Suomen Pankki | Press release

In March 2025, Finnish non-financial corporations (excl. housing corporations) drew over twice as much as in the same period a year earlier. The average interest rate on new corporate-loans fell by from March last year.

In March 2025, Finnish non-financial corporations[1] (excl. housing corporations) drew down a total of EUR 2.4 billion in loans from banks operating in Finland. This was over twice as much as in the same period a year earlier and 36% more than the March average in 2011–2024. In March 2025, the average interest rate on new corporate loans was 4.33%, compared to 5.55% in the same period a year earlier.

The average interest rate on new corporate-loans fell by 1.22 percentage points from March last year. Large new corporate loans experienced a steeper interest rate decline than smaller ones. The average interest rate on small corporate loans of up to EUR 50,000 decreased by 0.4 percentage points from March last year, to 6.85%. Meanwhile, the average interest rate on new corporate loans of over EUR 50,000 and up to 250,000 was 4.88%, having declined by 1.07 percentage points. The average interest rate on the largest loans of over EUR 1 million was 4.13% in March, representing a decline of 1.21 percentage points year-on-year.

In March 2025, the corporate loan stock[2] amounted to EUR 61.6 billion. Despite the higher drawdown volumes in March, the stock of corporate loans contracted by -2.4% year-on-year. Month-on-month, however, the stock expanded by over EUR 300 million in March 2025.

Loans

Drawdowns of new housing loans by Finnish households in March 2025 amounted to EUR 1.2 billion, which was EUR 230 million more than in the same period a year earlier. Buy-to-let housing loans accounted for EUR 130 million of the new housing loan drawdowns. The average interest rate on new housing loans declined from February, to 3.06% in March. At the end of March 2025, the housing loan stock totalled EUR 105.5 billion, and its year-on-year growth was -0.5%. Buy-to-let housing loans accounted for EUR 8.9 billion of the housing loan stock. At the end of March, the household loan stock included EUR 17.6 billion of consumer credit and EUR 17.7 billion of other loans.

In March, Finnish housing corporations drew down EUR 670 million of new loans[3]. The stock of loans granted to housing corporations amounted to EUR 45.4 billion.

Deposits

At the end of March 2025, the stock of Finnish households’ deposits totalled EUR 112.1 billion, and the average interest rate on these deposits was 1.06%. Overnight deposits accounted for EUR 68.4 billion and deposits with an agreed maturity for EUR 14.9 billion of the total deposit stock. In March, new deposit agreements with an agreed maturity made by Finnish households amounted to EUR 1.3 billion. The average interest rate on these new term deposits was 2.45%.

For further information, please contact:

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 2 June 2025.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics.

[1] Excl. overdrafts and credit card credit.

[2] Excl. housing corporations.

[3] Excl. overdrafts and credit card credit.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Hushållens aktieinvesteringar avkastade mycket bra 20259.2.2026 10:00:00 EET | Pressmeddelande

Hushållens aktieinvesteringar avkastade under året starkt i och med värdeökningen på inhemska aktier och vid årets slut var investeringarnas värde det högsta genom tiderna. Också hushållens fondinvesteringar var vid årets slut större än någonsin.

Kotitalouksien osakesijoitukset tuottivat erittäin hyvin vuonna 20259.2.2026 10:00:00 EET | Tiedote

Kotitalouksien osakesijoitukset tuottivat vuoden aikana vahvasti kotimaisten osakkeiden arvonnousun myötä, ja sijoitusten arvo oli vuoden lopussa kaikkien aikojen suurin. Myös kotitalouksien rahastosijoitukset olivat vuoden lopussa kaikkien aikojen suurimmat.

Household equity investments performed exceptionally well in 20259.2.2026 10:00:00 EET | Press release

Households’ equity investments performed strongly during the year, driven by the appreciation of domestic shares, and the value of investments reached an all-time high at the end of the year. Households’ mutual fund investments also closed the year at an all-time high.

Eurosystemets penningpolitiska beslut5.2.2026 15:23:03 EET | Pressmeddelande

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade.

EKP:n rahapoliittisia päätöksiä5.2.2026 15:23:03 EET | Tiedote

EKP:n neuvosto päättää euroalueen rahapolitiikasta.8 EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom