Drawdowns of vehicle loans declined in early 2025 year-on-year

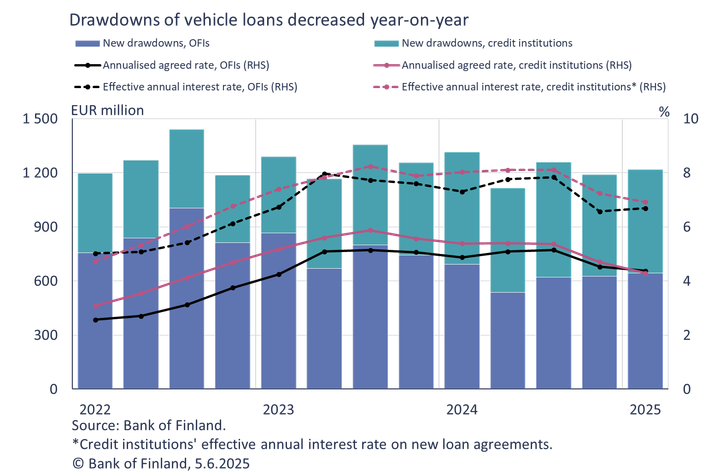

In the first quarter of 2025, other financial institutions (OFIs) granted a total of EUR 704 million in new consumer credits[1] to Finnish households. Consumer lending by OFIs concentrates on vehicle finance. EUR 644 million, or 91%, of the granted consumer credits were vehicle loans, with the remainder consisting of other consumer credits. The volume of vehicle loan drawdowns in the first quarter declined by 7% and that of other consumer credits by 5% compared to the corresponding period in 2024. The annualised agreed rate on new vehicle loans was 4.37%, which is 0.5 percentage points lower than a year earlier. In the first quarter of 2025, the average annualised agreed rate on other new consumer credits declined by over one percentage point year-on-year, from 9.85% to 8.69%. During the same period, the effective annual interest rate, which includes other expenses, on new vehicle loans fell from 7.30% to 6.69%, and that on other consumer credits declined from 13.43 percent to 12.67 percent

In addition to OFIs, consumer credits are granted by credit institutions operating in Finland (Finnish banks) and foreign credit institutions engaged in cross-border lending, which have increased their share of consumer lending in recent years. However, credit institutions lending across borders have a very low share of vehicle financing.[2] In the first quarter of 2025, banks operating in Finland granted new consumer credits1 in the amount of EUR 1.16 billion, almost 9% less than in the same period a year earlier. EUR 574 million, or roughly half of the total, consisted of vehicle loans. The volume of vehicle loan drawdowns declined by 8% year-on-year.

The stock of vehicle loans granted to Finnish households and held on OFIs’ balance sheets totalled EUR 3.3 billion at the end of the first quarter of 2025, with an average interest rate of 3.62%. Year-on-year, the stock contracted by 9.8%, and the average interest rate declined by 0.21 percentage points. However, not all vehicle loans granted by OFIs are held on their balance sheets. Securitised vehicle loans serviced by OFIs as off-balance-sheet items constitute a significant share of the total. At the end of the first quarter, the stock of Finnish banks’ vehicle loans was EUR 4.8 billion, with an average interest rate of 4.75%. The stock of vehicle loans granted by banks grew by 7.5%, and their average interest rate rose by 0.14 percentage points year-on-year. The combined stock of vehicle loans originated by OFIs and Finnish banks contracted by EUR 29 million year-on-year. Approximately two thirds of the stock of vehicle loans granted by OFIs and 90% of those granted by Finnish banks consist of fixed-rate loans.

Further information:

- Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The figures discussed in the release and their time series are available comprehensively in the dashboards for other financial institutions and banks.

The next news release on other financial institutions will be published on 4 September 2025.

Volume of loans granted by OFIs to Finnish NFCs and households, 2025Q1:

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

|

Secured |

1,577 |

3,368 |

|

Unsecured and with collateral deficit |

3,478 |

474 |

|

Total |

5,055 |

3,842 |

---

[1] New loan drawdowns. New loan drawdowns and information on their interest rates do not include continuous overdrafts and credit card credits or non-recourse factoring.

[2] Sources: Positive Credit Register, Bank of Finland calculations.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

Finland’s decisions on public finances should not be postponed19.12.2025 11:00:00 EET | Press release

Finland’s public finances are still far from being in balance. Reversing the rise in public debt will require considerable fiscal consolidation and investments in growth. An expansion of essential defence spending will hamper the fiscal adjustment process. Inflation in the euro area is at target, and growth in the euro area economy has been slightly higher than forecast.

Återhämtningen i Finlands ekonomi går sakta framåt19.12.2025 11:00:00 EET | Pressmeddelande

Finlands ekonomi lämnar snart perioden med svag tillväxt bakom sig, men ingen kraftig tillväxt väntas under åren framöver. Inflationen är fortsatt måttfull och sysselsättningen stiger gradvis. Den stramare handelspolitiken och globala politiska osäkerheter samt eventuella åtgärder för konsolidering av de offentliga finanserna kastar en skugga över tillväxtutsikterna för ekonomin i Finland. De offentliga finanserna uppvisar alltjämt ett djupt underskott.

Suomen talouden elpyminen etenee maltillisesti19.12.2025 11:00:00 EET | Tiedote

Suomen talouden hitaan kasvun jakso on jäämässä taakse, mutta voimakasta kasvua ei lähivuosina ole odotettavissa. Inflaatio pysyy maltillisena ja työllisyys kohenee vähitellen. Talouden kasvunäkymiä varjostavat kauppapolitiikan kiristyminen ja kansainvälisen politiikan epävarmuudet sekä mahdolliset julkisen talouden sopeutustoimet. Julkinen talous säilyy syvästi alijäämäisenä.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom