In January–March 2025, card payments were primarily made to vendors of food and non-alcoholic beverages

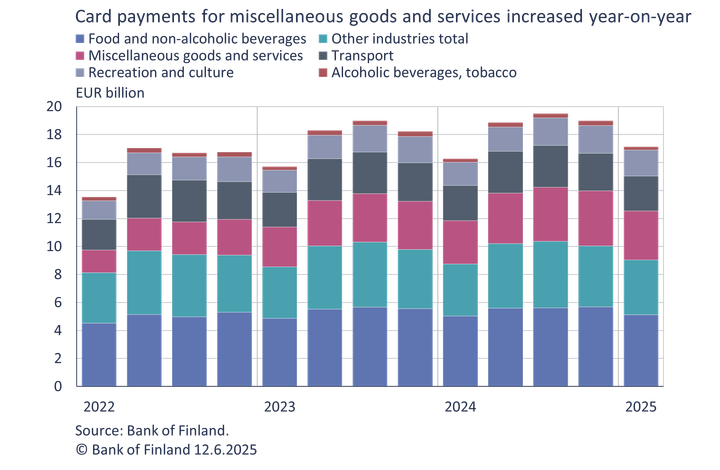

In the first quarter of 2025, the value of card payments by Finnish payment service providers’ customers totalled EUR 17.1 billion, which was EUR 854 million (5.2%) more than in the corresponding period a year earlier. Almost a third of this amount was paid to vendors in the food and non-alcoholic beverages industry. The aggregate value of customers’ purchases of food and non-alcoholic beverages was EUR 5.1 billion in the first quarter of 2025, 2% more than in the corresponding period a year earlier.

Card payments are categorised according to the vendor’s industry, rather than the contents of a given purchase. Approximately 76% of funds paid by customers were used in four industries: 30 % in food and non-alcoholic beverages, 20% in miscellaneous goods and services, 15% in transport, and 11% recreation and culture.

By industry, the growth is mainly explained by an increase in the consumption of miscellaneous goods and services. Customers paid a total of EUR 3.5 billion for miscellaneous goods and services, i.e. over EUR 400 million more than in the corresponding period a year earlier.[1] From October–December, the total value of card payments declined by 9.7%. Consumers typically spend more money in the rest of the year than in the first quarter.

Cards were used to make payments totalling EUR 1.8 billion to the recreation and culture industry, i.e. 12% more than a year earlier. Payments to vendors in the health industry totalled EUR 886 million, 10% more than in the corresponding period last year.

Only one industry had significantly less card payment volume in January–March 2025 than in the corresponding period last year. Customers paid a total of EUR 250 million to vendors of alcoholic beverages and tobacco, or EUR 21 million less than in the first quarter of 2024. The alcohol content limit for fermented alcoholic beverages in retail sales increased to 8.0% in June 2024, and Alko’s litre sales volume has been declining since then.[2] Overall, retail sales of alcohol have declined following the reform. Products affected by the legislative reform were bought increasingly from retail vendors and less from Alko[3], and therefore it is likely that a higher proportion of the sales of alcohol are now included in these statistics in the food and non-alcoholic beverages industry.

Some of the figures discussed in this news release have been published in the new payment statistics dashboard

The next quarterly news release on payment statistics will be published at 10 a.m. on 4 September 2025.

Further information

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi,

- Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi.

[1] The COICOP classification has a total of 13 industry categories and one for payments with the industry unspecified. More information on the classification is available on Statistics Finland's website.

[2] Further information on sales by litre volume is available in Alko’s press release (in Finnish), and more information on this year's decline in sales volumes is available in the dashboard.

[3] More information in a press release of the Finnish Competition and Consumer Authority (in Finnish)

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

Finland’s decisions on public finances should not be postponed19.12.2025 11:00:00 EET | Press release

Finland’s public finances are still far from being in balance. Reversing the rise in public debt will require considerable fiscal consolidation and investments in growth. An expansion of essential defence spending will hamper the fiscal adjustment process. Inflation in the euro area is at target, and growth in the euro area economy has been slightly higher than forecast.

Återhämtningen i Finlands ekonomi går sakta framåt19.12.2025 11:00:00 EET | Pressmeddelande

Finlands ekonomi lämnar snart perioden med svag tillväxt bakom sig, men ingen kraftig tillväxt väntas under åren framöver. Inflationen är fortsatt måttfull och sysselsättningen stiger gradvis. Den stramare handelspolitiken och globala politiska osäkerheter samt eventuella åtgärder för konsolidering av de offentliga finanserna kastar en skugga över tillväxtutsikterna för ekonomin i Finland. De offentliga finanserna uppvisar alltjämt ett djupt underskott.

Suomen talouden elpyminen etenee maltillisesti19.12.2025 11:00:00 EET | Tiedote

Suomen talouden hitaan kasvun jakso on jäämässä taakse, mutta voimakasta kasvua ei lähivuosina ole odotettavissa. Inflaatio pysyy maltillisena ja työllisyys kohenee vähitellen. Talouden kasvunäkymiä varjostavat kauppapolitiikan kiristyminen ja kansainvälisen politiikan epävarmuudet sekä mahdolliset julkisen talouden sopeutustoimet. Julkinen talous säilyy syvästi alijäämäisenä.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom