Average interest rates on consumer credit granted by other financial institutions have decreased

In the second quarter of 2025, drawdowns of unsecured consumer credit[1] from other financial institutions (OFIs) totalled EUR 67 million, an increase of 40% year on year. The annualised agreed interest rate on new unsecured consumer credit was 8.03% and the effective annual rate was 12.52%, as opposed to 8.71% and 13.50% a year earlier.

At the end of June 2025, the stock of consumer credit granted by OFIs was EUR 472 million, slightly higher than at the same time a year earlier. In June, the average interest rate on the stock was 13.1%, down one percentage point from the same period a year earlier. Unsecured consumer credit granted by OFIs only constitutes a small proportion (3%) of households’ total unsecured consumer credit.

Households’ stock of vehicle loans at EUR 9.7 billion

At the end of June 2025, the stock of vehicle loans granted by OFIs was EUR 4.8 billion, also including off-balance sheet loans granted by financial institutions[2]. At the same time, the stock of vehicle loans granted by credit institutions (banks) was only slightly higher (EUR 4.9 billion). At the end of June, households had a total of EUR 9.7 billion in vehicle loans, which was EUR 125 million more than at the same time a year earlier. Vehicle loans constitute approximately 34% of households’ total consumer credit.

Average interest rates on new vehicle loans have declined from a year earlier. The annualised agreed interest rate on vehicle loans drawn down from OFIs in the second quarter of 2025 was 4.35%, while the annualised agreed rate on vehicle loans from banks was 4.28%. The effective annual interest rate[3], which includes other expenses, on new vehicle loans granted by OFIs was 6.85%, as opposed to 6.99% on those granted by banks. At the same time a year earlier, the effective annual interest rate on vehicle loans granted by OFIs was 7.76% and on those granted by credit institutions 8.10%.

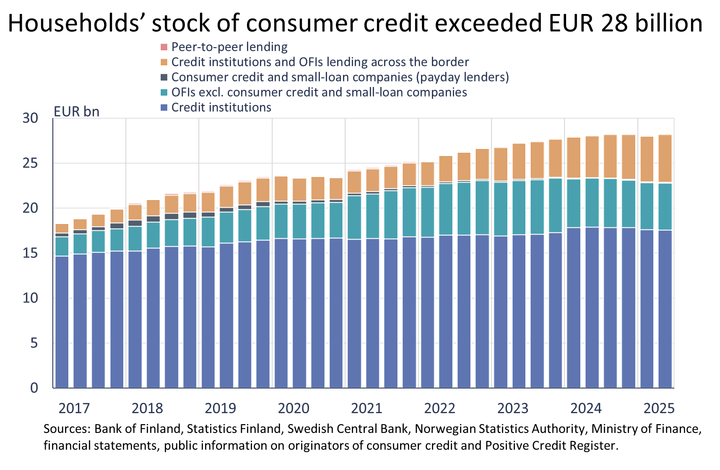

Households’ stock of total consumer credit exceeded EUR 28 billion

At the end of the second quarter of 2025, households’ total consumer credit stock was EUR 28.2 billion, and its year-on-year growth rate was 0.5%. Half of the consumer credit (EUR 14.1 billion) was unsecured consumer credit (excl. vehicle loans), and its year-on-year growth rate was 1.9%. The majority (62%) of households’ consumer credit was granted by credit institutions. OFIs have granted 19% of all consumer credit. Among entities granting consumer credit, cross-border lending credit institutions and other financial institutions have recently increased their share (19%) of the total consumer credit stock the most.

The total consumer credit stock excludes consumer credit on debt collection agencies’ balance sheets. The sale of non-performing loans to debt collection agencies partly contributes to the slower growth of the consumer credit stock. According to calculations based on the Positive Credit Register, at the end of June 2025, debt collection agencies had over EUR 1.7 billion of credit to consumers[4] on their balance sheets, of which a significant proportion is estimated to be consumer credit.

Further information:

- Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

- Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

The next news release on other financial institutions will be published on 4 December 2025.

Published data from the OFI data collection can be found on the Bank of Finland’s website at this link.

Expanded data content of the dashboard

The data content of the dashboard on loans granted by other financial institutions to Finnish households and non-financial corporations has been expanded. As a new data item, the dashboard now has corporate loans granted by instrument. Loan instruments divide loans granted by subcategory, for example into finance leasing or factoring. This provides further insights into the type of finance being granted by OFIs to Finnish non-financial corporations. In addition to the instrument details, the dashboard now also shows the relative proportions of non-performing loans of the respective loan stocks and the effective annual rates of new consumer loan drawdowns. In addition, the presentation of the data has been enhanced.

[1] Excluding overdrafts and credit card credit.

[2] Securitised vehicle loans serviced by OFIs as off-balance-sheet items constitute a significant share of the total.

[3] In the OFI data collection, effective annual interest rate refers to new drawdowns, while in banking statistics, it refers to new agreements.

[4] The use and interpretation of new data may involve uncertainty. The uncertainties are reduced as more data is collected, and more experience is gained about its detailed analysis. The Positive Credit Register data does not enable one to distinguish “consumer credits”. Credits to consumers on collection companies’ balance sheet include vehicle loans, revolving credit and other credit to consumers.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

BOFITs prognos om den ekonomiska utvecklingen i Ryssland 2025–202720.10.2025 14:01:00 EEST | Pressmeddelande

Den snabba tillväxten i den ryska ekonomin är över. Under första halvåret 2025 sjönk BNP-tillväxten i Ryssland rent av betydligt snabbare än förutsett och den ekonomiska tillväxten för helåret 2025 blir högst 1 %.

BOFIT Ennuste Venäjän talouskehityksestä vuosina 2025–202720.10.2025 14:01:00 EEST | Tiedote

Venäjän talouden nopea kasvu on ohi. Venäjän BKT:n kasvuvauhti on vuoden 2025 alkupuoliskolla hidastunut selvästi ennakoituakin nopeammin, ja koko vuonna talous kasvaa korkeintaan yhden prosentin vauhtia.

BOFIT Forecast for Russian Economy 2025–202720.10.2025 14:01:00 EEST | Press release

Russia’s latest episode of high economic growth is over. In the first half of 2025, Russian GDP growth slowed even more rapidly than predicted, and growth for all of 2025 will remain at or below 1 %.

Finlands Banks chefdirektör deltar i IMF:s årsmöten15.10.2025 11:00:00 EEST | Pressmeddelande

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) och Världsbankens gemensamma årsmöte i Washington DC den 17 oktober 2025. Chefdirektör Rehn företräder Finland i valutafondens styrelse.

Suomen Pankin pääjohtaja IMF:n vuosikokouksiin15.10.2025 11:00:00 EEST | Tiedote

Suomen Pankin pääjohtaja Olli Rehn osallistuu Kansainvälisen valuuttarahaston (IMF) ja Maailmanpankin yhteiseen vuosikokoukseen Washington DC:ssä 17.10.2025. Pääjohtaja Rehn edustaa Suomea valuuttarahaston hallintoneuvostossa.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom