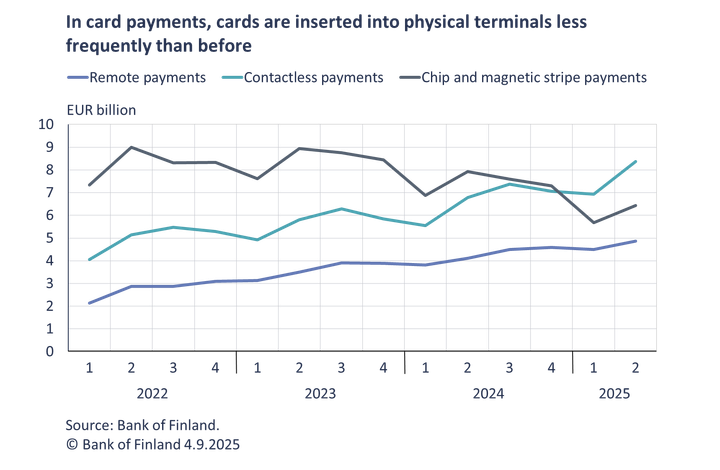

Total value of contactless payments surpassed chip-based card payments in April–June 2025

In the second quarter of 2025, Finnish payment cards were used for a total of 652 million card payments, an increase of 3% compared with the same period in the previous year. The aggregate value of contactless payments rose by 23% year on year.

In the second quarter of 2025, Finnish payment cards were used for a total of 652 million card payments, an increase of 21 million payments (3%) compared with the same period in the previous year. The aggregate value of these card payments at EUR 19.7 billion was the highest quarterly value recorded in the history of these statistics.

A total of 125 million card payments were initiated on a computer or mobile device in the second quarter of 2025, representing an increase of 19% year on year. The aggregate value of these remote card payments (EUR 4.9 billion) grew 18% year on year. Contactless payments accounted for 431 million card payments, an 8% increase compared with the second quarter of 2024. The aggregate value of contactless payments rose by 23% year on year, reaching EUR 8.4 billion in the second quarter of 2025. In the second quarter of 2025, a chip or magnetic stripe was used to make 95 million card payments, 24% fewer than in the corresponding period a year earlier. The value of these payments fell by 19% year on year to EUR 6.4 billion. In 2025, for the first time, the aggregate value of chip and magnetic stripe payments was lower than that of contactless payments.

Card transactions made in other EU Member State using Finnish payment cards in the second quarter of 2025 totalled EUR 2.5 billion, a 25% increase on the same period a year earlier. The aggregate value of card transactions outside the EU in the second quarter of 2025 was EUR 0.4 billion, i.e. 11% more than a year earlier.

The total number of credit transfers in the second quarter of 2025 was 312 million, 3% fewer than in the corresponding period a year earlier. However, the aggregate value of credit transfers (EUR 995 billion) rose 7% from the previous year. Nearly 80% of the value of credit transfers in the second quarter of 2025 was directed to Finnish counterparties.

The figures in news release have been published in the payment statistics dashboard.

The next quarterly news release on payment statistics will be published at 10 a.m. on 16 December 2025.

Further information

- Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi,

- Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

BOFITs prognos om den ekonomiska utvecklingen i Ryssland 2025–202720.10.2025 14:01:00 EEST | Pressmeddelande

Den snabba tillväxten i den ryska ekonomin är över. Under första halvåret 2025 sjönk BNP-tillväxten i Ryssland rent av betydligt snabbare än förutsett och den ekonomiska tillväxten för helåret 2025 blir högst 1 %.

BOFIT Ennuste Venäjän talouskehityksestä vuosina 2025–202720.10.2025 14:01:00 EEST | Tiedote

Venäjän talouden nopea kasvu on ohi. Venäjän BKT:n kasvuvauhti on vuoden 2025 alkupuoliskolla hidastunut selvästi ennakoituakin nopeammin, ja koko vuonna talous kasvaa korkeintaan yhden prosentin vauhtia.

BOFIT Forecast for Russian Economy 2025–202720.10.2025 14:01:00 EEST | Press release

Russia’s latest episode of high economic growth is over. In the first half of 2025, Russian GDP growth slowed even more rapidly than predicted, and growth for all of 2025 will remain at or below 1 %.

Finlands Banks chefdirektör deltar i IMF:s årsmöten15.10.2025 11:00:00 EEST | Pressmeddelande

Finlands Banks chefdirektör Olli Rehn deltar i Internationella valutafondens (IMF) och Världsbankens gemensamma årsmöte i Washington DC den 17 oktober 2025. Chefdirektör Rehn företräder Finland i valutafondens styrelse.

Suomen Pankin pääjohtaja IMF:n vuosikokouksiin15.10.2025 11:00:00 EEST | Tiedote

Suomen Pankin pääjohtaja Olli Rehn osallistuu Kansainvälisen valuuttarahaston (IMF) ja Maailmanpankin yhteiseen vuosikokoukseen Washington DC:ssä 17.10.2025. Pääjohtaja Rehn edustaa Suomea valuuttarahaston hallintoneuvostossa.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom