Student loan drawdowns declined year-on-year in August 2025

In August 2025, Finns drew down EUR 143 million in student loans, a 13% decrease compared to the corresponding period a year earlier. From the beginning of August, higher education students were able to draw down their entire loan allocation for the autumn semester, while secondary education students could access the first loan disbursement for the autumn semester. The average loan drawdown in August 2025 was slightly above EUR 3,000. It is estimated that more than half of the drawdowns were made at the maximum permitted amount.[1] The maximum amounts and disbursement dates of government-guaranteed student loans for the upcoming academic year remained unchanged from the previous year.[2]

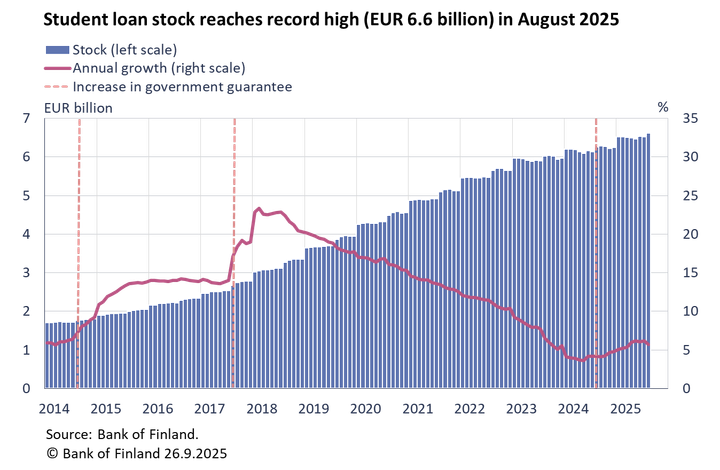

During the past academic year (August 2024–July 2025), students drew down EUR 918 million in student loans, a 17% increase on the previous academic year. Following the changes introduced at the beginning of the academic year, students could, however, draw down even over 30% more government-guaranteed student loan than before. Drawdown volumes in the past academic year were slightly lower than in 2021–2022, when student loan drawdowns reached EUR 935 million, a record high in the history of the statistics. However, the increased drawdown volumes have accelerated the growth of the student loan stock from a year earlier. At the end of August 2025, the stock of student loans reached an all-time high at EUR 6.6 billion, with an annual growth rate of 5.6%.

The average interest rate on student loans drawn down in August 2025 was 2.79%, which was 1.28 percentage points lower than a year earlier. The average margin on new student loan drawdowns was approximately 0.5%.[3] For student loans, it is more common than for other household loans to be linked to banks’ own prime rates instead of Euribor rates. In August, the average interest rate on new Euribor-linked student loans was 2.76%, in contrast with 3.05% for those linked to prime rates. In August 2025, 8% of new student loans were linked to prime rates, down from 11% a year earlier.

Loans

In August 2025, drawdowns of new housing loans by Finnish households amounted to EUR 1.1 billion, an increase of EUR 10 million compared to the same period a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 110 million. The average interest rate on new housing loans increased from July to 2.76% in August. At the end of August 2025, the housing loan stock totalled EUR 105.8 billion, with a year-on-year change of -0.1%. Buy-to-let mortgages constituted EUR 9.0 billion of the housing loan stock. At the end of August, the Finnish household loans comprised EUR 17.6 billion of consumer credit and EUR 17.8 billion of other loans.

Drawdowns of new loans[4] by Finnish non-financial corporations in August totalled EUR 1.7 billion, including EUR 650 million of loans to housing corporations. The average interest rate on new corporate loan drawdowns fell from July to 3.73%. At the end of August, the stock of loans granted to Finnish non-financial corporations totalled EUR 107.9 billion, with loans to housing corporations accounting for EUR 45.7 billion.

Deposits

At the end of August 2025, the total stock of Finnish households’ deposits was EUR 115.4 billion, with an average interest rate of 0.81%. Overnight deposits accounted for EUR 70.3 billion and deposits with agreed maturity for EUR 15.6 billion of the total deposit stock. In August, Finnish households entered into new deposit agreements with an agreed maturity in the amount of EUR 1.2 billion. The average interest rate on these new term deposits was 2.10%.

Further information

- Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi,

- Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 28 October 2025.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

[1] Data on the average loan drawdown and estimated proportion of maximum drawdowns are derived from the Positive credit register and calculations by the Bank of Finland. The maximum amount of government-guaranteed student loans depends on factors such as the student’s age and level of education.

[2] We addressed the changes effective from 1 August 2024 in our release published on 30 September 2024: https://www.suomenpankki.fi/en/statistics/statistical-news/mfi-balance-sheet/2024/the-amount-of-student-loan-available-for-drawing-down-was-raised-in-august/

[3] Based on Positive credit register data and Bank of Finland calculations.

[4] Excluding overdrafts and credit card credit.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

IMF:s kommentarer om Finlands ekonomi10.11.2025 15:30:00 EET | Pressmeddelande

Internationella valutafonden (IMF) offentliggjorde sina kommentarer om Finlands ekonomi måndagen den 10 november.

IMF:n lausunto Suomen taloudesta10.11.2025 15:30:00 EET | Tiedote

Kansainvälinen valuuttarahasto (IMF) julkisti lausuntonsa Suomen taloudesta maanantaina 10. marraskuuta.

The IMF’s concluding statement on the Finnish economy10.11.2025 15:30:00 EET | Press release

The International Monetary Fund (IMF) published its concluding statement on the Finnish economy on Monday 10 November.

Den kinesiska ekonomin mattas av under 2025–202710.11.2025 13:00:00 EET | Pressmeddelande

Enligt Finlands Banks forskningsinstitut för tillväxtmarknader BOFIT har den ekonomiska tillväxten i Kina mattats av under de senaste månaderna efter att ha varit starkare än väntat i början av året.

Kiinan talous kasvaa nykyistä hitaammin vuosina 2025–202710.11.2025 13:00:00 EET | Tiedote

Suomen Pankin nousevien talouksien tutkimuslaitoksen BOFITin mukaan Kiinan talouskasvu on hidastunut viime kuukausina odotettua vahvemman alkuvuoden jälkeen.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom