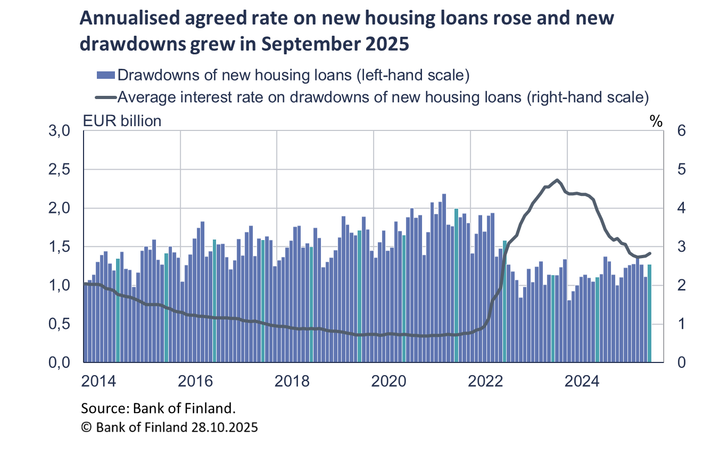

Interest rate on new housing loans slightly up in September 2025

In September 2025, Finnish households drew down new housing loans to a total of EUR 1.3 billion, an increase of 11% on September 2024. Despite this, new housing loan drawdowns were 18% below the average for September in 2011–2024. The average interest rate on the new drawdowns rose slightly from August, as did the 12-month Euribor, the most common reference rate for new housing loans. Hence, in September the average interest rate on new housing loans was 2.82%, 0.9 percentage points lower than in the same month a year earlier. Of the new drawdowns, EUR 115 million, or approximately 9%, were buy-to-let mortgages.

The maturities of new owner-occupied residential mortgages and buy-to-let mortgages have lengthened from the previous year. In September 2025, the average maturity of new owner-occupied home loans was 22 years and 11 months, compared with 22 years and 4 months a year earlier in September. Correspondingly, the average maturity of new buy-to-let mortgages was 22 years and 1 months, as opposed to 22 years and 5 months a year earlier. The share of loans with a maturity of over 20 years has increased: in September 2025 these loans accounted for 76.1% of all new housing loans, compared with 72.5% in September 2024.

With the growth in housing loan drawdowns, the stock of housing loans continued to contract only slightly in September 2025. Thus, the annual rate of change of the housing loan stock (EUR 105.7 billion) was -0.04%, compared with -0.77% in September 2024. At the end of September 2025, the stock of owner-occupied residential mortgages stood at EUR 96.7 billion (annual rate of change -0.3%), and the stock of buy-to-let mortgages totalled EUR 9.0 billion (annual rate of change 3.0%).

Loans

At the end of September 2025, of all loans taken out by Finnish households, consumer credit totalled EUR 17.5 billion and other loans, EUR 17.8 billion.

Drawdowns of new loans[1] by Finnish non-financial corporations in September amounted to EUR 2.2 billion, of which EUR 500 million was loans to housing corporations. The average interest rate on the new drawdowns was up from August, at 3.76%. At the end of September, the stock of loans granted to Finnish non-financial corporations stood at EUR 107.9 billion, with loans to housing corporations accounting for EUR 45.8 billion.

Deposits

At the end of September 2025, the aggregate stock of Finnish households’ deposits stood at EUR 115.4 billion, and the average interest rate on these deposits was 0.80%. Overnight deposits accounted for EUR 70.5 billion and deposits with agreed maturity for EUR 15.5 billion of the deposit stock. In September, Finnish households made EUR 1.1 billion of new agreements on deposits with agreed maturity, at an average interest rate of 2.14%.

Further information

- Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 28 November 2025.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics/.

[1] Excl. overdrafts and credit card credit.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kutsu medialle: Suomen Pankin julkinen kuuleminen eduskunnan talousvaliokunnassa 4.11. klo 12.0028.10.2025 12:00:00 EET | Kutsu

Talousvaliokunta järjestää kansanedustajille ja medialle avoimen, Eduskunnan pankkivaltuuston kertomuksen 2024 käsittelyyn liittyvän julkisen kuulemisen ”Euroalueen ja Suomen talouden näkymät epävarmuuden ajassa” tiistaina 4.11.2025 klo 12.00 Pikkuparlamentin auditoriossa (Arkadiankatu 3). Tilaisuus näytetään myös suorana lähetyksenä verkossa osoitteessa https://verkkolahetys.eduskunta.fi/ Ohjelma klo 12.00 Tilaisuuden avaus, talousvaliokunnan puheenjohtaja Vilhelm Junnila klo 12.05 Suomen Pankin puheenvuoro ”Euroalueen ja Suomen talouden näkymät epävarmuuden ajassa”, pääjohtaja Olli Rehn klo 12.40 Valiokunnan kysymykset ja keskustelua klo 13.15 Finanssivalvonnan kommenttipuheenvuoro, johtaja Tero Kurenmaa klo 13.30 Valiokunnan kysymykset ja keskustelua klo 13.50 Tilaisuuden päätös, talousvaliokunnan puheenjohtaja Vilhelm Junnila Medialla on mahdollisuus haastatella Suomen Pankin pääjohtaja Olli Rehniä ja Finanssivalvonnan johtaja Tero Kurenmaata heidän puheenvuorojensa jälkeen. Ilmoit

Ansvaret för att utveckla en finländsk lösning för omedelbara betalningar överförs från betalningsrådet till Siirto Brand Oy28.10.2025 12:00:00 EET | Pressmeddelande

Betalningsrådet började 2022 målmedvetet främja arbetet för att utveckla en kontobaserad lösning för omedelbara betalningar i Finland. En finländsk lösning för omedelbara betalningar ökar konkurrensen på marknaden för massbetalningar och erbjuder ett alternativ till kort- och kontantbetalningar.

Suomalaisen pikamaksuratkaisun kehittämisvastuu siirtyy maksuneuvostolta Siirto Brand Oy:lle28.10.2025 12:00:00 EET | Tiedote

Maksuneuvosto alkoi vuonna 2022 määrätietoisesti edistää tilipohjaisen pikamaksuratkaisun aikaansaamista Suomeen. Suomalainen pikamaksuratkaisu lisää kilpailua vähittäismaksumarkkinoilla ja tarjoaa vaihtoehdon kortti- ja käteismaksamiselle.

Responsibility for developing a Finnish instant payment solution is to be transferred from the Payments Council to Siirto Brand Oy28.10.2025 12:00:00 EET | Press release

In 2022, the Payments Council began to firmly promote the idea of an account-based instant payment solution for Finland. A Finnish instant payment solution will increase competition in the retail payments market and offer an alternative to card and cash payments.

BOFITs prognos om den ekonomiska utvecklingen i Ryssland 2025–202720.10.2025 14:01:00 EEST | Pressmeddelande

Den snabba tillväxten i den ryska ekonomin är över. Under första halvåret 2025 sjönk BNP-tillväxten i Ryssland rent av betydligt snabbare än förutsett och den ekonomiska tillväxten för helåret 2025 blir högst 1 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom