High volume of corporate loans drawn down from banks in October

In October 2025, non-financial corporations[1] drew down EUR 2.4 billion of new loans[2] from banks operating in Finland. This was 36% more than in the same period a year earlier and 52% above the October average for 2011–2024. In October, the most drawdowns[3] were made by industrial companies.

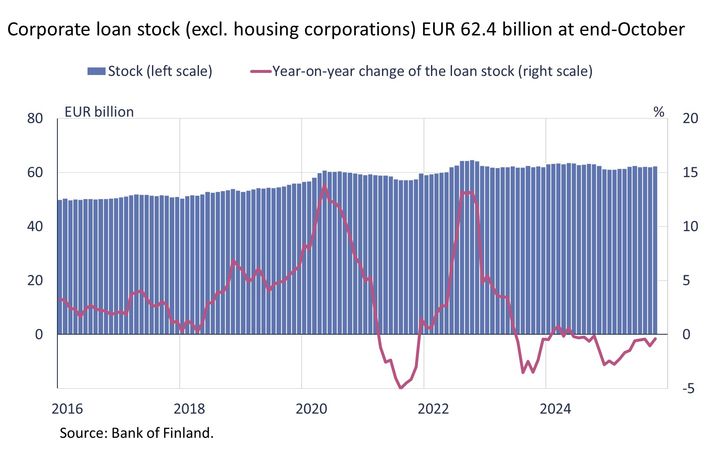

Reflecting the high drawdown volume, the stock of corporate loans granted by banks grew by EUR 290 million from September to EUR 62.4 billion at the end of October. Despite the monthly increase, the corporate loan stock was still down -0.4% year-on-year. The year-on-year growth rate of the corporate loan stock has remained consistently negative since June 2024. Out of the corporate loan stock,[4] loans granted to large non-financial corporations accounted for 51% and those to small and medium-sized enterprises (SMEs[5]) for 49%.

In October, the average interest rate on new corporate loans was 3.57%, as opposed to 4.94% in the same period a year earlier. In October, average interest rates fell the most for large loans exceeding €1 million. In Finland, changes in Euribor rates affect the interest paid on corporate loans. At the end of October, 84% of the corporate loan stock was Euribor-linked. The average margin on the corporate loan stock was 1.28%[6]. The average margin on loans to large corporations was 1.06%, compared to 1.51% for SMEs. Changes in average loan margins on the loan stocks have been minor over the past year.

Impairments and credit losses recorded on corporate bank loans have remained moderate relative to the loan stock. In January–October 2025, they totalled EUR 142 million, a decline of 8% on the corresponding period of the previous year. The stock of non-performing corporate loans[7] has risen only slightly over the past year, and stood at 1.9% of the loan stock in October 2025 Most of the non-performing corporate loans are SME loans.

Loans

Finnish households drew down EUR 1.4 billion of new housing loans in October 2025, which was 1% less than a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 132 million. In October, the average interest rate on new housing loans (2.82%) remained unchanged from September. At the end of October 2025, the stock of housing loans stood at EUR 105.8 billion, with an annual growth rate of −0.04%. Buy-to-let mortgages constituted EUR 9.0 billion of the housing loan stock. At the end of October, Finnish households’ loans comprised EUR 17.5 billion of consumer credit and EUR 17.8 billion of other loans.

Drawdowns of new loans by Finnish non-financial corporations in October 2025 totalled EUR 3.0 billion, including EUR 527 million of loans to housing corporations. The average interest rate on new corporate-loan drawdowns declined from September to 3.47% in October. At the end of October, the stock of loans granted to Finnish non-financial corporations totalled EUR 108.4 billion, with loans to housing corporations accounting for EUR 45.9 billion.

Deposits

At the end of October 2025, the total stock of Finnish households’ deposits was EUR 115.2 billion, with an average interest rate of 0.80%. Overnight deposits accounted for EUR 70.2 billion and deposits with an agreed maturity for EUR 15.6 billion of the total deposit stock. In October, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.1 billion. The average interest rate on these deposits was 2.16%.

Further information

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

- Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 07 January 2026.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics.

[1] Non-financial corporations, excluding housing corporations.

[2] Excl. overdrafts, card credit and non-recourse factoring.

[3] 38% of all drawdowns.

[4] As at end of September 2025.

[5] https://stat.fi/meta/kas/pk_yritys_en.html.

[6] As at end of September 2025.

[7] A loan is defined non-performing when it is more than 90 days past due or there is evidence indicating the customer's inability to perform on its obligations.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Internationella valutafonden ger ut en landrapport om Finlands ekonomi19.1.2026 10:10:00 EET | Nyheter

Internationella valutafonden (IMF) har slutfört sin årliga utvärdering av det ekonomiska läget och de ekonomiska utsikterna för Finland. Utvärderingen grundar sig på diskussioner som IMF:s delegation i oktober-november 2025 förde i Finland med myndigheter, forskningsinstitut, privata finansinstitut, arbetsmarknadsparter och andra instanser. Den nu utgivna rapporten representerar IMF:s experters bedömningar och åsikter och den godkändes av IMF:s direktion den 9 januari 2026.

Kansainvälinen valuuttarahasto julkaisee maaraportin Suomen taloudesta19.1.2026 10:10:00 EET | Uutinen

Kansainvälinen valuuttarahasto (IMF) on saanut päätökseen vuosittaisen arvionsa Suomen talouden tilasta ja näkymistä. Arvio perustuu keskusteluihin, joita Suomessa loka-marraskuussa 2025 vieraillut IMF:n asiantuntijaryhmä kävi viranomaisten, tutkimuslaitosten, yksityisten rahoituslaitosten, työmarkkinaosapuolten ja muiden tahojen kanssa. Nyt julkaistu raportti edustaa IMF:n asiantuntijoiden arvioita ja näkemyksiä, ja se hyväksyttiin IMF:n johtokunnassa 9.1.2026.

Finlands Bank har ställt upp nya klimatetappmål för investeringsverksamheten och uppdaterat sina principer för ansvarsfulla investeringar16.1.2026 10:00:00 EET | Nyheter

Finlands Banks direktion har fattat beslut om nya klimatetappmål som styr bankens investeringsverksamhet mot nettonollutsläpp senast 2050. De uppdaterade målen ligger i linje med tidigare uppnådda etappmål, som var vägledande för verksamheten fram till 2025.

Suomen Pankki asetti sijoitustoiminnalle uudet ilmastovälitavoitteet ja päivitti vastuullisen sijoittamisen periaatteet16.1.2026 10:00:00 EET | Uutinen

Suomen Pankin johtokunta on päättänyt uusista ilmastovälitavoitteista, jotka ohjaavat pankin sijoitustoimintaa kohti hiilineutraalisuutta viimeistään vuoteen 2050 mennessä. Päivitys jatkaa aiempien välitavoitteiden linjaa, jotka saavutettuina ohjasivat toimintaa vuoden 2025 loppuun saakka.

Bank of Finland sets new interim climate targets for its investment activities and updates its responsible investment principles16.1.2026 10:00:00 EET | News

The Bank of Finland Board has adopted new interim climate targets to guide its investment activities towards carbon neutrality by 2050 at the latest. This update continues the approach of the previous interim targets, which guided activities up to the close of 2025 and which have been attained.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom