High volume of corporate loans drawn down from banks in October

28.11.2025 10:00:00 EET | Suomen Pankki | Press release

In October 2025, non-financial corporations[1] drew down EUR 2.4 billion of new loans[2] from banks operating in Finland. This was 36% more than in the same period a year earlier and 52% above the October average for 2011–2024. In October, the most drawdowns[3] were made by industrial companies.

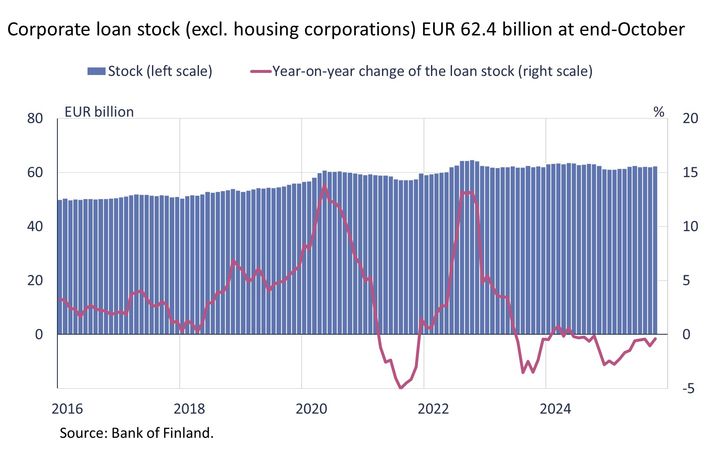

Reflecting the high drawdown volume, the stock of corporate loans granted by banks grew by EUR 290 million from September to EUR 62.4 billion at the end of October. Despite the monthly increase, the corporate loan stock was still down -0.4% year-on-year. The year-on-year growth rate of the corporate loan stock has remained consistently negative since June 2024. Out of the corporate loan stock,[4] loans granted to large non-financial corporations accounted for 51% and those to small and medium-sized enterprises (SMEs[5]) for 49%.

In October, the average interest rate on new corporate loans was 3.57%, as opposed to 4.94% in the same period a year earlier. In October, average interest rates fell the most for large loans exceeding €1 million. In Finland, changes in Euribor rates affect the interest paid on corporate loans. At the end of October, 84% of the corporate loan stock was Euribor-linked. The average margin on the corporate loan stock was 1.28%[6]. The average margin on loans to large corporations was 1.06%, compared to 1.51% for SMEs. Changes in average loan margins on the loan stocks have been minor over the past year.

Impairments and credit losses recorded on corporate bank loans have remained moderate relative to the loan stock. In January–October 2025, they totalled EUR 142 million, a decline of 8% on the corresponding period of the previous year. The stock of non-performing corporate loans[7] has risen only slightly over the past year, and stood at 1.9% of the loan stock in October 2025 Most of the non-performing corporate loans are SME loans.

Loans

Finnish households drew down EUR 1.4 billion of new housing loans in October 2025, which was 1% less than a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 132 million. In October, the average interest rate on new housing loans (2.82%) remained unchanged from September. At the end of October 2025, the stock of housing loans stood at EUR 105.8 billion, with an annual growth rate of −0.04%. Buy-to-let mortgages constituted EUR 9.0 billion of the housing loan stock. At the end of October, Finnish households’ loans comprised EUR 17.5 billion of consumer credit and EUR 17.8 billion of other loans.

Drawdowns of new loans by Finnish non-financial corporations in October 2025 totalled EUR 3.0 billion, including EUR 527 million of loans to housing corporations. The average interest rate on new corporate-loan drawdowns declined from September to 3.47% in October. At the end of October, the stock of loans granted to Finnish non-financial corporations totalled EUR 108.4 billion, with loans to housing corporations accounting for EUR 45.9 billion.

Deposits

At the end of October 2025, the total stock of Finnish households’ deposits was EUR 115.2 billion, with an average interest rate of 0.80%. Overnight deposits accounted for EUR 70.2 billion and deposits with an agreed maturity for EUR 15.6 billion of the total deposit stock. In October, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.1 billion. The average interest rate on these deposits was 2.16%.

Further information

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

- Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 07 January 2026.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics.

[1] Non-financial corporations, excluding housing corporations.

[2] Excl. overdrafts, card credit and non-recourse factoring.

[3] 38% of all drawdowns.

[4] As at end of September 2025.

[5] https://stat.fi/meta/kas/pk_yritys_en.html.

[6] As at end of September 2025.

[7] A loan is defined non-performing when it is more than 90 days past due or there is evidence indicating the customer's inability to perform on its obligations.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kontaktlös betalning blev vanligare i oktober–december 2025 jämfört med motsvarande tidpunkt året innan5.3.2026 10:00:00 EET | Pressmeddelande

Med kort betalades i oktober–december mer än under motsvarande period året innan. Framför allt gjordes under det sista kvartalet fler kontaktlösa betalningar än under motsvarande period 2024.

Lähimaksaminen oli yleisempää loka-joulukuussa 2025 kuin vastaavana ajankohtana edellisvuonna5.3.2026 10:00:00 EET | Tiedote

Korteilla maksettiin loka-joulukuussa enemmän kuin viime vuonna vastaavana ajanjaksona. Erityisesti lähimaksuja tehtiin vuoden viimeisellä neljänneksellä enemmän kuin vuonna 2024 samalla ajanjaksolla.

Contactless payments increased in October–December 2025 from a year earlier5.3.2026 10:00:00 EET | Press release

Cards payments in October–December grew year-on-year. In particular, more contactless payments were made in the fourth quarter than in same period in 2024.

Hushållens utestående konsumtionskrediter över 28 miljarder euro4.3.2026 10:00:00 EET | Pressmeddelande

Hushållens totala utestående konsumtionskrediter uppgick vid utgången av 2025 till 28,2 miljarder euro och årsökningen har mattats av till 0,1 %. Av hushållens totala utestående konsumtionskrediter bestod ungefär hälften av konsumtionskrediter utan säkerhet (exkl. fordonslån) och deras årsökning var 1,5 %.

Kotitalouksien kulutusluottokanta yli 28 mrd. euroa4.3.2026 10:00:00 EET | Tiedote

Kotitalouksien kokonaiskulutusluottokanta oli vuoden 2025 lopussa 28,2 mrd. euroa ja sen vuosikasvuvauhti oli hidastunut 0,1 prosenttiin. Kotitalouksien kokonaiskulutusluottokannasta noin puolet oli vakuudettomia kulutusluottoja (pl. ajoneuvolainat), ja niiden vuosikasvuvauhti oli 1,5 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom