Household equity investments performed exceptionally well in 2025

9.2.2026 10:00:00 EET | Suomen Pankki | Press release

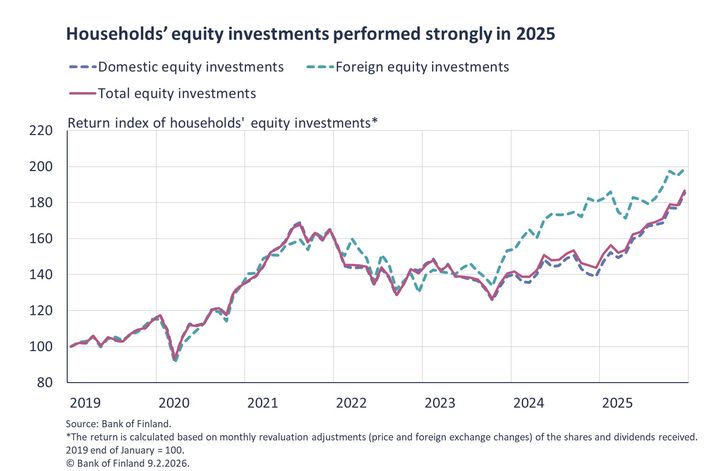

Households’ equity investments performed strongly during the year, driven by the appreciation of domestic shares, and the value of investments reached an all-time high at the end of the year. Households’ mutual fund investments also closed the year at an all-time high.

Finnish households’ equity investments1 performed exceptionally well in 2025. Taking into account revaluation adjustments and dividends, households’ equity investments yielded a total return of 29.9% in 2025. At the end of the year, the value of the equity investments reached an all-time high of EUR 59.0 billion. The high rate of return was explained by the strong performance of Finnish companies’ equities held by households (33.6%) and households’ high allocation to domestic equities2. At the end of 2025, 85% of households’ equity investments consisted of domestic companies’ shares. Over a longer period, for example since the beginning of 2019, however, households’ investments in foreign companies’ shares have outperformed their domestic equity investments. At the end of 2024, the value of household equity investments was EUR 46.5 billion. The previous peak before the end of 2025 was EUR 56.1 billion in August 2021.

During 2025, households invested EUR 244 million in net terms3 in equities, which is significantly less than in previous years. Broken down by region, households reduced their holdings in domestic equities and increased foreign equities. Households sold domestic equities in net terms for EUR 299 million over the whole of 2025. The majority of the sales took place in the fourth quarter, when households sold domestic equities on a net basis for EUR 470 million. Over the full year, households increased their investments in foreign companies’ equities on a net basis by EUR 543 million.

Investment funds

Finnish households continued to make positive net subscriptions to investment funds in the fourth quarter of 2025. Households invested a total of EUR 854 million in investment funds during the quarter, of which EUR 496 million (58%) went to domestic investment funds4 and the remainder, EUR 358 million, to foreign investment funds5. Over the full year 2025, households made net new investments in mutual funds worth EUR 3.0 billion, of which EUR 1.9 billion (61%) went to domestic mutual funds.

In addition to new investments, the value of households’ investment fund holdings was supported by positive revaluations in the fourth quarter of 2025. The value of domestic investment fund holdings increased by EUR 1.25 billion in the final quarter, and the value of foreign investment fund holdings increased by EUR 407 million. Over the full year 2025, the value of households’ investment fund holdings increased by EUR 3.6 billion, of which EUR 2.7 billion was attributable to the appreciation of domestic investment fund holdings and EUR 802 million to the appreciation of foreign investment fund holdings.

Due to positive revaluations and new investments, the value of households’ investment fund investments reached an all-time high of EUR 53.8 billion at the end of December 2025. Of the investments, EUR 43.3 billion was in domestic investment funds and EUR 10.4 billion in foreign investment funds. At the end of December 2024, households held investment fund investments worth EUR 47.3 billion.

Further information

- Pauli Korhonen, tel. +358 9 183 2280, email: pauli.korhonen(at)bof.fi,

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on saving and investing will be published at 10 am on 8 May 2026.

---

1 Quoted shares held in custody in Finland.

2 By comparison, households’ investments in foreign companies’ shares generated a return of 10.1% in 2025.

3 Purchases minus sales.

4 Including UCITS and non-UCITS funds registered in Finland.

5 Includes units of foreign investment funds held in custody in Finland.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Eurosystemets penningpolitiska beslut5.2.2026 15:23:03 EET | Pressmeddelande

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade.

EKP:n rahapoliittisia päätöksiä5.2.2026 15:23:03 EET | Tiedote

EKP:n neuvosto päättää euroalueen rahapolitiikasta.8 EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan.

I december 2025 hade hushållen nästan lika mycket banklån som ett år tidigare30.1.2026 10:00:00 EET | Pressmeddelande

Beloppet av de finländska hushållens sammanlagda utestående banklån var nästan oförändrat från året innan och uppgick till 140,9 miljarder euro i december 2025. Det förekommer emellertid skillnader i utvecklingen av utbetalningarna av lån för olika ändamål.

Kotitalouksilla oli joulukuussa 2025 pankkilainaa lähes saman verran kuin vuosi sitten30.1.2026 10:00:00 EET | Tiedote

Suomalaisten kotitalouksien yhteenlaskettu pankkilainakanta pysyi lähes muuttumattomana vuodentakaisesta; se oli 140,9 mrd. euroa joulukuussa 2025. Eri käyttötarkoituksiin otettujen lainamäärien kehityksessä on kuitenkin eroja.

Household bank loans almost unchanged year-on-year in December 202530.1.2026 10:00:00 EET | Press release

Finnish households’ aggregate stock of bank loans remained almost unchanged from a year earlier, at EUR 140.9 billion in December 2025. However, developments in loan volumes by different purposes vary.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom