ADMICOM OYJ'S FINANCIAL STATEMENTS RELEASE 2022: A year of strong growth: Revenue growth of 27% and EBITDA margin 45% of revenue

ADMICOM OYJ'S FINANCIAL STATEMENTS RELEASE 2022: A YEAR OF STRONG GROWTH: REVENUE GROWTH OF 27% AND EBITDA MARGIN 45% OF REVENUE

Unofficial translation of the company release on January 13, 2023 at 9 AM EET. In case the document differs from the original, the Finnish version prevails.

Figures in parenthesis refer to the comparable period in the previous year, unless otherwise stated.

October-December 2022 summary (October 1, 2021 – December 31, 2021)

-

Revenue of Q4 amounted to EUR 8.039 million (6.329) resulting in +27.0% growth from comparison period. Of the growth 9.4 percentage points was organic and 17.6 percentage points was inorganic growth related to acquisitions.

-

EBITDA grew by 10.6% and totalled EUR 2.948 million (2.665), amounting to 36.7% of revenues (42.1%).

-

EBITA grew by 11.1% and totalled EUR 2.868 million (2.583), amounting to 35.7% of revenue (40.8%).

-

Operating profit decreased by 21.5%, amounting to EUR 1.790 million (2.280). Profit for the period was EUR 1.239 million (1.760).

-

The company announced a strategy update on November 2, 2022. The aim is to significantly increase the productivity and quality of operations of construction sector entrepreneurs through digitalisation.

-

Jari Kangassalo was appointed to the Group Leadership Team as of November 2, 2022.

January-December 2022 summary (January 1, 2021 – December 31, 2021)

-

Yearly revenue amounted to EUR 31.615 million (24.857) resulting in +27.2% growth from comparison period. Of the growth 12.1 percentage points was organic and 15.1 percentage points was inorganic growth related to acquisitions.

-

EBITDA grew by 19.0% and totalled EUR 14.115 million (11.862), amounting to 44.6% of revenues (47.7%).

-

EBITA grew by 19.2% and totalled EUR 13.735 million (11.519), amounting to 43.4% of revenue (46.3%).

-

Operating profit grew by 4.2%, amounting to EUR 10.811 million (10.374). Profit for the period decreased by 1.0%, amounting to EUR 7.975 million (8.054).

-

The Group completed two acquisitions during the financial year. In May, the entire share capital of the software company PlanMan Oy was acquired, and in June, the entire share capital of the software company Kotopro Oy and Kotopro Holding Oy was acquired.

-

Petri Kairinen started as the CEO of Admicom Group on June 20, 2022. Mikko Järvi was appointed to the Group Leadership Team on June 20, 2022 and Jari Kangassalo on November 2, 2022.

-

The company announced a strategy update on November 2, 2022. The aim is to significantly increase the productivity and quality of operations of construction sector entrepreneurs through digitalisation.

-

In 2023, the company estimates that revenue growth will continue and profitability as a whole will be at a strong level. The company will publish a more detailed financial guidance for 2023 and financial targets for the new strategy period in the Capital Markets Day on January 30, 2023.

-

The parent company's Board of Directors proposes that a dividend of EUR 1.30 per share be paid for the financial year 2022.

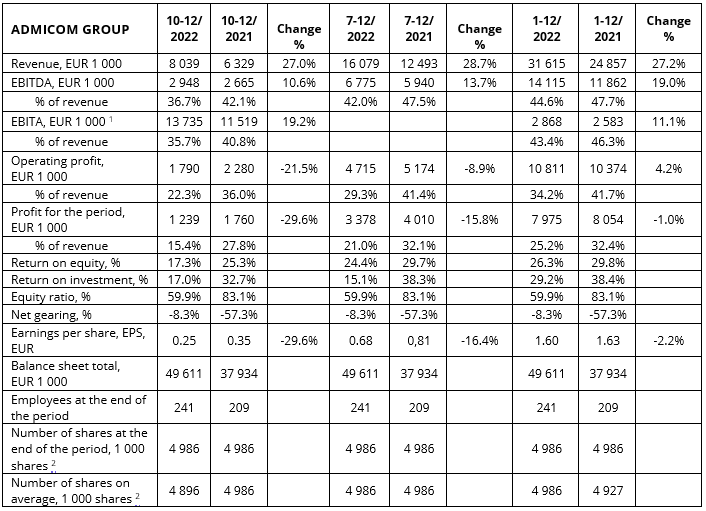

Key figures

1Operating profit before amortisation of consolidated goodwill and goodwill and amortisation

2 The number of shares on December 31, 2021 takes into account the shares (61,287 shares) recorded in the directed share issue on December 22, 2021 and eliminates the impact of the shares owned by the Group's companies (2,520).

CEO Petri Kairinen:

"The past year was again a time of profitable growth for Admicom, but also a time of change. The acquisitions made at the end of 2021 and the acquisitions in early 2022 significantly expanded Admicom's solution offering and customer base. During the year, we served more than 3,000 customer organizations, which accounted to more than 50 % increase compared to last year, forming a significant expansion revenue and cross-sales potential.

Supported by acquisitions, our revenue grew by 27 % year-on-year and by 27 % in the fourth quarter. Our profitability for the full year was at an excellent level with an EBITDA of 45 %. Our fourth-quarter EBITDA, 37 % of revenue, is typically lower than the full year seasonally, and the quarter was also burdened by growth investments and strategic changes.

During the third quarter, we started clarifying our strategy and announced the chosen direction at the beginning of November. In the updated strategy, we seek to accelerate the growth rate by focusing on the customer experience of construction vertical customers. We will improve the productivity and operational quality of enterprises in the sector through digitalization. In the chosen strategy, Admicom will develop from a multi-industry ERP system supplier to a versatile data-driven digitizer and simplifier of processes in the construction and real estate value chain.

Our strategy has two phases: in the first phase, during the next 1-2 years, we will create the conditions for accelerated growth and internationalization during a possible recession in the construction industry. In the second phase, we will accelerate our growth both in Finland and in selected international markets. Our strategic direction allows us to focus our expertise and processes specifically around the digitalization of the construction industry. Thus we are better able to take advantage of synergies between our subsidiaries and make further acquisitions that benefit the whole. Through this, we aim for accelerating growth and more scalable business in the medium term. We will review our goals and explain our strategy in more detail at the Capital Markets Day, which will be held as a hybrid event in Helsinki on January 30, 2023.

In the short term, the global recession and its impact on the construction industry, are also likely to hamper Admicom's growth. However, we are confident that we will continue to grow, as our solutions specifically enhance our customers' operations and productivity. Based on the sales figures for the last months of the year, we have not yet seen clear signs of the impact of the recession. This year, we will continue both strong new sales and, in particular, cross-selling to our current customers.

Admicom's team has grown and diversified significantly during 2022. Our employees have conveyed to the new CEO a sense of belonging and an understanding of the importance of driving towards a shared mission. I would like to thank all the employees of Admicom for their efforts towards common goals."

Outlook

Financial guidance

In 2023, the company estimates that revenue growth will continue and profitability as a whole will be at a strong level.

The company will publish a more detailed financial guidance for 2023 and financial targets for the new strategy period in the Capital Markets Day on January 30, 2023.

Themes affecting revenue and profitability

The company sees significant growth opportunities in the Group's software solutions and in expansion revenue and cross-selling to existing customers, but the nascent economic downturn is causing uncertainty in the development of new sales in 2023 and raising the risk of customer churn. In addition, the growth in revenue in 2023 will be slowed down by the growing use of Aitio Finland Oy's software development resources for Admicom Group's internal product development projects and the change in the business model implemented in the Lakeus business towards the end of 2022. Strategic investments in growth, growing R&D investments and structural changes in the business weaken the development of profitability.

The Group’s revenue and financial development

The Group's revenue in the period of January 1, 2022 – December 31, 2022 amounted to EUR 31.615 million (24.857). Revenue grew by 27.2% from the previous year. Of the growth, 12.1 percentage points were organic and 15.1 percentage points structural. The organic growth is mainly explained by the growth in new sales of ERP software. The inorganic growth in 2022 consisted mainly of the acquisitions of Aitio Finland, Kotopro and Hillava.

The impact of the annual adjustment fees on the growth of revenue was +2.5 percentage points and revenue in the financial year included annual adjustment fees totalling EUR 1.588 million (0.973). SaaS invoicing accounted for 71% (73%) of revenues, accounting services, that consist mainly of recurring revenues, accounted for 20% (22%) of revenues, and customer onboarding and consulting revenues and other revenues accounted for 9% (5%) of revenues. By business, net sales for 2022 were divided as follows: ERP solutions 72%, project management solutions 14%, documentation solutions 4%, software development services 4%, and industry 7%.

The Group's EBITDA for 2022 grew by 19.0% to EUR 14.115 million (11.862) and was 44.6% of revenue (47.7%). EBITDA growth was positively impacted by strong net sales growth, significant growth in annual balancing invoicing and strong relative profitability in core businesses.

The Group's operating profit for the period January 1 – December 31, 2022 was EUR 10.811 million (10.374), an increase of 4.2% on last year. Depreciation for the financial year was EUR 3.314 million (1.488), most of which, EUR 2.924 million, were group-level goodwill amortisations. Profit for the financial year was EUR 7.975 million (8.054). The increase in operating profit and profit for the financial year relative to EBITDA growth was weakened during the review period by amortisation and write-down of goodwill in the Lakeus business, as well as by the significant increase in amortisation of group goodwill amortisation due to the acquisition of the share capital of Aitio Finland Oy, Hillava Oy, PlanMan Oy, Kotopro Holding Oy and Kotopro Oy.

For the review period October 1, 2022 – December 31, 2022, revenue amounted to EUR 8.037 million (6.329). Revenue growth remained strong, amounting to 27.0%. In the fourth quarter, the majority of growth, 17.6 percentage points, was inorganic growth related to acquisitions.

Q4 EBITDA increased by 10.6% compared to the corresponding period of 2021, being EUR 2.948 million, resulting to 36.7% of net sales (2.665, 42.1%). EBITDA margin decreased and EBITDA growth slowed down as expected from the strong level of the comparison period, which was affected by, among other things, the changed margin structure due to acquisitions and increased investments in strategic development projects and product development.

Operating profit for the fourth quarter October 1, 2022 – December 31, 2022 was EUR 1.790 million (2.280) and the profit for the review period was EUR 1.239 million (1.760). The development of operating profit and result for the financial year in relation to EBITDA growth was weakened during the period by amortisation and write-down of goodwill in the Lakeus business, as well as by the significant increase in amortisation of group goodwill amortisation due to the acquisition of the share capital of Aitio Finland Oy, Hillava Oy, PlanMan Oy, Kotopro Holding Oy and Kotopro Oy.

The Company’s balance sheet, financing and cash flow

The Group’s balance sheet total amounted to EUR 49.611 million (37.934) on December 31, 2022. The balance sheet total was mainly increased by the increase in group goodwill related to the acquisitions of Kotopro Oy, Kotopro Holding Oy and Planman Oy. As a result of acquisitions, the Group's goodwill increased to EUR 30.595 million (15.898) at the end of the financial year.

The Group's equity at the end of the financial year was EUR 29.398 million and the equity ratio was 59.9% (83.1%). A dividend of EUR 7.483 million was distributed to shareholders during the review period and EUR 2.494 million in additional capital return from the invested unrestricted equity fund.

In connection with the Kotopro acquisition, the group raised a variable rate loan of EUR 13.0 million from financial institution, which will mature for payment in June 2025. The terms and conditions of the loan include a covenant condition measuring the net debt-to-EBITDA ratio that has been fulfilled at the balance sheet date. In addition, the group's other interest-bearing liabilities totalled EUR 0.088 million at the balance sheet date. At the balance sheet date, interest-bearing liabilities totaled EUR 13.088 million (0.0).

The group's cash flow for the financial year was EUR 2.524 million negative (4.237) due to acquisitions and dividend payments. The group's cash flow from operating activities before financing items and taxes for the financial year was EUR 15.392 million (12.220). Cash flow from operating activities was EUR 11.197 million (11.229), cash flow from investing activities was EUR -16,748 million (-2,510), and cash flow from financing activities was EUR 3.027 million (-4.482).

The group's financial position remained strong despite investments and dividend payments, and the group's liquid cash and cash equivalents on December 31, 2022 were EUR 15.531 million (18.055). On December 31, 2022, the group's net debt was EUR -2.443 million and net gearing was -8.3%.

Investments and depreciation

The most significant investment during the financial year was the acquisition of the entire share capital of Kotopro Holding Oy and Kotopro Oy. The total valuation of the arrangement at the time of acquisition was EUR 15.3 million and it will be paid in cash. 80% of the purchase price, EUR 12.25 million, was paid to the sellers at the time of signing the deed of sale on June 17, 2022. The remainder (the "Additional Purchase Price") will be paid to the sellers 37 months after the transaction and is tied to the development of Kotopro Oy's recurring contract base growth (MRR) and profitability during the 36-month period following the date of the transaction. The additional purchase price is EUR 0.0-3.1 million. The consolidated goodwill generated by the acquisition of Kotopro Holding Oy and Kotopro Oy was EUR 12.19 million (EUR 12.52 million on June 17, 2022.) in the balance sheet on December 31, 2022 and will be written off starting from June 18, 2022 in 20 years in accordance with the National Accounting Standard (FAS). The depreciation period is set at 20 years based on the long-term strategic value of the acquisition and the expected return. Despite Kotopro's strong growth, the group's management estimates that the completion of the additional purchase price is unlikely at the balance sheet date, which is why the related contingent liability has been valued at zero in the balance sheet on December 31, 2022 (EUR 3,500 million on June 17, 2022). Kotopro Holding Oy, the parent company of Kotopro Oy, has merged with the group's parent company Admicom Oyj on December 31, 2022.

The acquisition of the entire share capital of PlanMan Oy was the second significant investment of the financial year. The purchase price consisted of the debt-free value of the EUR 4.0 million share capital and in addition, the sellers were paid approximately EUR 2.0 million for additional liquid assets. The third instalment of approximately EUR 0.5 million is conditional on ensuring business continuity and product development and will be paid on may 31, 2025. The additional purchase price of EUR 0.5 million has been recorded in other long-term liabilities of the group's balance sheet. As of June 1, 2022, the EUR 4.602 million consolidated goodwill generated from the acquisition of PlanMan Oy will be written off in 10 years in accordance with the National Accounting Standard (FAS). PlanMan Oy has merged its parent company Tocoman Oy on December 31, 2022.

Other investments during the financial year were directed at intangible assets and property, plant and equipment and totaled EUR 0.008 million. No development costs have been capitalised in the balance sheet during the financial year 2022 or in the comparison period, with the exception of the development costs capitalised by Kotopro Oy in connection with the acquisition of Kotopro Oy and capitalised by Kotopro Oy in the financial year 2021, totalling EUR 0.090 million.

Depreciation for the financial year was 3.314 EUR million (1.488). 73 % of depreciation consists of depreciation of consolidated goodwill. 10 % of depreciation consists of amortisation of intangible assets such as R&D costs and software licenses, for which depreciation plans mostly end in the year 2025. 2 % of depreciation came from depreciation of machinery and equipment. 15 % the depreciation and amortisation came from the goodwill write-down of the Lakeus business. In December 2022, a strategic change was made to the Lakeus accounting firm business, in which the company abandoned customer relationships using third-party financial management systems and focused on customers using Adminet software. In connection with the change, the goodwill of the Lakeus business amounted to EUR 0.369 millionn write-down, after which the goodwill value of the Lakeus business is zero Eur.

Personnel, Management and Board of Directors

At the end of the financial year, the Group had 241 employees, of whom 168 worked at Admicom Finland Oy, 6 in parent company Admicom Oyj, 22 in Tocoman Oy, 21 in Aitio Finland Oy, 6 in Hillava Oy and 18 in Kotopro Oy. 29% of the personnel worked in accounting services, 28% in R&D and R&D services, 16 % in sales and marketing, 11% in customer onboarding services, 9% in the services unit and 7% in administration.

As of November 11, 2022, the Group Leadership Team consists of:

- Petri Kairinen, CEO

- Petri Aho, deputy CEO, CFO, M&A and strategy

- Anna-Maija Ijäs, Business Unit Director, ERP Solutions

- Jari Kangassalo, Business Unit Director, Project management solutions

- Mikko Järvi, Business Unit Director, Documentation solutions

- Thomas Raehalme, CTO and Business Unit Director of software development services

The Chairman of the Board of Directors of Admicom Oyj is Petri Niemi, and the ordinary members are Henna Mäkinen, Marko Somerma, Pasi Aaltola and Olli Nokso-Koivisto.

Admicom's Board of Directors decided on April 28, 2022 to establish an Audit Committee, of which Henna Mäkinen (Chairman), Marko Somerma and Petri Niemi were elected as members.

The parent company's audit firm is KPMG OY AB, with Anna-Riikka Maunula, APA as the principal auditor.

Shares and shareholders

Issued shares and share capital

Admicom Oyj's shares on December 31, 2022 totaled 4,988,985 shares and the company's share capital at the end of December 2022 was EUR 106,000. At the end of the financial year, Admicom Finland Oy held 2,520 shares in Admicom Oyj.

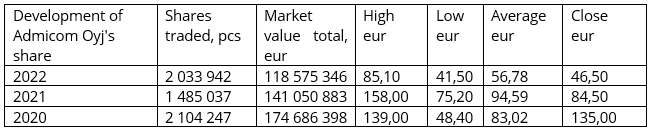

Trading in a share

Trading in Admicom's share was reasonably brisk and during the year approximately 41% of the share capital was exchanged. Admicom Oyj's share value at the end of the year was EUR 46.50 and the market value was approximately EUR 232 million.

Shareholders

Admicom Group had a total of 3,725 shareholders on December 31, 2022. The largest shareholder was nominee registered shareholding in Skandinaviska Enskilda Bank (SEB) with a 40.5% stake, after which the largest holdings were Matti Häll 25.9% and Danske Invest Equity Fund with a 5.5% stake.

On December 31, 2022, nominee registered shareholders owned 48.8% of the share capital.

The total holdings of the Board of Directors and the Management Team amounted to 63,933 shares (1.28% of the share capital).

Annual General Meeting and Administration

The parent company's Annual General Meeting was held in Jyväskylä on February 25, 2022. The Annual General Meeting discharged the Board of Directors and the CEO from liability and decided to distribute as a dividend EUR 1.50 per share paid to the owners on March 8, 2022. In addition, the Annual General Meeting decided to distribute a return of capital of EUR 0.50 per share. The return of capital was paid on March 8, 2022

The Annual General Meeting resolved that the remuneration payable to the external members of the Board of Directors shall be EUR 25,000 and EUR 55,000 to the Chairman of the Board of Directors for the term of office extending to the next Annual General Meeting.

The Annual General Meeting decided to appoint Petri Niemi, Henna Mäkinen and Marko Somerma as new members of the Board of Directors, and Olli Nokso-Koivisto ja Pasi Aaltola continued as board members. Petri Niemi was selected as chairman of the board.

The Annual General Meeting decided on the establishment of the Nomination Board. The Nomination Board submits a proposal to the Annual General Meeting concerning the composition and remuneration of the Board of Directors. The 4 largest shareholders in accordance with the share register on August 31, 2022 will each nominate one member to the Nomination Board. In addition, the Chairman of the Company's Board of Directors acts as a member of the Nomination Board. The company announced the composition of the Nomination Board 2022 on October 11, 2022.

Risks and uncertainty factors

The main risks and uncertainties of Admicom Group's business include:

- The focus on construction sector customers increases the sensitivity to economic cycles, which can slow down growth or be reflected in unforeseen customer churn through bankruptcies. The aim is to reduce the risk by supporting the customers' business through consulting and developing customer service, as well as by offering customers solutions that improve productivity and cost-effectiveness.

- Technology and information security risks are a critical area for a cloud service company. The company is constantly taking measures to detect and prevent technology and information security threats.

- Reputational risk, which is essentially linked to data protection and information security risks as well as risks of service failures. In order to reduce the risk, the company continuously develops its software and the organization's data protection and information security processes, familiarizes its personnel with data protection and information security issues, and regularly monitors customer satisfaction.

- Risks related to key personnel. The company is constantly recruiting new experts to prepare for critical removals, in addition to which the company has invested in the development of new remuneration systems and management.

- Risks associated with changes in the competitive field. The number of M&A transactions and the interests of foreign private equity investors and companies in Finnish software companies have increased, which can shape the power relations in the competitive field. In addition, small, focused software houses have emerged in the industry. The company actively monitors changes in the competitive field and takes into account changes in them in strategy work and business.

- Risks related to possible mergers and acquisitions of Admicom, which are typical when acquiring or integrating businesses. The combination of operations related to completed acquisitions and the expansion of process expertise related to mergers and acquisitions will help to manage risks.

Proposal of the Board of Directors concerning profit for the financial year

The parent company's distributable funds amount to EUR 24,852,405 and the profit for the financial year to EUR 9,098,774 The Board of Directors of the parent company proposes a dividend of EUR 1.30 per registered share be paid of the profit for the financial period, a total of EUR 6,485,681.

There have been no material changes in the company's financial position since the end of the financial year. The company's liquidity is good, and the proposed distribution of profits does not, in the View of the Board of Directors, jeopardise the company's solvency.

Relevant events after the end of the reporting period

No material events.

Accounting principles of the annual financial report

The annual financial report has been prepared in accordance with good accounting principles and Finland’s legislation. The figures in the half-year financial report are unaudited and in FAS-format. The information has been presented in extent of which is required by the rules of Nasdaq First North Growth Market Finland, section 4.4. The presented figures have been rounded up from the exact figures.

All the figures in the annual financial report are figures of Admicom Group.

Financial publications and Annual General Meeting

The company will publish the Q1 interim report on April 5, 2023, H1 report on July 5, 2023 and Q3 interim report on October 5, 2023.

The company will organise a Capital Markets Day on January 30, 2023, for which more information can be found at https://investors.admicom.fi/cmd/.

Admicom's Annual General Meeting is scheduled to be held on March 21, 2023. The Board of Directors convenes the Annual General Meeting separately.

The Company will publish the Group's Annual Report 2022 and the Financial Statements in Finnish on January 13, 2023 at approximately 9 a.m. Unofficial English translation of the Group's Annual Report 2022 and the Financial Statements will be available later on the company's website at https://investors.admicom.fi/. In addition, a web conference regarding the financial statements will be arranged for investors on January 13, at 2 p.m. Further information about the event is available on Admicom’s website: https://investors.admicom.fi/event-sign-up/.

More detailed financial information can be viewed from the attachment ‘Admicom Oyj’s financial statements release’

Admicom Oyj

BOARD OF DIRECTORS

Additional information:

Petri Kairinen

CEO

petri.kairinen@admicom.fi

+358 50 303 4275

Petri Aho

CFO

petri.aho@admicom.fi

+358 44 724 1767

Keywords

Contacts

Petri KairinenCEO

Tel:+358 50 303 4275petri.kairinen@admicom.fiPetri AhoCFO

Tel:+358 44 724 1767petri.aho@admicom.fiDocuments

About Admicom Oyj

Admicom Oyj

Founded in 2004, Admicom is a forerunner in IT system development for SMEs and a comprehensive software and accounting services partner.

At the core of our service package is the Adminet ERP system, which covers a wide range of solutions for managing clients' operations, from construction site mobile tools to real-time financial monitoring and project management. A highly automated SaaS solution helps SMEs improve their competitiveness and profitability and significantly saves time on site and in the office. We also provide our customers training, consulting and accounting services.

Our software suite also includes Adminet Lite, a cost-effective software and service package for small businesses, Hillava, a precision solution for mobile work control, Kotopro, a modern software solution for high-quality documentation, and Tocoman, a pioneer in project management software solutions for the construction industry, including quantity and cost calculation, scheduling and BIM3 solutions for building information modeling.

We work continuously to enhance the integration between our software solutions to provide our customers with a coherent user experience, thus enabling them to build a more profitable business by using modern software solutions.

The ever-growing Admicommunity employs more than 240 people in its offices in Jyväskylä, Helsinki, Tampere, Oulu, Seinäjoki and Turku. Further information: https://investors.admicom.fi/.

Subscribe to releases from Admicom Oyj

Subscribe to all the latest releases from Admicom Oyj by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Admicom Oyj

ADMICOM OYJ’S INTERIM REPORT Q1 1.1.-31.3.2025: STRATEGY EXECUTION PROGRESSING AS PLANNED – CHALLENGING MARKET ENVIRONMENT CONTINUED. ANNUAL RECURRING REVENUE GREW BY 5.5%, ADJUSTED EBITDA AT 25.3%.9.4.2025 08:02:00 EEST | Press release

Unofficial translation of Admicom Oyj’s interim report Q1 on April 9, 2025 at 8:00 EEST. In case the document differs from the original, the Finnish version prevails. An investor call on Admicom's Q1 results will be held on April 9, 2025 at 10 AM EEST. You can register for the event via this link: https://admicom.events.inderes.com/q1-2025 Figures in parenthesis refer to the comparable period in the previous year, unless otherwise stated. January – March 2025 (Q1) summary: Annual recurring revenue (ARR)1) increased by 5.5% and was EUR 35.6 million (33.8). Recurring revenue2) increased by 9.2% and was EUR 8.8 million (8.1). Revenue increased by 7.7% and was EUR 9.3 million (8.6). Adjusted EBITDA3) was EUR 2.3 million (2.7), or 25.3% of revenue (30.9%). Adjustments to EBITDA were EUR 81 thousand (80). Adjusted EBIT3) was EUR 1.2 million (1.7), or 13.3% of revenue (19.9%). Earnings per share were EUR 0.14 (0.21). Bauhub generated EUR 374 thousand to Group’s revenue and EUR 1.4 million to

Decisions of Admicom Oyj's Annual General Meeting on March 19, 202519.3.2025 18:03:00 EET | Press release

Unofficial translation of the company release on March 19, 2025 at 6:00 p.m. EET. In case the document differs from the original, the Finnish version prevails. Decisions of Admicom Oyj's Annual General Meeting and the decisions of the organizing meeting of the Board of Directors on March 19, 2025 Admicom Oyj's Annual General Meeting on March 19, 2025 approved the company's financial statements for the financial year 2024 and discharged the members of the Board of Directors and the CEO from liability for the financial year 2024. The decisions can be read in full from the minutes of the Annual General Meeting, available in Finnish on Admicom Oyj’s website https://investors.admicom.fi/annual-general-meeting/ on April 2, 2025 at the latest. Distribution of profits The Annual General Meeting resolved that a dividend of EUR 0.65 per registered share be paid of the profit for the financial period 2024. The dividend will be paid to a shareholder registered in the Company’s shareholders’ regist

Changes in Admicom's organization and leadership model19.3.2025 08:05:00 EET | Press release

Unofficial translation of the company release on March 19, 2025 at 08:00 a.m. EET. In case the document differs from the original, the Finnish version prevails. Admicom renews its leadership model Admicom Oyj ("Admicom" or "Group") is renewing its leadership model and simplifying its organizational structure. The objective of the change is to enhance operational decision-making and expedite the accelerated growth strategy phase to better serve Admicom's customers. Changes in Group Leadership Team From March 19 ,2025 onwards, Admicom's Leadership Team consists of seven members instead of the previous nine. The Group's new Leadership Team responsibilities are as follows: Simo Leisti, Chief Executive Officer, CEO Satu Helamo, Chief Financial Officer, CFO Helena Marjokorpi, Chief Human Resources Officer, CHRO Pekka Pulkkinen, Chief Growth Officer, CGO Thomas Raehalme, Chief Technology Officer, CTO Teemu Uusitalo, Chief Product Officer, CPO In addition, a Chief Strategy Officer will be hire

Admicom kiihdyttää tekoälykehitystään 2,4 miljoonan euron tutkimushankkeella13.3.2025 11:36:43 EET | Tiedote

Admicom kiihdyttää tekoälykehitystään 2,4 miljoonan euron tutkimushankkeella Lehdistötiedote Julkaisuvapaa Business Finlandin osittain rahoittamassa hankkeessa tutkitaan tekoälyn mahdollisuuksia rakentamisen tuottavuuden parantamisessa ja tavoitellaan uusista tekoälypohjaisista ratkaisuista Admicomille erottautumistekijää myös globaaleilla markkinoilla. Tavoitteena jopa 25 % parempi tuottavuus Admicom tutkii, miten rakennusalalla voidaan rakentaa paremmin tekoälyä hyödyntämällä. Business Finland tukee yhteensä 2,4 miljoonan euron tutkimushanketta noin miljoonan euron rahoituksella. Admicomin oma investointi projektiin ei muuta yhtiön nykyistä taloudellista ohjeistusta. Hankkeen tavoitteena on löytää keinoja parantaa asiakkaiden tuottavuutta jopa 25 % verrattuna yrityksiin, jotka eivät käytä Admicomin ratkaisuja. – Olen nähnyt monien toimialojen hyötyvän paremmasta tuottavuudesta, kun ne omaksuvat uusia työskentelytapoja ottamalla käyttöön digitaalisia teknologioita, viimeisimpänä tekoä

Admicom accelerates its AI solution development with €2.4 million research project13.3.2025 11:36:43 EET | Press release

Admicom accelerates its AI solution development with €2.4 million research project The project, partially funded by Business Finland, explores the potential of artificial intelligence in improving productivity in construction and aims to make new AI-based solutions a differentiating factor for Admicom also in the global market. Aiming for up to 25% more productivity Admicom is researching how the construction industry can build better by utilising AI. Business Finland supports a research project totalling EUR 2.4 million with approximately EUR 1 million in funding. Admicom's own project investment does not change company's current financial guidance. Admicom aims to further accelerate customer productivity by up to 25% compared to companies not using Admicom’s solutions. − I have seen many industries benefit from improved productivity as they adopt new ways of working by adopting digital technologies, most recently AI. I truly believe this will be the case with the construction industr

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom