Almost a fifth of households’ consumer credit originated by OFIs

7.3.2023 10:00:00 EET | Suomen Pankki | Press release

In the last quarter of 2022, households drew down EUR 80 million of unsecured consumer credit from other financial institutions (OFIs),[1] which was a little more than in the corresponding period a year earlier. The average agreed annual interest rate on new unsecured consumer credit was 9.3%. Almost a quarter of the consumer credit was drawn down from consumer credit and small-loan companies. The average interest rate on these drawdowns was 20%.

The stock of consumer credit originated by consumer credit and small-loan companies, also known as payday lenders, decreased, and the average interest rate declined in 2022.[2] At the end of December 2022, the stock of consumer granted by consumer credit and small-loan companies to Finnish households stood at EUR 154 million, with an average interest rate of 35%. Payday lenders’ stock of consumer credit has contracted significantly since 2018, when payday lenders had an estimated EUR 700 million of loan receivables from households. In September 2019, a 20%-interest rate cap on consumer credit entered into force, after which some of the companies granting small loans have discontinued either the extension of new loans or their activities altogether. The contraction of the loan stock also reflects the sale of loans off balance sheets.

Other financial institutions originate the majority of vehicle loans

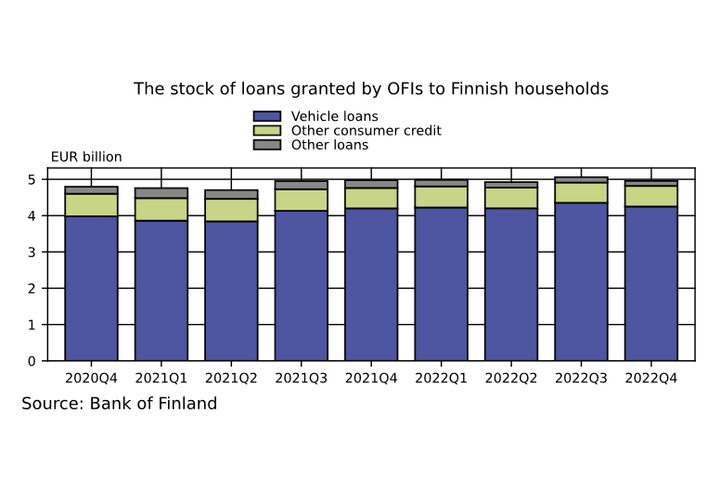

The aggregate stock of consumer credit granted by OFIs was EUR 4.9 billion at the end of 2022. Consumer credit granted by OFIs account for 19% of households’ total stock of credit (EUR 25.1 billion). The majority (68%) of households’ consumer credit has been originated by banks (credit institutions).

The majority (88%) of consumer credit originated by OFIs consisted of vehicle loans.

At present, vehicle loans constitute a more important part of OFIs’ business than before. As regards market share measured as a proportion of the loan stock, at the end of December 2022, OFIs accounted for 56% and banks for 44% of all vehicle loans (EUR 7.6 billion).

Finnish households drew down a total of EUR 1 billion of new vehicle loans from OFIs during the last quarter of 2022. The amount of vehicle loans drawn down from credit institutions in the same period was EUR 375 million. Hence, the total amount of vehicle loans drawn down in the last quarter of 2022 was EUR 1.4 billion. The agreed annual interest rate (3.4%) on new vehicle loans drawn down from OFIs in the last quarter of 2022 was lower than the interest rate on vehicle loans from credit institutions (4.7%). Likewise, the effective annual interest rate, which also includes other expenses,[3]on vehicle loans granted by OFIs was lower (5.5%) in comparison to similar loans granted by banks (6.8%).

For further information, please contact:

Tommi Salenius, tel. +358 09 183 2156, email: tommi.salenius(at)bof.fi

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi

The next Other financial institutions release will be published in autumn 2023.

[1] Excl. pawnshops.

[2] At the end of 2021, the stock stood at EUR 214 million and the average interest rate was over 40%.

[3] In the OFI data collection, effective annual interest rate refers to new drawdowns, while in banking statistics, it refers to new agreements.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

I Finland påträffades 483 förfalskade eurosedlar under 202527.2.2026 11:00:00 EET | Pressmeddelande

Bland de utelöpande sedlarna i Finland påträffades 483 förfalskade eurosedlar under 2025. Under 2023 påträffades 653 förfalskade eurosedlar i omlopp och 714 stycken under 2024.

Suomessa löytyi viime vuonna kierrosta 483 euroseteliväärennöstä27.2.2026 11:00:00 EET | Tiedote

Suomessa setelien kierrosta löydettiin vuoden 2025 aikana 483 euroseteliväärennöstä. Vuonna 2023 kierrosta löytyi 653 euroseteliväärennöstä ja vuonna 2024 niitä löytyi 714.

Total of 483 counterfeit euro banknotes found in circulation in Finland last year27.2.2026 11:00:00 EET | Press release

In 2025, a total of 483 counterfeit euro banknotes were detected among banknotes in circulation in Finland. The number of counterfeit euro banknotes detected in 2023 and 2024 was 653 and 714, respectively.

Genomsnittsräntan på bostadslån har stabiliserats27.2.2026 10:00:00 EET | Pressmeddelande

I januari hade 94 % av de nya bostadslånen Euribor som referensränta. Det senaste året har intresset för 12 mån. Euribor som referensränta för nya bostadslån minskat och intresset för kortare Euriborräntor ökat. Av de utestående bostadslånen har 95 % av lånen Euribor som referensränta och endast 5 % av lånen löper med fast ränta eller har bundits till bankernas egna referensräntor.

Asuntolainojen keskikoron kehitys tasaantunut27.2.2026 10:00:00 EET | Tiedote

Tammikuussa uusissa asuntolainoissa 94 prosentissa käytettiin viitekorkona euriborkorkoa. Viimeisen vuoden aikana 12 kuukauden euriborkoron suosio uusien asuntolainojen viitekorkona on vähentynyt ja vastaavasti lyhempien euriborkorkojen kasvanut. Asuntolainakannasta 95 prosentissa lainoista on käytetty viitekorkona euriborkorkoja, ja vain 5 % lainoista oli kiinteäkorkoisia tai pankkien omiin viitekorkoihin sidottuja.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom