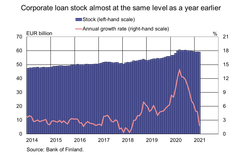

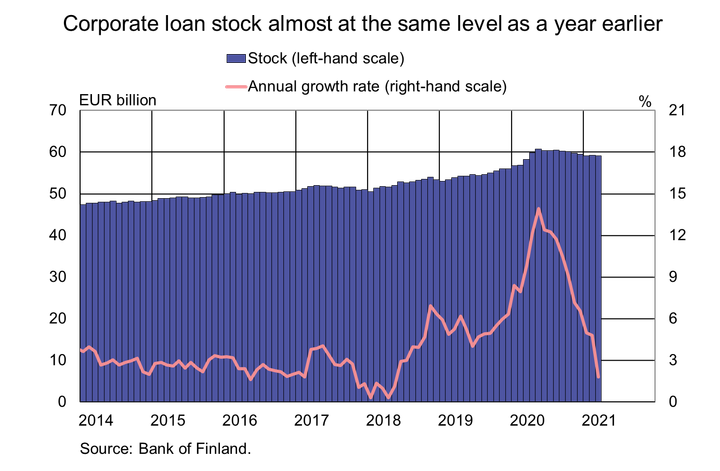

Corporate loan stock almost at the same level as a year earlier

The stock of loans granted by banks to non-financial corporations (NFCs)[1] has contracted by EUR 1.7 bn from the peak at end-May 2020 (EUR 60.8 bn) to EUR 59.1 bn at the end of March 2021. Nevertheless, in March the corporate loan stock still grew by 1.8% on the same month last year. During the COVID-19 pandemic, the corporate loan stock has grown at the fastest pace (14%) in May 2020. Since then, the annual growth rate has slowed significantly.

Growth in the stock of corporate loans has moderated particularly due to fewer drawdowns. In the first quarter of 2021, drawdowns of new corporate loans were down 42% on the same period a year earlier, when they were exceptionally brisk. In March 2021, new drawdowns totalled EUR 1.4 bn, with an average interest rate of 2.01%. According to the Bank Lending Survey, demand for corporate loans is estimated to have declined in the first quarter of 2021 mainly on account of weaker fixed investment.

Overall, despite the pandemic, impairments and credit losses from loans to NFCs have remained low. There are, however, differences between industrial branches. For example, in industries severely affected by the pandemic, such as accommodation and food service activities as well as arts, entertainment and recreation, more impairments and credit losses have been recorded relative to the loan stock, on average, than in other industries.

Uncertainty and precautionary behaviour have also been reflected in the swift growth of deposits placed by NFCs. Over the past year, corporate deposits have grown by almost EUR 5 bn. At the end of March 2021, NFCs held deposits amounting to EUR 44.3 bn in banks operating in Finland. The average interest rate on the deposits in March was -0.08%.

Loans

Finnish households drew down new housing loans in March 2021 in the amount of EUR 2.1 bn, up EUR 360 million on the same month last year. At the end of March, the stock of housing loans stood at EUR 103.6 bn, with an annual growth rate of 3.8%. Of all loans of Finnish households at the end of March, EUR 16.5 bn were consumer credit and EUR 17.4 bn were other loans.

Housing corporations’ drawdowns of new loans[2] in March totalled 450 million. The average interest rate on these declined from February, to 1.26%. At the end of March, the stock of loans to housing corporations stood at EUR 37.6 bn.

Deposits

At the end of March 2021, the stock of deposits of Finnish households totalled EUR 104.8 bn, and the average interest rate on the deposits was 0.05%. Of the total, overnight deposits accounted for EUR 94.8 bn and deposits with an agreed maturity for EUR 3.4 bn. In March, households concluded EUR 70 million of new agreements on deposits with an agreed maturity, at an average interest rate of 0.22%.

Data on buy-to-let housing loans will be released for the first time tomorrow 4 May in an article of the Bank of Finland Bulletin(financial stability issue).

The exclusion of non-recourse factoring (purchase of trade receivables) from the volume of corporate loans and average interest rates from March 2014 onwards led to a reduction in the average interest rate on loans to NFC and the amount of new loans.

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Anu Karhu, tel. +358 10 183 2228, email: anu.karhu(at)bof.fi

The next monthly statistical release will be published at 10 a.m. on 1 June 2021.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] Excl. housing corporations.

[2] Excl. overdrafts and credit card credit.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Inlåningen från hushållen var den största genom tiderna i november 20257.1.2026 10:00:00 EET | Pressmeddelande

Inlåningen från hushållen har ökat 2025 samtidigt som inlåningsräntorna har sjunkit. Inlåningen har ökat i alla inlåningsformer. Dessutom ingick finländska företag i november rikligt med nya avtal om tidsbunden inlåning.

Kotitalouksien talletuskanta oli kaikkien aikojen suurin marraskuussa 20257.1.2026 10:00:00 EET | Tiedote

Kotitaloudet ovat kasvattaneet talletuksiaan vuonna 2025 samaan aikaan kun talletusten korot ovat laskeneet. Talletukset ovat kasvaneet kaikissa talletusmuodoissa. Lisäksi suomalaiset yritykset solmivat marraskuussa runsaasti uusia määräaikaistalletussopimuksia.

Households' deposit stock at all-time high in November 20257.1.2026 10:00:00 EET | Press release

Households have increased their deposits in 2025 while interest rates on deposits have declined. Deposits have grown in all deposit categories. In addition, Finnish corporations concluded a high volume of new agreements on deposits with agreed maturity in November.

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom