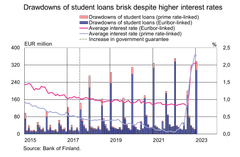

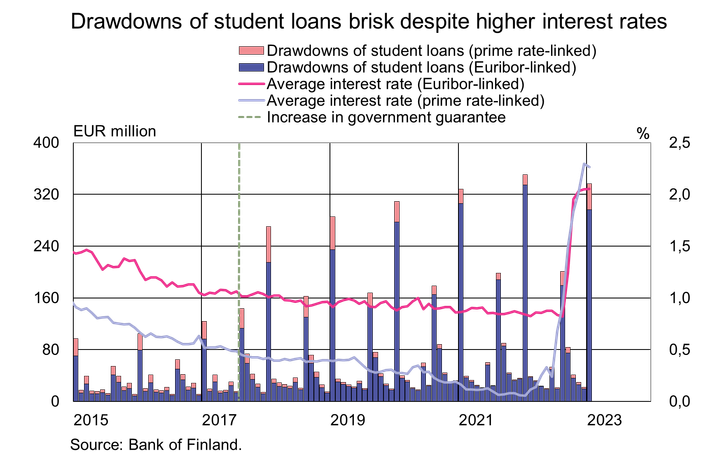

Drawdowns of student loans brisk despite higher interest rates

In January 2023[1], drawdowns of student loans totalled EUR 335 million, a decline of 4% on January last year. The average interest rate on the student loans drawn down in January 2023 was 2.24%. The interest rates on new student loan drawdowns have risen since January 2022, when the average interest was 0.09%. Loans linked to Euribor rates accounted for 88% of all the new drawdowns, and the average interest on these was 2.26%. Out of the new drawdowns of Euribor-linked student loans, 75% were tied to the 6- or 12-month Euribor.

The stock of student loans has grown at a brisk pace in recent years, although the annual growth rate has moderated steadily. At the end of the January 2023, the stock of student loans stood at EUR 6.0 billion, with an annual growth rate of 9.0%. This was the lowest annual growth rate since November 2014. The stock of student loans has almost doubled since the reform of student financial aid that came into effect in 2017.

In addition to larger loan tranches as a result of the student financial aid reform, the stock of student loans has also been augmented by an increase in the number of borrowers. The total number of people with outstanding student loan debt has grown rapidly in recent years. According to the statistics of the Social Insurance Institution, in the academic year 2021–2022 there were 515,000 people with student debt, when three years earlier there were 80,000 less.

Loans

Finnish households drew down new housing loans in January 2023 to a total of EUR 0.8 billion, or EUR 570 less than in January last year. Of the total, EUR 80 million were housing loans for investment property. The average interest rate on new housing loans rose from December, to 3.58%. At the end of January 2023, the stock of housing loans stood at EUR 108.1 billion, and the annual growth rate of the loan stock was 0.0%. Investment property loans accounted for EUR 8.7 billion of the housing loan stock. At the end of January 2023, the stock of loans to Finnish households comprised EUR 17.0 billion in consumer credit and EUR 18.2 billion in other loans.

Finnish non-financial corporations drew down new loans[2] in January 2023 to a total of EUR 1.9 billion, of which EUR 420 million were loans to housing corporations. The average interest rate on the new drawdowns rose from December, to 4.26%. At the end of January 2023, the stock of loans to Finnish non-financial corporations stood at EUR 104.9 billion, of which loans to housing corporations accounted for EUR 42.5 billion.

Deposits

At the end of January 2023, the stock of deposits of Finnish households amounted to EUR 110.9 bn, and the average interest rate on the deposits was 0.29%. Of the total, overnight deposits accounted for EUR 100.6 billion and deposits with agreed maturity for EUR 4.4 billion. In January, households made EUR 860 million of new agreements on deposits with agreed maturity, at an average interest rate of 1.98%.

For further information, please contact:

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 30 March 2023.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] The loan amount for the spring semester became available for drawdown in January.

[2] Excl. overdrafts and credit card credit.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

En inhemsk lösning för omedelbara betalningar skulle öka funktionssäkerheten och konsumenternas valfrihet8.5.2025 11:30:00 EEST | Pressmeddelande

Finländarna måste ha tillgång till förmånliga, mångsidiga och tillförlitliga betalningssätt som fungerar säkert också under exceptionella omständigheter. En lösning för omedelbara betalningar som baserar sig på kontoöverföringar i real tid skulle öka vår förmåga att hantera systemen för betalning och erbjuda konsumenterna ett välkommet alternativ.

Kotimainen pikamaksamisen ratkaisu lisäisi toimintavarmuutta ja kuluttajien valinnanvapautta8.5.2025 11:30:00 EEST | Tiedote

Suomalaisilla tulee olla käytössään edullisia, monipuolisia ja luotettavia maksutapoja, jotka toimivat turvallisesti myös poikkeustilanteissa. Reaaliaikaisiin tilisiirtoihin perustuva pikamaksuratkaisu lisäisi kykyämme hallita maksamisessa käytettyjä järjestelmiä ja tarjoaisi kuluttajille tervetulleen vaihtoehdon.

A Finnish instant payment solution would improve resilience and consumer choice8.5.2025 11:30:00 EEST | Press release

People must have access in Finland to inexpensive, versatile and reliable methods of payment and these must function securely even in exceptional situations. An instant payment solution based on real-time credit transfers would enhance our ability to govern the systems used in making payments and would offer consumers greater choice.

Inlåningen från hushållen ökar8.5.2025 10:00:00 EEST | Pressmeddelande

Vid utgången av mars 2025 var inlåningen från de finländska hushållen (112,1 miljarder euro) 3 miljarder euro större än vid motsvarande tid för ett år sedan. Inlåningen har senast varit större 2022. I juli 2022 var inlåningen den största genom tiderna, dvs. nära 114 miljarder euro. Vid utgången av mars 2025 var 68,4 miljarder euro av inlåningen från hushållen inlåning över natten[1], 14,9 miljarder euro tidsbunden inlåning och 28,8 miljarder euro placeringsdepositioner[2].

Kotitalouksien talletuskanta kasvussa8.5.2025 10:00:00 EEST | Tiedote

Maaliskuun 2025 lopussa suomalaisten kotitalouksien talletuskanta (112,1 mrd. euroa) oli 3 mrd. euroa suurempi kuin vuosi sitten vastaavana aikana. Talletuskanta oli viimeksi suurempi vuonna 2022. Vuoden 2022 heinäkuussa se oli kaikkien aikojen suurin eli lähes 114 mrd. euroa. Maaliskuun 2025 lopussa kotitalouksien talletuksista 68,4 mrd. euroa oli yön yli -talletuksia[1], 14,9 mrd. euroa määräaikaistalletuksia ja 28,8 mrd. euroa sijoitustalletuksia[2].

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom