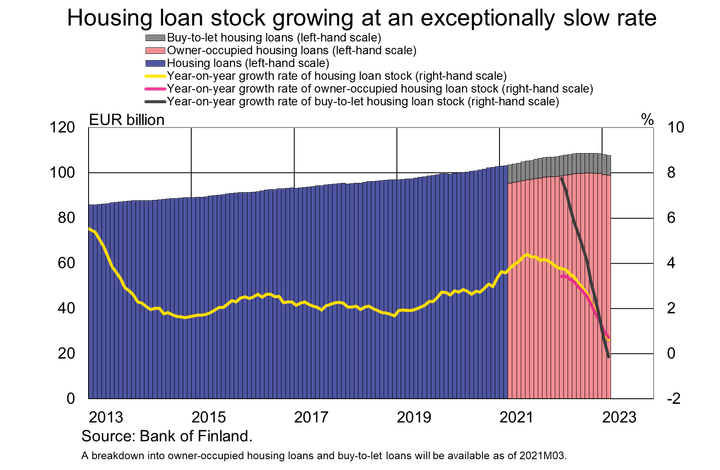

Housing loan stock growing at an exceptionally slow rate

In February 2023, the year-on-year rate of growth of the stock of households’ housing loans[1] (EUR 107.9 billion) slowed down to 0.6%, having stood at 3.8% just a year earlier. Annual growth has slowed down due to decreasing drawdowns of housing loans. In February 2023, the stock of buy-to-let housing loans (EUR 8.7 billion) contracted 0.1% year-on-year, in stark contrast with a growth rate of almost 8% in March 2022. The rate of growth of the owner-occupied housing loan stock (EUR 99.1 billion) has also slowed down significantly, to 0.7%.

The drawdowns of new housing loans remained sluggish in February. In February 2023, new drawdowns of housing loans amounted to EUR 980 million. The last time housing loan drawdowns were this low in February was in 2003. In February 2023, the average interest rate on new housing loan drawdowns was 3.80%. The average interest rate on buy-to-let housing loans (4.05%) was higher than that of owner-occupied housing loans (3.78%).

In February 2023, 95% of new housing loans were linked to Euribor rates. Other reference rates are seldom used as reference rates for housing loans. As interest rates have risen, the popularity of the most common reference rate, the 12-month Euribor, has decreased in favour of shorter-term Euribor rates. In February 2023, 60% of new housing loans were linked to the 1-year Euribor, 18% to the 6-month Euribor and 17% to the 3-month Euribor. The average interest rate on new housing loans linked to the 1-year Euribor was 4.10%, in comparison to 3.59% on loans linked to the 6-month Euribor and 3.14% on loans linked to the 3-month Euribor.

According to a separate bank survey, 25% of the housing loan stock[2] was hedged against an increase in interest rates with a separate hedging product. In addition, 2.5% of the housing loan stock[3] consisted of fixed-interest rate loans. Interest rate hedges dampen the rise of the average interest rate on the housing loan stock. At the end of February 2023, the average interest on the housing loan stock was 2.38%.

Loans

At the end of February 2023, Finnish households’ loan stock comprised EUR 16.9 billion in consumer credit and EUR 18.2 billion in other loans.

Drawdowns of new loans[4] by Finnish non-financial corporations in February totalled EUR 1.4 billion, whereof loans to housing corporations amounted to EUR 390 million. The average interest rate on new corporate loan drawdowns declined from January, to 4.21%. At the end of February, the stock of loans granted to Finnish non-financial corporations stood at EUR 104.7 billion, whereof loans to housing corporations accounted for EUR 42.6 billion.

Deposits

At the end of February 2023, the stock of Finnish households’ deposits totalled EUR 110.2 billion, and the average interest rate on these deposits was 0.35%. Overnight deposits accounted for EUR 99.4 billion and deposits with agreed maturity for EUR 5.2 billion of the total deposit stock. In February, Finnish households made EUR 970 million of new agreements on deposits with an agreed maturity, at an average interest rate of 2.20%.

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 3 May 2023.

Related statistical data and ‑graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

[1] Some banks recorded changes in the market value of interest rate hedges in the balance sheet item for which an interest rate hedge agreement had been signed between the bank and the customer. As interest rates rose, the revaluation adjustments recognised in the housing loan stock reduced the size of these banks’ housing loan portfolios. Due to a change in reporting practices, in December 2022, these items were no longer reported in the balance-sheet item covered by the interest rate hedge agreement. In the most recent publication, the change has been implemented in the reporting history since 2022M03. The change increased the housing loan stock in March–November 2022.

[2] At the end of June 2022.

[3] At the end of June 2022.

[4] Excl. overdrafts and credit card credit.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Finlands Bank har ställt upp nya klimatetappmål för investeringsverksamheten och uppdaterat sina principer för ansvarsfulla investeringar16.1.2026 10:00:00 EET | Nyheter

Finlands Banks direktion har fattat beslut om nya klimatetappmål som styr bankens investeringsverksamhet mot nettonollutsläpp senast 2050. De uppdaterade målen ligger i linje med tidigare uppnådda etappmål, som var vägledande för verksamheten fram till 2025.

Suomen Pankki asetti sijoitustoiminnalle uudet ilmastovälitavoitteet ja päivitti vastuullisen sijoittamisen periaatteet16.1.2026 10:00:00 EET | Uutinen

Suomen Pankin johtokunta on päättänyt uusista ilmastovälitavoitteista, jotka ohjaavat pankin sijoitustoimintaa kohti hiilineutraalisuutta viimeistään vuoteen 2050 mennessä. Päivitys jatkaa aiempien välitavoitteiden linjaa, jotka saavutettuina ohjasivat toimintaa vuoden 2025 loppuun saakka.

Bank of Finland sets new interim climate targets for its investment activities and updates its responsible investment principles16.1.2026 10:00:00 EET | News

The Bank of Finland Board has adopted new interim climate targets to guide its investment activities towards carbon neutrality by 2050 at the latest. This update continues the approach of the previous interim targets, which guided activities up to the close of 2025 and which have been attained.

Inlåningen från hushållen var den största genom tiderna i november 20257.1.2026 10:00:00 EET | Pressmeddelande

Inlåningen från hushållen har ökat 2025 samtidigt som inlåningsräntorna har sjunkit. Inlåningen har ökat i alla inlåningsformer. Dessutom ingick finländska företag i november rikligt med nya avtal om tidsbunden inlåning.

Kotitalouksien talletuskanta oli kaikkien aikojen suurin marraskuussa 20257.1.2026 10:00:00 EET | Tiedote

Kotitaloudet ovat kasvattaneet talletuksiaan vuonna 2025 samaan aikaan kun talletusten korot ovat laskeneet. Talletukset ovat kasvaneet kaikissa talletusmuodoissa. Lisäksi suomalaiset yritykset solmivat marraskuussa runsaasti uusia määräaikaistalletussopimuksia.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom