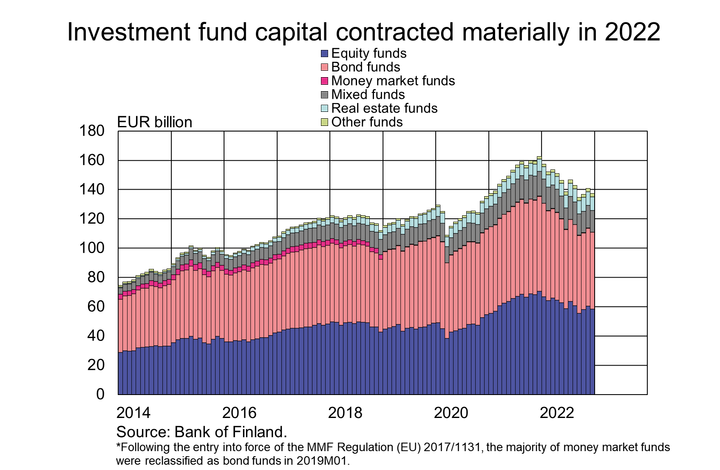

Investment fund capital decreased materially in 2022

After record growth in 2021, the fund capital of Finnish investment funds[1] decreased materially in 2022. At the end of 2022, the fund capital stood at EUR 137.5 billion, over EUR 25 billion less than a year earlier. The reduction in the fund capital was mainly due to the depreciation of securities held by investment funds, but the funds also had a large volume of redemptions.

In 2022, the value of investment fund capital depreciated by EUR 20.2 billion[2], and redemptions from the funds amounted to EUR 5 billion. The capital of the largest types of funds – equity and bond funds – decreased by roughly the same amount in 2022 (over EUR 12 billion). The decrease was due to the rise of interest rates and depreciation of equity prices. At the end of December 2022, the fund capital of equity funds amounted to EUR 58.3 billion, compared to EUR 52.6 billion for bond funds. Equity and bond funds together account for 81% of investment funds’ total fund capital. The next largest fund types are mixed funds and real estate funds.

In 2022, clearly the largest redemptions were made from bond funds. During the year, new subscriptions in bond funds amounted to EUR 18.5 billion and redemptions to EUR 24.1 billion. Hence, net redemptions from bond funds amounted to EUR 5.6 billion. Net redemptions from equity funds totalled EUR 1.1 billion. In 2022, the largest new investments[3] were made in real estate funds, exceeding redemptions by EUR 750 million. The largest redemptions (EUR 1.6 billion) from Finnish investment funds in 2022 were made by non-financial corporations, whereof Finnish companies accounted for 65%.

Majority of the funds’ investments were targeted abroad

At the end of December 2022, out of Finnish investment funds’ aggregate investments of EUR 141.9 billion, 32% was allocated to Finland and 68% abroad. The majority (39%) of domestic investments were inter-fund investments. 27% of the investments were made directly in Finnish non-financial corporations’ equities.

The largest foreign investments were made in listed equities (44%) and bonds (33%). The largest (45%) foreign equity investments were allocated to US equities. The highest share (20%) of foreign bonds held by the investment funds were issued by Swedish residents. As a whole, the largest foreign investments were made in the United States (EUR 23.2 billion), Luxembourg (EUR 13.3 billion) and Sweden (EUR 11.6 billion).

Finnish households are the largest owner of investment funds

At the end of December 2022, Finnish households had direct holdings of EUR 30.0 billion in Finnish investment funds, which is 13 % less than a year earlier. A large amount of Finnish households’ assets is also channelled to domestic investment funds through unit-linked policies with insurance corporations. In the Bank of Finland's investment fund statistics, these are shown as insurance institutions’ investments.

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: shttps://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next news release on saving and investing will be published at 10 am on 11 May 2023.

[1] Including UCITS and non-UCITS investment funds registered in Finland.

[2] Redemptions in net terms.

[3] In net terms.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.7–31.12.202525.6.2025 14:00:00 EEST | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.7–31.12.2025. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.7.–31.12.202525.6.2025 14:00:00 EEST | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.7.–31.12.2025 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

Reference rate and penalty interest rates for 1 July – 31 December 202525.6.2025 14:00:00 EEST | Press release

The reference rate under section 12 of the Interest Act (633/1982) for the period 1 July – 31 December 2025 is 2.5 %. The penalty interest rate for the same period is 9.5 % pa (under section 4 of the Act, the reference rate plus seven percentage points). The penalty interest rate applicable to commercial contracts is 10.5 % pa (under section 4 a of the Act, the reference rate plus eight percentage points).

Invitation to the media: 10th RiskLab Finland, Bank of Finland and European Systemic Risk Board Joint Conference on AI and Systemic Risk Analytics, 27 June17.6.2025 14:56:31 EEST | Press invitation

Dear journalist, You are invited to participate in the 10th RiskLab Finland, Bank of Finland and European Systemic Risk Board Joint Conference on AI and Systemic Risk Analytics on Friday 27 June 2025 online or at the Bank of Finland auditorium (Rauhankatu 19, Helsinki). The conference will be held in a hybrid format, allowing virtual participation. The afternoon session starting at 14.00 will entail speeches from Governor Olli Rehn and Nobel Laureate in Economics Simon Johnson followed by an interview of Professor Johnson by Governor Rehn. In the registration form below, we ask you to indicate whether you will participate in the full programme or the afternoon session. Kindly find the programme below. Please note that all times listed in the conference schedule are in Finnish local time (UTC+3 EEST). Please register by 25 June 2025 at 15.00 by using link below: Register here ------ Full programme Time: Friday, 27 June 2025 Place: Bank of Finland Auditorium, address: Rauhankatu 19, Hels

I januari–mars 2025 betalades med kort i första hand till affärer som säljer livsmedel och alkoholfria drycker12.6.2025 10:00:00 EEST | Pressmeddelande

De finländska betaltjänstleverantörernas kunder betalade med betalkort för sammanlagt 17,1 miljarder euro under första kvartalet 2025, vilket var 854 miljoner euro (5,2 %) mer än vid motsvarande tidpunkt året innan. Nästan en tredjedel av summan betalades till försäljare, vars näringsgren är livsmedel och alkoholfria drycker. Kunderna köpte livsmedel och alkoholfria drycker till ett värde av 5,1 miljarder euro under första kvartalet 2025, vilket var 2 % mer än vid motsvarande tidpunkt för ett år sedan.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom