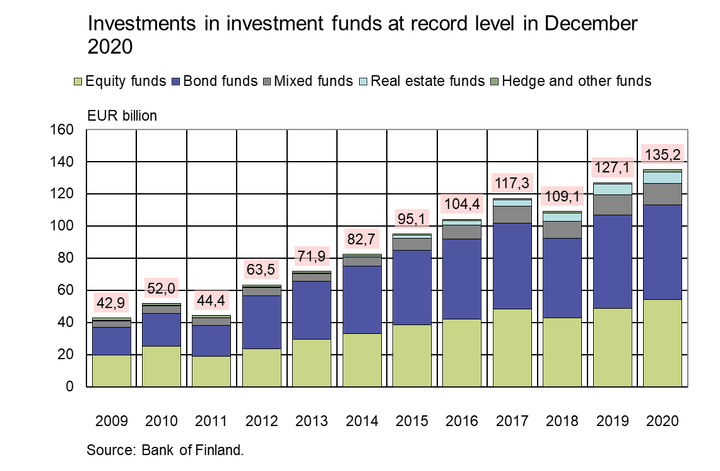

Investments made in Finnish investment funds at record level

4.2.2021 10:00:00 EET | Suomen Pankki | Press release

In December 2020, investments in Finnish investment funds amounted to EUR 135.2 billion, more than ever before. Fund share liability grew by EUR 8.1 billion during 2020. In January-March 2020, investment funds’ market value declined by EUR 15.6 billion, in addition to net redemptions of EUR 2.8 billion due to the international coronavirus pandemic[1]. However, the appreciation of the invested assets and new subscriptions after April 2020 increased Finnish investment funds’ fund share liability by the end of 2020. In April-December 2020, the appreciation of investments increased the value of fund units by EUR 21.9 billion, while new subscriptions in these funds amounted to a further EUR 4.5 billion in net terms.

In 2020, the largest new net investments in Finnish investment funds were made by households (EUR 1.2 billion). In addition, the appreciation of asset prices increased households’ fund holdings by EUR 2.3 billion in 2020 despite the decline in the spring. At the end of December 2020, households’ holdings in domestic investment funds amounted to EUR 37.8 billion, of which domestic households accounted for EUR 27.8 billion. Households have their largest holdings in Finnish investment funds. In addition to direct investments, Finnish households hold investments worth EUR 31.6 billion through unit-linked insurance policies.

Finns own almost 80% of Finnish investment fund units. These holdings amounted to EUR 105,1 billion at the end of December 2020. The highest foreign holdings belonged to Swedes, Norwegians and Luxembourgers. In 2020, foreign investors made more net investments in Finnish funds than Finns did. Foreign investors made net fund subscriptions of EUR 1.3 billion while Finnish investors invested EUR 0.4 billion.

Where are the funds’ investments?

At the end of December 2020, out of Finnish investment funds’ aggregate investments of EUR 138.6 billion, 31% was allocated to Finland and 69% abroad. The largest foreign investments were made in the United States (EUR 20.0 billion), Sweden (EUR 13.4 billion) and Luxembourg (EUR 12.4 billion). The funds’ investments in the EU area amounted to EUR 52.7 billion.

During 2020, investment funds made new investments of EUR 2.1 billion in net terms. The funds invested EUR 3.8 billion abroad but reduced domestic holdings by EUR 1.8 billion. In addition to new subscriptions, changes in valuation increased the funds’ foreign holdings by EUR 2.1 billion. The funds’ domestic holdings increased by EUR 4.4 billion as a result of changes in valuation.

[1] In March-April, investment funds’ fund share liability was reduced both by changes in the value of equity funds’ fund share liability and net redemptions, in particular from short-term fixed income funds.

For further information, please contact:

Antti Alakiuttu, tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing/.

The next news release on saving and investing will be published on 11 May 2021.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kontaktlös betalning blev vanligare i oktober–december 2025 jämfört med motsvarande tidpunkt året innan5.3.2026 10:00:00 EET | Pressmeddelande

Med kort betalades i oktober–december mer än under motsvarande period året innan. Framför allt gjordes under det sista kvartalet fler kontaktlösa betalningar än under motsvarande period 2024.

Lähimaksaminen oli yleisempää loka-joulukuussa 2025 kuin vastaavana ajankohtana edellisvuonna5.3.2026 10:00:00 EET | Tiedote

Korteilla maksettiin loka-joulukuussa enemmän kuin viime vuonna vastaavana ajanjaksona. Erityisesti lähimaksuja tehtiin vuoden viimeisellä neljänneksellä enemmän kuin vuonna 2024 samalla ajanjaksolla.

Contactless payments increased in October–December 2025 from a year earlier5.3.2026 10:00:00 EET | Press release

Cards payments in October–December grew year-on-year. In particular, more contactless payments were made in the fourth quarter than in same period in 2024.

Hushållens utestående konsumtionskrediter över 28 miljarder euro4.3.2026 10:00:00 EET | Pressmeddelande

Hushållens totala utestående konsumtionskrediter uppgick vid utgången av 2025 till 28,2 miljarder euro och årsökningen har mattats av till 0,1 %. Av hushållens totala utestående konsumtionskrediter bestod ungefär hälften av konsumtionskrediter utan säkerhet (exkl. fordonslån) och deras årsökning var 1,5 %.

Kotitalouksien kulutusluottokanta yli 28 mrd. euroa4.3.2026 10:00:00 EET | Tiedote

Kotitalouksien kokonaiskulutusluottokanta oli vuoden 2025 lopussa 28,2 mrd. euroa ja sen vuosikasvuvauhti oli hidastunut 0,1 prosenttiin. Kotitalouksien kokonaiskulutusluottokannasta noin puolet oli vakuudettomia kulutusluottoja (pl. ajoneuvolainat), ja niiden vuosikasvuvauhti oli 1,5 %.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom