Tesi’s Diversity Review: Number of women doubled in VC & PE investment teams, yet progress remains to be made

This is Tesi’s fourth Diversity Review, and it covers the investment teams of all Finnish VC & PE fund management companies.

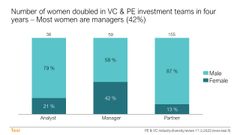

The Review shows that since 2019 the number of people working in Finnish VC & PE investment teams has increased by 40%, while the number of women has doubled. Nowadays, one in five team members is a woman. Most women are managers (42%), but only 13% of partners are women.

“The number of women at managerial level in venture capital teams, which invest in startups, has risen to 46%, which is above the industry average. In view of these figures, I expect an increase in the proportion of women at partner level also in venture capital teams. I’d like this trend to accelerate because so far there are still relatively few women partners in these teams compared to the average for the investment industry,” comments Tesi’s CEO Pia Santavirta.

According to the results of the Diversity Review, the age distribution of VC & PE investors is very even in Finland and talent also moves upwards in the teams evenly, from analysts to managers and then to partners. The number of young people in the sector has grown steadily during the four-year review period, and currently one-third of VC & PE investors is younger than 35.

“A pronounced generational change is occurring in buyout teams, which focus on M&As. The seasoned veterans in these teams have made way for new talent,” comments Santavirta, and adds: “Many new trainee programmes have been launched in the PE & VC industry, providing younger people interested in investment with a pathway to work in the field.”

Almost 90% of people working in the teams have a university degree in a business or technical field. Likewise, over one-half have work experience in finance or consulting. One-third of VC & PE investors has previous work experience from the industry. The work and study backgrounds of investors working in venture capital teams is more diversified than the average. Women hold more academic qualifications than men and are more highly educated across the board than men.

”Team diversity is one component of sustainability, and both are very important to us at Tesi. By publishing these results, we’re trying to develop the venture capital and private equity market. We want to openly and transparently bring to light the progress made on themes important to the sector,” explains Investment Associate Jens Färm, who was in charge of conducting the review.

Diversity of Finnish VC & PE investment teams (figure for 2021 in brackets)

- There are 37 VC & PE fund management companies in Finland, and at the end of 2022 some 250 people worked in their investment teams.

- The proportion of women in the investment teams is 21% (18%).

- Women account for 21% (32%) of the investment teams´ analysts, 42% (31%) of their managers, and 13% (11%) of their partners.

- The proportion of under 35-year-olds in the investment teams is 31% (29%) and over 55-year-olds 12% (14%).

- Some 88% of people working in the teams have a university degree in a business or technical field.

- Of the people working in the teams, 32% have work experience mainly from the finance sector, 23% from consulting, and 33% from the industry.

Keywords

Contacts

Pia SantavirtatoimitusjohtajaTesi

Tel:+358 40 546 7749pia.santavirta@tesi.fiSusanna AaltonenDirectorTesi / Viestintä

Tel:040 593 4221susanna.aaltonen@tesi.fiImages

Links

About Tesi

Tesi wants to raise Finland to the forefront of transformative economic growth. We develop the market, and work for the success of Finnish growth companies. We invest in private equity and venture capital funds, and also directly in growth companies. We provide long-running support, market insights, patient capital, and skilled ownership. tesi.fi | Twitter | LinkedIn | Newsletter

Subscribe to releases from Tesi

Subscribe to all the latest releases from Tesi by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Tesi

Suomalainen startup-ekosysteemi kasvaa voimakkaasti, vaikka muu talouskasvu on kituliasta7.11.2025 09:01:35 EET | Tiedote

Tesin (Suomen Teollisuussijoitus), Suomen Startup-yhteisön ja Pääomasijoittajat ry:n yhdessä tekemän selvityksen mukaan suomalaisen startup-ekosysteemin kasvu on jatkunut voimakkaana, vaikka muu talous tarpoo vastatuulessa. Kotimaiset startup-lähtöiset yritykset tuottavat jo yli 12,5 miljardia euroa liikevaihtoa ja työllistävät lähes 50 000 ihmistä.

Finnish startup ecosystem growing robustly despite sluggish economy overall7.11.2025 09:01:35 EET | Press release

A joint study by Tesi (Finnish Industry Investment), the Finnish Startup Community and the Finnish Venture Capital Association reveals continued strong growth in Finland’s startup ecosystem, even while the rest of the economy struggles against headwinds. Finnish startups already generate over EUR 12.5 billion in revenues and employ nearly 50,000 people.

Tesin puolivuosikatsaus 1.1.–30.6.2025 – Uuden strategian toteutus vauhdikkaasti liikkeelle26.9.2025 08:00:31 EEST | Tiedote

Tesin (Suomen Teollisuussijoitus Oy) alkuvuoden 2025 vahva tulos jatkoi edellisvuoden positiivista kehitystä. Tulokseen vaikutti erityisesti yksittäisten sijoitusten merkittävä arvonnousu. Yleisesti haastavasta taloudellisesta toimintaympäristöstä huolimatta Tesin uusi sijoitusstrategia on lähtenyt käyntiin vahvasti.

Tesi’s Interim Review 1 Jan – 30 Jun 2025 – Strong start for new strategy26.9.2025 08:00:31 EEST | Press release

Tesi (Finnish Industry Investment Ltd) delivered a strong result for the first half of 2025, continuing the positive trend from the previous year. The result was driven in particular by significant value increases in individual portfolio companies. Despite a generally challenging economic environment, Tesi’s new investment strategy has gotten off to a strong start.

IQM kerännyt 275 miljoonaa euroa kasvun vauhdittamiseksi – Ten Eleven Ventures ja Tesi johtavina sijoittajina3.9.2025 15:05:50 EEST | Tiedote

Suomalainen, alansa johtava kvanttitietokoneyritys IQM Quantum Computers (IQM) on kerännyt 275 miljoonan euron kasvurahoituksen. Sijoituskierroksen johtavana sijoittajana toimi yhdysvaltalainen Ten Eleven Ventures, ollen yrityksen ensimmäinen yhdysvaltalainen sijoittaja, yhdessä Tesin (Suomen Teollisuussijoitus Oy) kanssa.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom