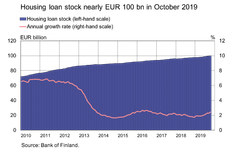

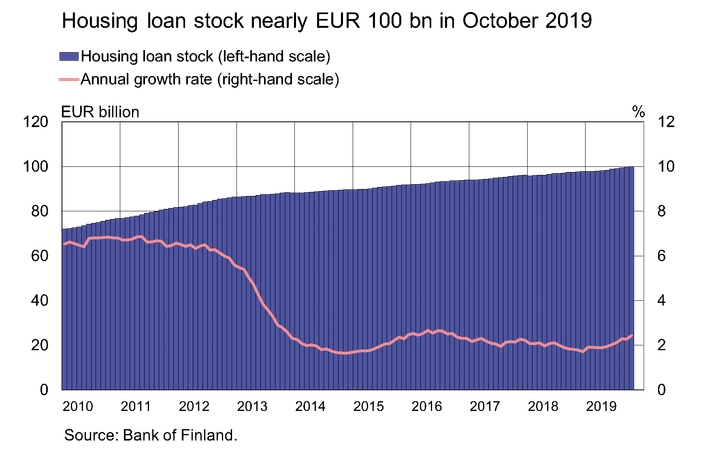

Housing loan stock nearly EUR 100 bn

New housing loan drawdowns in October 2019 amounted to EUR 1.9 bn, up by EUR 145 million on the corresponding period a year earlier. The last time housing loan drawdowns in October have exceeded this level was in 2007. The decline in the average interest rate on new housing loans has halted since the summer, and during the past three months the average rate has been 0.72%.

Recent years have seen a lengthening in the average amortisation periods of housing loans in Finland. In October 2019, the average maturity of a housing loan was 20 years 9 months. Over 68% of new housing loans were granted with a maturity of over 20 years. The share of loans with longer amortisation periods (over 29 years) in new housing loans has increased: in October 2019, the share was 7%, compared with 3% in October 2018.

Loans

At the end of October, household credit comprised EUR 16.5 bn in consumer credit and EUR 17.6 bn in other loans. New drawdowns of loans to non-financial corporations (excl. overdrafts and credit card credit) amounted to EUR 2.2 bn in October. The average interest rate on new corporate-loan drawdowns declined from September, to 2.21%. At the end of October, the stock of euro-denominated loans to non-financial corporations was EUR 90.6 bn, of which loans to housing corporations accounted for EUR 34.6 bn.

Deposits

The stock of deposits by Finnish households at end-October totalled EUR 94.4 bn and the average interest rate on the deposits was 0.11%. Overnight deposits accounted for EUR 81.5 bn and deposits with agreed maturity for EUR 4.9 bn of the deposit stock. In October, households concluded EUR 0.4 bn of new agreements on deposits with agreed maturity, at an average interest rate of 0.12%.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

Contacts

Meri Sintonen, tel. +358 9 183 2247, email: meri.sintonen(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Inlåningen från hushållen var den största genom ti-derna vid utgången av juni7.8.2025 10:00:00 EEST | Pressmeddelande

Vid utgången av juni 2025 var inlåningen från de finländska hushållen (114,7 miljarder euro) den största genom tiderna. Den var nästan 4 miljarder euro större än vid motsvarande tidpunkt ett år tidigare. Vid utgången av juni var 69,9 miljarder euro av inlåningen från hushållen inlåning över natten[1], 15,4 miljarder euro tidsbunden inlåning[2] och 29,4 miljarder euro placeringsdepositioner[3]. I juni var årsökningen i inlåningen över natten 2,7 %, den tidsbundna inlåningen 10,1 % och placeringsdepositionerna 2,5 %. Inlåningsräntorna har sjunkit. Vid utgången av juni 2025 var den genomsnittliga räntan på tidsbunden inlåning 2,30 % då den för ett år sedan var 3,17 %. Genomsnittsräntan på nya tidsbundna inlåningsavtal har under motsvarande tid sjunkit med nästan 1,4 procentenheter och var 2,18 % vid utgången av juni 2025. Genomsnittsräntan på placeringsdepositioner har sjunkit jämfört med ett år tidigare med över en procentenhet och var 1,28 % vid utgången av juni 2025. Vid utgången av ju

Kesäkuun lopussa kotitalouksien talletuskanta oli kaikkien aikojen suurin7.8.2025 10:00:00 EEST | Tiedote

Kesäkuun 2025 lopussa suomalaisten kotitalouksien talletuskanta (114,7 mrd. euroa) oli kaikkien aikojen suurin. Se oli lähes 4 mrd. euroa suurempi kuin vuosi sitten vastaavana aikana. Kesäkuun lopussa kotitalouksien talletuksista 69,9 mrd. euroa oli yön yli -talletuksia[1], 15,4 mrd. euroa määräaikaistalletuksia[2] ja 29,4 mrd. euroa sijoitustalletuksia[3]. Kesäkuussa yön yli -talletusten vuosikasvuvauhti oli 2,7 %, määräaikaistalletusten 10,1 % ja sijoitustalletusten 2,5 %. Talletusten korot ovat laskeneet. Kesäkuun 2025 lopussa määräaikaistalletusten kannan keskikorko oli 2,30 %, kun vuosi sitten se oli 3,17 %. Uusien määräaikaistalletussopimusten keskikorko on laskenut vastaavana aikana lähes 1,4 prosenttiyksikköä ja oli 2,18 % kesäkuun 2025 lopussa. Sijoitustalletusten kannan keskikorko on laskenut vuoden takaisesta yli prosenttiyksikön, ja se oli 1,28 % kesäkuun 2025 lopussa. Kesäkuun lopussa 2025 yön yli -talletuksille maksettava korko (0,36 %) oli 0,11 prosenttiyksikköä alhaisem

Household deposit stock at all-time high in June7.8.2025 10:00:00 EEST | Press release

At the end of June 2025, the stock of Finnish households’ deposits (EUR 114.7 billion) stood at an all-time high. It was almost EUR 4 billion higher than at the same time a year earlier. At the end of June, EUR 69.9 billion of households’ deposits were overnight deposits[1], EUR 15.4 billion were deposits with an agreed maturity[2], and EUR 29.4 billion were investment deposits[3]. In June, the year-on-year rate of growth for overnight deposits was 2.7%, for deposits with an agreed maturity 10.1% and for investment deposits 2.5%. Deposit interest rates have declined. At the end of June 2025, the average interest rate on deposits with an agreed maturity stood at 2.30%, compared with 3.17% in June last year. The average interest rate on new deposit agreements with an agreed maturity fell by almost 1.4 percentage points over the same period, reaching 2.18% in June 2025. The average interest rate on the stock of investment deposits decreased by over one percentage point from a year earlier

Iina Lario blir kommunikationschef vid Finlands Bank29.7.2025 15:10:00 EEST | Pressmeddelande

Politices magister Iina Lario har utnämnts till kommunikationschef vid Finlands Bank. Utnämningen gäller för en period på fem år.

Iina Lario Suomen Pankin viestintäpäälliköksi29.7.2025 15:10:00 EEST | Tiedote

Suomen Pankin viestintäpäälliköksi on nimitetty valtiotieteiden maisteri Iina Lario. Nimitys on tehty viiden vuoden määräajaksi.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom