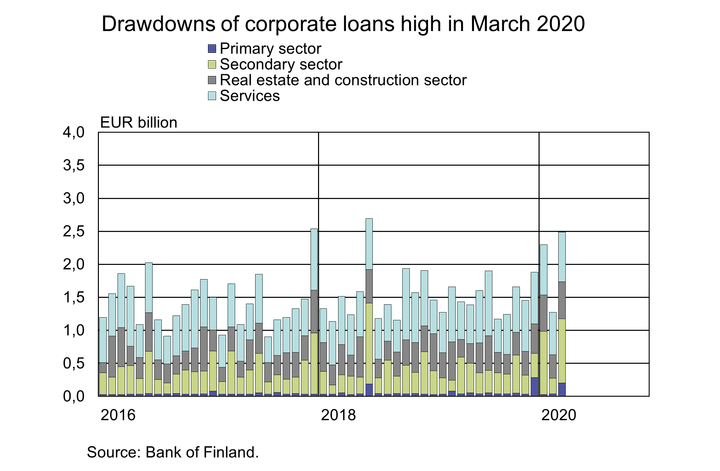

Drawdowns of large corporate loans high in March 2020

In euro terms, most of the new corporate loan drawdowns (79%) in March were large loans of over EUR 1 million. Drawdowns of smaller corporate loans (up to EUR 250,000) accounted for 12% and were lower than in the corresponding month a year earlier. The average interest rate on new corporate loans was 1.93% and the average rate on large corporate loans was 1.47%.

Non-financial corporations renegotiated loan agreements in March 2020 in the amount of EUR 1.1 bn, which is over double the amount renegotiated a year earlier in March. For smaller [3] corporate loans, the renegotiated amount was as much as four times higher than a year earlier.

Fuelled by the high level of loan drawdowns, the stock of corporate [4] loans grew to EUR 58.3 bn in March 2020 and the annual growth rate of the stock rose to 9.6%. At the end of March, companies had EUR 18 bn of undrawn credit facilities, i.e. almost the same amount as in February 2020.

March 2020 also saw a brisk growth in the stock of corporate [5] commercial paper arranged by Finnish credit institutions (EUR 5.3 bn). New issuance activity was brisk and the stock grew by EUR 1.4 bn on the previous month. The highest growth was recorded in the stock of commercial paper issued by manufacturing companies.

Loans

In March 2020, households’ drawdowns of new housing loans amounted to EUR 1.7 bn, up by EUR 250 million on the corresponding month a year earlier. At the end of March, the stock of euro-denominated housing loans totalled EUR 100.7 bn and the annual growth rate of the stock was 2.7%. Household credit at end-March comprised EUR 16.7 bn in consumer credit and EUR 17.7 bn in other loans. New drawdowns of loans by housing corporations (excl. overdrafts and credit card credit) amounted to EUR 490 million. The average interest rate on these rose from February, to 1.10%. At the end of March, the stock of loans to housing corporations totalled EUR 35.6 bn.

Deposits

At the end of March 2020, the stock of deposits of Finnish households amounted to EUR 96.9 bn and the average interest rate on the deposits was 0.10%. Overnight deposits accounted for EUR 84.3 bn and deposits with an agreed maturity for EUR 4.5 bn of the deposit stock. In March, households concluded EUR 0.2 bn of new agreements on deposits with an agreed maturity, at an average interest rate of 0.15%.

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi,

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi.

The next news release will be published at 1 pm on 1 June 2020.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

1 Excl. overdrafts and credit card credit.2 Included in the secondary production sector.3 Loans of up to EUR 250,000.4 Loans to Finnish non-financial corporations (S.111) excl. housing corporations.5 Finnish non-financial corporations excl. housing corporations.Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

MUISTUTUS: Kutsu medialle Suomen Pankin tiedotustilaisuuteen 21.5. rahoitusjärjestelmän vakaudesta19.5.2025 11:45:58 EEST | Kutsu

Miten Suomen rahoitusjärjestelmän toimintaympäristö on kehittynyt? Vaikuttaako hallinnon vaihtuminen Yhdysvalloissa arvioon rahoitusjärjestelmän vakaudesta? Miten suomalaiset yritykset kestävät toistuvien kriisien toimintaympäristössä? Mitä uutta positiivinen luottotietorekisteri kertoo asuntovelallisista?

Kutsu medialle: Suomen Pankin tiedotustilaisuus 21.5. rahoitusjärjestelmän vakaudesta15.5.2025 14:11:56 EEST | Kutsu

Miten Suomen rahoitusjärjestelmän toimintaympäristö on kehittynyt? Vaikuttaako hallinnon vaihtuminen Yhdysvalloissa arvioon rahoitusjärjestelmän vakaudesta? Miten suomalaiset yritykset kestävät toistuvien kriisien toimintaympäristössä? Mitä uutta positiivinen luottotietorekisteri kertoo asuntovelallisista?

En inhemsk lösning för omedelbara betalningar skulle öka funktionssäkerheten och konsumenternas valfrihet8.5.2025 11:30:00 EEST | Pressmeddelande

Finländarna måste ha tillgång till förmånliga, mångsidiga och tillförlitliga betalningssätt som fungerar säkert också under exceptionella omständigheter. En lösning för omedelbara betalningar som baserar sig på kontoöverföringar i real tid skulle öka vår förmåga att hantera systemen för betalning och erbjuda konsumenterna ett välkommet alternativ.

Kotimainen pikamaksamisen ratkaisu lisäisi toimintavarmuutta ja kuluttajien valinnanvapautta8.5.2025 11:30:00 EEST | Tiedote

Suomalaisilla tulee olla käytössään edullisia, monipuolisia ja luotettavia maksutapoja, jotka toimivat turvallisesti myös poikkeustilanteissa. Reaaliaikaisiin tilisiirtoihin perustuva pikamaksuratkaisu lisäisi kykyämme hallita maksamisessa käytettyjä järjestelmiä ja tarjoaisi kuluttajille tervetulleen vaihtoehdon.

A Finnish instant payment solution would improve resilience and consumer choice8.5.2025 11:30:00 EEST | Press release

People must have access in Finland to inexpensive, versatile and reliable methods of payment and these must function securely even in exceptional situations. An instant payment solution based on real-time credit transfers would enhance our ability to govern the systems used in making payments and would offer consumers greater choice.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom