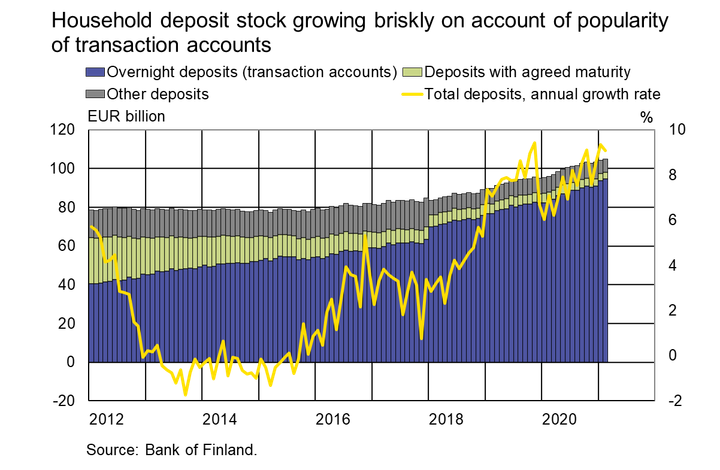

Household deposits growing at brisk pace

At the end of February 2021, the stock of household deposits totalled EUR 104.7 bn. The majority (EUR 94.5 bn) of the funds in household deposit accounts were in transaction accounts, the stock of which grew by EUR 670 million in February. Deposits with agreed maturity amounted to EUR 3.5 bn, while other deposits placed by households totalled EUR 6.7 bn.

Household deposits have long been growing at an accelerating rate, although the pace slowed slightly in February, with the annual growth rate standing at 9.1%. Deposit growth has long been mainly attributable to increasing deposits in transaction accounts. In February, the annual growth rate of these deposits was 11.4% and that of other deposits was 3.4%. The stock of deposits with agreed maturity contracted in February at an annual rate of -23.1%.

The interest paid on households’ transaction accounts averaged 0.03% in February 2021. The average interest rate on the stock of deposits with agreed maturity has risen since September 2020, to 0.57% in February 2021. This rise has reflected growth in the share of deposits with an agreed maturity of over 1 year. The interest paid on these deposits was higher (0.93% in February) than on deposits with shorter maturities (0.19% in February). Deposits with a maturity of over 1 year include, for example, savings deposits for first-home purchase (ASP deposits), on which banks pay 1% interest.

Loans[1]

Finnish Households’ drawdowns of new housing loans in February 2021 totalled EUR 1.7 bn, up EUR 130 million on the same month last year. At the end of February 2021, the stock of housing loans amounted to EUR 103.2 bn and the annual growth rate of the stock was 3.6%. Of all loans of Finnish households at the end of February, EUR 16.5 bn were consumer credit and EUR 17.4 bn were other loans.

Drawdowns of new corporate loans by Finnish non-financial corporations (excl. overdrafts and credit card credit) in February 2021 totalled EUR 1.5 bn. The average interest rate on these rose from January, to 2.30%. At the end of February, the stock of loans granted to Finnish non-financial corporations totalled EUR 96.7 bn, of which loans to housing corporations accounted for EUR 37.5 bn.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi

Anu Karhu, tel. +358 9 183 2228, email: anu.karhu(at)bof.fi

The next news release will be published at 10 a.m. on 3 May 2021.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1]Includes loans in all currencies to residents in Finland. The statistical releases of the Bank of Finland up to January 2021, as well as those of the ECB, present loans and deposits in euro to euro area residents and also include non-profit institutions serving households. For these reasons, the figures in this section differ from those in the aforementioned releases.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Inlåningen från hushållen var den största genom ti-derna vid utgången av juni7.8.2025 10:00:00 EEST | Pressmeddelande

Vid utgången av juni 2025 var inlåningen från de finländska hushållen (114,7 miljarder euro) den största genom tiderna. Den var nästan 4 miljarder euro större än vid motsvarande tidpunkt ett år tidigare. Vid utgången av juni var 69,9 miljarder euro av inlåningen från hushållen inlåning över natten[1], 15,4 miljarder euro tidsbunden inlåning[2] och 29,4 miljarder euro placeringsdepositioner[3]. I juni var årsökningen i inlåningen över natten 2,7 %, den tidsbundna inlåningen 10,1 % och placeringsdepositionerna 2,5 %. Inlåningsräntorna har sjunkit. Vid utgången av juni 2025 var den genomsnittliga räntan på tidsbunden inlåning 2,30 % då den för ett år sedan var 3,17 %. Genomsnittsräntan på nya tidsbundna inlåningsavtal har under motsvarande tid sjunkit med nästan 1,4 procentenheter och var 2,18 % vid utgången av juni 2025. Genomsnittsräntan på placeringsdepositioner har sjunkit jämfört med ett år tidigare med över en procentenhet och var 1,28 % vid utgången av juni 2025. Vid utgången av ju

Kesäkuun lopussa kotitalouksien talletuskanta oli kaikkien aikojen suurin7.8.2025 10:00:00 EEST | Tiedote

Kesäkuun 2025 lopussa suomalaisten kotitalouksien talletuskanta (114,7 mrd. euroa) oli kaikkien aikojen suurin. Se oli lähes 4 mrd. euroa suurempi kuin vuosi sitten vastaavana aikana. Kesäkuun lopussa kotitalouksien talletuksista 69,9 mrd. euroa oli yön yli -talletuksia[1], 15,4 mrd. euroa määräaikaistalletuksia[2] ja 29,4 mrd. euroa sijoitustalletuksia[3]. Kesäkuussa yön yli -talletusten vuosikasvuvauhti oli 2,7 %, määräaikaistalletusten 10,1 % ja sijoitustalletusten 2,5 %. Talletusten korot ovat laskeneet. Kesäkuun 2025 lopussa määräaikaistalletusten kannan keskikorko oli 2,30 %, kun vuosi sitten se oli 3,17 %. Uusien määräaikaistalletussopimusten keskikorko on laskenut vastaavana aikana lähes 1,4 prosenttiyksikköä ja oli 2,18 % kesäkuun 2025 lopussa. Sijoitustalletusten kannan keskikorko on laskenut vuoden takaisesta yli prosenttiyksikön, ja se oli 1,28 % kesäkuun 2025 lopussa. Kesäkuun lopussa 2025 yön yli -talletuksille maksettava korko (0,36 %) oli 0,11 prosenttiyksikköä alhaisem

Household deposit stock at all-time high in June7.8.2025 10:00:00 EEST | Press release

At the end of June 2025, the stock of Finnish households’ deposits (EUR 114.7 billion) stood at an all-time high. It was almost EUR 4 billion higher than at the same time a year earlier. At the end of June, EUR 69.9 billion of households’ deposits were overnight deposits[1], EUR 15.4 billion were deposits with an agreed maturity[2], and EUR 29.4 billion were investment deposits[3]. In June, the year-on-year rate of growth for overnight deposits was 2.7%, for deposits with an agreed maturity 10.1% and for investment deposits 2.5%. Deposit interest rates have declined. At the end of June 2025, the average interest rate on deposits with an agreed maturity stood at 2.30%, compared with 3.17% in June last year. The average interest rate on new deposit agreements with an agreed maturity fell by almost 1.4 percentage points over the same period, reaching 2.18% in June 2025. The average interest rate on the stock of investment deposits decreased by over one percentage point from a year earlier

Iina Lario blir kommunikationschef vid Finlands Bank29.7.2025 15:10:00 EEST | Pressmeddelande

Politices magister Iina Lario har utnämnts till kommunikationschef vid Finlands Bank. Utnämningen gäller för en period på fem år.

Iina Lario Suomen Pankin viestintäpäälliköksi29.7.2025 15:10:00 EEST | Tiedote

Suomen Pankin viestintäpäälliköksi on nimitetty valtiotieteiden maisteri Iina Lario. Nimitys on tehty viiden vuoden määräajaksi.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom