Other financial institutions have granted EUR 25.2 billion of loans

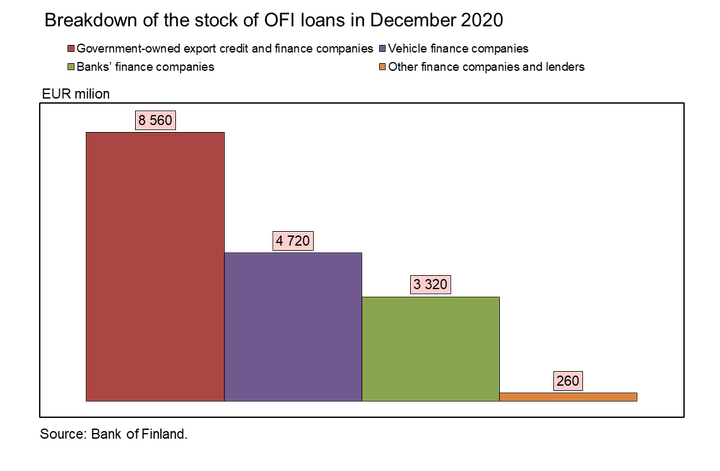

In December 2020, the stock of loans granted by other financial institutions[1] was EUR 25.2 billion. Loans granted by government-owned finance companies supporting Finnish companies’ growth and business activities accounted for almost 65% of the whole loan stock. At the end of 2020, the stock of loans granted by OFIs to non-financial corporations amounted to EUR 12.3 billion while the stock of loans to households stood at EUR 4.6 billion.[2] The rest of the loans granted consisted of intra-group finance.

Vehicle finance is the most significant form of household financing outside the banking sector

Loans granted by OFIs to households are almost exclusively extended in Finland. Vehicle finance constitutes a significant proportion of loans granted to households. In December, the stock of vehicle finance amounted to EUR 3.9 billion. The stock of other consumer credit than vehicle loans was EUR 600 million. Only 26% of loans granted by OFIs to households were unsecured. Consumer credit secured by vehicle collateral are counted as secured loans in the OFI statistics, which explains the high proportion of secured consumer credit in comparison with bank statistics.[3]. In the last quarter of 2020, households drew down EUR 250 million of new loans, with car finance accounting for EUR 170 million.

The stock of loans granted by OFIs to households was equal to 14% of the stock of non-housing household loans granted by banks. In December 2020, the stock non-housing household loans granted by banks was EUR 33.7 billion, whereof unsecured loans accounted for EUR 14.8 billion.

Government-subsidised export and business development makes up a significant share of finance received by non-financial corporations from outside the banking sector.

In December 2020, the stock of loans granted by government-owned finance companies to non-financial corporations was EUR 8.5 billion, which is almost 70% of all loans granted by OFIs. The stock of loans granted by banks’ finance companies was EUR 2.6 billion, while loans granted by vehicle financiers amounted to EUR 1.0 billion. As at December 2020, other types of corporate finance amounted to EUR 100 million. In the last quarter of 2020, non-financial corporations drew down almost EUR 500 of new loans from OFIs.

70% of credit granted to non-financial corporations was secured. In December 2020, the stock of secured loans granted totalled EUR 8.6 billion. EUR 4.5 billion of the OFI credit was granted domestically and EUR 7.8 billion to the rest of the world.

Finance granted by OFIs complements bank finance. As at December 2020, the stock of loans granted by OFIs to Finnish non-financial corporations was 8% of the stock of corporate loans granted by banks. The stock of loans granted by banks to non-financial corporations[4] was EUR 59.4 billion.

The stock of loans granted by OFIs in Finland, 2020Q4:

|

Non-financial corporation loans (EUR million) |

Household loans (EUR million) |

|

|

Secured |

8,560 |

3,410 |

|

Unsecured |

4,200 |

1,220 |

|

Total |

12,760 |

4,630 |

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Jaakko Suni, tel. +358 10 831 2402, email: jaakko.suni (at)bof.fi

The next Other financial institutions release will be published in autumn 2021.

[1] The Bank of Finland’s ‘Other financial institutions’ statistics includes financial corporations registered in Finland and providing household and corporate financing, operating in sectors S.125 (Other financial intermediaries), S.126 Financial auxiliaries) and S.127 (Captive financial institutions and money lenders). Foreign lenders (so-called cross-border lenders) are excluded from the data collection.

[2] The stock of loans granted to households also includes credit and loans granted to unincorporated businesses.

[3] Loans granted by banks and credit institutions may only be secured by collateral meeting the requirements of Regulation No 575/2013 of the European Parliament and of the Council.

[4] Excl. housing corporations.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Utbetalningarna av företagslån ökade från i fjol30.4.2025 10:00:00 EEST | Pressmeddelande

I mars 2025 utbetalades nya företagslån (exkl. bostadsbolag) mer än det dubbla jämfört med motsvarande tidpunkt för ett år sedan. Genomsnittsräntan på nya företagslån sjönk jämfört med mars året innan.

Yrityslainanostot piristyneet viime vuodesta30.4.2025 10:00:00 EEST | Tiedote

Maaliskuussa 2025 uusia yrityslainoja (pl. asuntoyhteisöt) nostettiin yli kaksi kertaa enemmän kuin vuosi sitten vastaavana aikana. Uusien yrityslainojen keskikorko laski edellisvuoden maaliskuuhun verrattuna.

Corporate loan drawdowns picked up from last year30.4.2025 10:00:00 EEST | Press release

In March 2025, Finnish non-financial corporations (excl. housing corporations) drew over twice as much as in the same period a year earlier. The average interest rate on new corporate-loans fell by from March last year.

BOFIT-prognos: Eskaleringen av handelskriget bromsar upp den ekonomiska tillväxten i Kina och ökar obalanserna i ekonomin28.4.2025 16:00:00 EEST | Pressmeddelande

Finlands Banks forskningsinstitut för tillväxtmarknader (BOFIT) har gett ut sin prognos över den ekonomiska utvecklingen i Kina för 2025–2027.

BOFIT-ennuste: Kauppasodan kärjistyminen hidastaa Kiinan kasvua ja lisää talouden epätasapainoja28.4.2025 16:00:00 EEST | Tiedote

Suomen Pankin nousevien talouksien tutkimuslaitos (BOFIT) julkaisi ennusteensa Kiinan talouden kehityksestä vuosiksi 2025–2027.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom