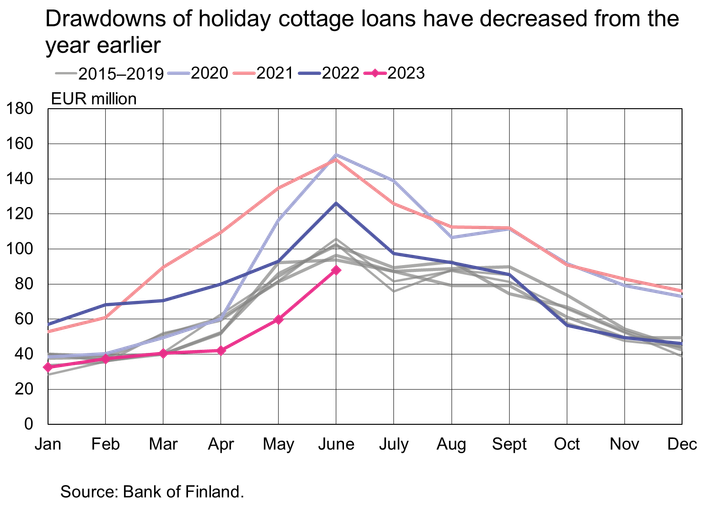

Drawdowns of holiday cottage loans decreased from last year in June

In June 2023, Finnish households drew down new housing loans for the purchase of holiday homes (holiday cottage loans) to the value of EUR 88 million, which is 30% less than a year earlier in June. In June, the stock of households’ holiday cottage loans saw an exceptional year-on-year contraction of 1.4%. The volume of holiday cottage loans drawn down during the coronavirus pandemic was exceptionally high. Compared to the period before the pandemic, i.e. June 2019, drawdowns of holiday cottage loans were 6% lower in June 2023.

In June 2023, Finnish households drew down new housing loans for the purchase of holiday homes (holiday cottage loans) to the value of EUR 88 million, which is 30% less than a year earlier in June. Compared to the period before the pandemic, i.e. June 2019, drawdowns of holiday cottage loans were 6% lower in June 2023. The volume of holiday cottage loans drawn down in 202o and 2021 was exceptionally high. The majority of holiday cottage loans are drawn down during the summer months.

The average interest rate on new holiday cottage loan drawdowns rose in June to 4.59%. This marks a rise of 0.17 percentage points from May and 2.88 percentage points in comparison with June 2022. The higher average interest rate on new loans for holiday cottages is mainly explained by the rise in Euribor rates. The majority (96%) of new drawdowns of holiday cottage loans are linked to Euribor rates.

The average repayment period of new drawdowns of holiday cottage loans was 18 years and 11 months, which is in the same magnitude as a year earlier in June, when the average repayment period stood at 19 years and one month.

At the end of June, the stock of holiday cottage loans stood at EUR 4.5 billion. In June, the stock of households’ holiday cottage loans saw an exceptional year-on-year contraction of 1.4%, in contrast to an annual growth of 6.7% a year earlier. The average interest on the stock of holiday cottage loans rose from May to stand at 3.57%.

Loans

In June 2023, Finnish households drew down EUR 1.3 billion of new housing loans, which is EUR 610 million less than in the same period a year earlier. Buy-to-let mortgages accounted for EUR 110 million of the new housing loan drawdowns. The average interest rate on new housing loans rose from May to stand at 4.39% in June. At the end of June 2023, the housing loan stock totalled EUR 107.1 billion, and its year-on-year growth rate was -1.2%. Buy-to-let mortgage loans accounted for EUR 8.6 billion of the housing loan stock. At the end of June, the household loan stock included EUR 17.1 billion of consumer credit and EUR 17.8 billion of other loans.

Drawdowns of new loans[1] by Finnish non-financial corporations in June totalled EUR 3.3 billion, including EUR 690 million of loans to housing corporations. The average interest rate on drawdowns of new corporate loans declined from May and was 5.01%. At the end of June, the stock of loans granted to Finnish non-financial corporations was EUR 105.7 billion, of which loans to housing corporations accounted for EUR 43.2 billion.

Deposits

At the end of June 2023, the stock of Finnish households’ deposits totalled EUR 110.9 billion, and the average interest rate on these deposits was 0.73%. Overnight deposits accounted for EUR 81.8 billion and deposits with an agreed maturity for EUR 7.3 billion of the total deposit stock.[2] In June, Finnish households made new agreements on deposits with an agreed maturity in the amount of EUR 480 million, at an average interest rate of 2.90%.

For further information, please contact:

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi,

Tuomas Nummelin, tel. +358 9 183 2373, email: tuomas.nummelin(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 31 August 2023.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics2/.

[1] Excl. overdrafts and credit card credit.

[2] Deposits were subject to reclassifications in June, further information: https://www.suomenpankki.fi/en/statistics2/statistics-info/whats_new/2023/classification-change-in-mfi-data-collection-rati/

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Marja Nykänen utnämnd till medordförande i Finansiella stabilitetsrådets regionala konsultativa grupp för Europa1.7.2025 17:00:00 EEST | Pressmeddelande

Utnämningen stärker Finlands aktiva roll som främjare av global finansiell stabilitet.

Marja Nykänen nimitetty kansainvälisen rahoitusvakausneuvoston Euroopan alueellisen ryhmän toiseksi puheenjohtajaksi1.7.2025 17:00:00 EEST | Tiedote

Nimitys vahvistaa Suomen aktiivista roolia kansainvälisen rahoitusvakauden edistäjänä.

Marja Nykänen appointed as Co-Chair of Financial Stability Board’s Regional Consultative Group for Europe1.7.2025 17:00:00 EEST | Press release

This appointment reinforces Finland’s active role in fostering international financial stability.

Hushållen har mycket konsumtionskrediter – tillväxttakten har mattats av1.7.2025 10:00:00 EEST | Pressmeddelande

I maj 2025 uppgick det utestående beloppet av konsumtionskrediter som banker med verksamhet i Finland beviljat hushåll till 17,6 miljarder euro och utlåningen minskade med −0,7 % från året innan. Minskningen i det utestående beloppet av konsumtionskrediter är en följd av att utnyttjandet av konto- och kortkrediter och utbetalningarna av konsumtionskrediter utan säkerhet har minskat. Konsumtionskrediter beviljade av banker står för 63 % av hushållens totala utestående konsumtionskrediter. I maj 2025 minskade hushållens utestående kortkrediter[1] (3,6 miljarder euro) med −1,0[2] jämfört med ett år tidigare, då de utestående kortkrediterna vid motsvarande tidpunkt året innan ökade med nästan 6 %. Vid utgången av maj var 19 % av kortkrediterna räntefri betaltidskredit och 81 % äkta kortkrediter, dvs. kortkredit med ränta. I januari–maj 2025 utbetalades från bankerna 9 % mindre sedvanliga konsumtionskrediter utan säkerhet[3] jämfört med motsvarande tidpunkt ett år tidigare. Också det utestå

Kotitalouksilla runsaasti kulutusluottoja –kasvuvauhti hidastunut1.7.2025 10:00:00 EEST | Tiedote

Toukokuussa 2025 Suomessa toimivien pankkien kotitalouksille myöntämien kulutusluottojen kanta oli 17,6 mrd. euroa ja se supistui vuodentakaisesta −0,7 %. Kulutusluottokannan supistumiseen vaikuttavat tili- ja korttiluottojen vähentynyt käyttö ja vähäisemmät vakuudettomien kulutusluottojen nostomäärät. Pankkien myöntämät kulutusluotot kattavat 63 % kotitalouksien kokonaiskulutusluottokannasta. Toukokuussa 2025 kotitalouksien korttiluottokanta[1] (3,6 mrd. euroa) supistui −1,0 %[2] vuodentakaiseen verrattuna, kun vuosi sitten vastaavana aikana korttiluottokanta kasvoi lähes 6 prosentin vauhdilla. Toukokuun lopussa korttiluotoista 19 % oli korotonta maksuaikaluottoa ja 81 % pidennettyjä korttiluottoja eli korollista korttiluottoa. Tavanomaisia vakuudettomia kulutusluottoja[3] nostettiin pankeista tammi-toukokuun 2025 aikana 9 % vähemmän kuin vuosi sitten vastaavana aikana. Myös vakuudettomien kulutusluottojen kanta supistui toukokuussa. Suomessa toimivien pankkien myöntämistä kulutusluot

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom