Households’ deposit stock grew in the second quarter of the year

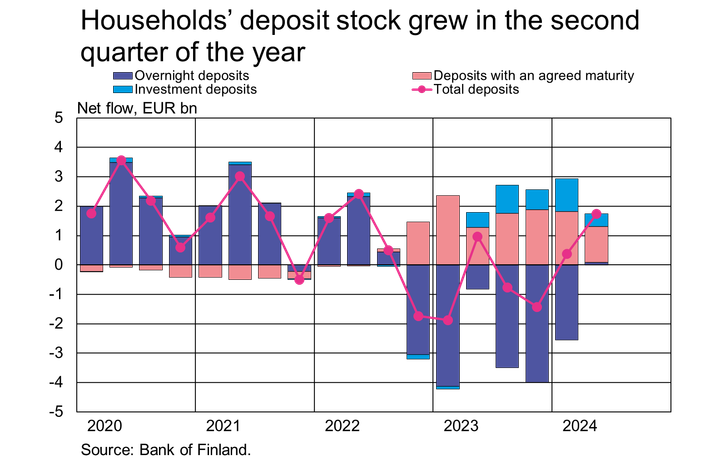

In the second quarter of 2024, the stock of Finnish households’ deposit stock grew by EUR 1.7 billion in net terms. Most of all, households reallocated their assets to fixed-term deposit accounts (EUR 1.2 billion) and second most to investment deposit accounts1 (EUR 420 million). Meanwhile, households deposited EUR 80 million on overnight deposit accounts2. At a quarterly level, the last period with positive growth in overnight deposits was in the third quarter of 2022. At the end of June, EUR 68.1 billion of households’ deposits were overnight deposits, EUR 14 billion deposits with an agreed maturity and EUR 28.7 billion investment deposits.

Despite the growth in the second quarter, the total household deposit stock (EUR 110.8 billion) contracted by 0.1% from a year earlier. The deposit stock has contracted on a year-on-year basis since February 2023, but the rate of decline has slowed down this year. The total deposit stock has decreased due to the reduction in balances on overnight deposit accounts. In the last 12 months, the volume of overnight deposits has decreased by EUR 10 billion. Due to the reduction of deposit funds, the overnight deposit stock declined by 12.8% year-on-year in June 2024.

Meanwhile, the increased popularity of fixed-term and investment deposits due to the rising interest rate level has slowed down the contraction of the deposit stock. In June, the annual rate of growth of the stock of deposits with an agreed maturity was over 90%, while the stock of investment deposits grew by 12.5% year-on-year. In euro terms, households have moved EUR 6.7 billion of their assets to deposit accounts with an agreed maturity and EUR 3.2 billion to investment deposit accounts over the past 12 months.

At the end of June 2024, the average interest rate on the total deposit stock stood at 1.34%. The highest average interest was paid on deposits with an agreed maturity (3.17%) and the second-highest on investment deposits (2.17%). The average interest rate on the overnight deposit stock was 0.47%. In June, the average interest rate on new deposit agreements with an agreed maturity was unchanged from May at 3.56%.

The average interest rate on the stock of deposits with an agreed maturity has risen continuously ever since mid-2022. From a year ago, the average interest rate has risen by 1.13 percentage points. The rise in the interest rate on investment deposits and overnight deposits has slowed down this year, and the respective average rates declined slightly from May. From a year earlier, the average interest rate on the stock of investment deposits has risen by 0.81 percentage points, while the average interest rate on overnight deposits rose by 0.19 percentage points.

For further information, please contact:

- Antti Hirvonen, tel. +358 9 183 2121, email: antti.hirvonen(at)bof.fi,

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Related statistical data and graphs are also available on the Bank of Finland website: . https://www.suomenpankki.fi/en/statistics2/.

The next news release on saving and investing will be published at 10 am on 11 November 2024.

1 Investment deposits are deposits redeemable at notice. They do not have a fixed maturity date (unlike deposits with an agreed maturity), but they have a notice period, during which the deposit cannot be converted into cash without consequences (unlike overnight deposits). This class also includes investment accounts without a period of notice or agreed maturity but which have restrictive drawing provisions.

2 Overnight deposits include transaction accounts and other types of accounts from which funds may be withdrawn or transferred freely.

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kutsu medialle: Suomen Pankin tiedotustilaisuus 19.12.2025 Suomen talouden näkymistä17.12.2025 09:00:00 EET | Kutsu

Elpyykö Suomen talous? Miten kauppasota ja maailmantilanteeseen liittyvä epävarmuus vaikuttaa talouskehitykseemme? Mitkä ovat julkisen talouden näkymät?

Aleksi Grym blir avdelningschef för Finlands Banks betalningssystemsavdelning16.12.2025 16:42:15 EET | Pressmeddelande

Pol.lic., ekon. mag. Aleksi Grym har utnämnts till avdelningschef för Finlands Banks betalningssystemsavdelning från och med den 1 mars 2026. Utnämningen gäller för en period på fem år.

Aleksi Grym maksujärjestelmät-osaston osastopäälliköksi16.12.2025 16:42:15 EET | Tiedote

Suomen Pankin maksujärjestelmät-osaston osastopäälliköksi on nimitetty VTL, KTM Aleksi Grym. Nimitys on tehty viiden vuoden määräajaksi 1.3.2026 alkaen.

Aleksi Grym appointed Head of Payment Systems Department16.12.2025 16:42:15 EET | Press release

Aleksi Grym, Lic.Soc.Sc, MSc (Econ. & Bus. Adm.), has been appointed Head of Department at the Bank of Finland’s Payment Systems Department. The appointment is for a five-year term effective from 1 March 2026.

Fler kortbetalningar till försäljare inom kultur och fritid i juli–september 2025 än tidigare16.12.2025 10:00:00 EET | Pressmeddelande

Fler kortbetalningar i juli–september 2025 än tidigare. Ökningen förklaras sektorspecifikt huvudsakligen av tre sektorer: kultur och fritid, livsmedel samt konsumtion av andra varor och tjänster. För två sektorer minskade kortbetalningarnas totalsumma i juli–september 2025.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom