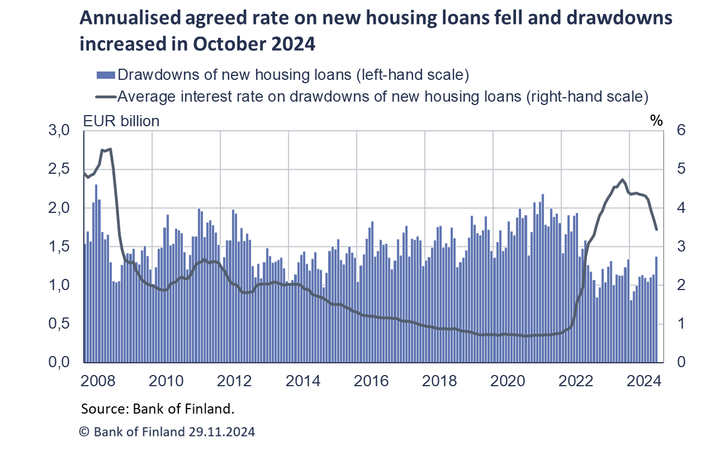

October 2024 sees housing loan drawdowns picking up from the previous year

Finnish households drew down new housing loans (owner-occupied and buy-to-let mortgages) in October 2024 to a total of EUR 1.4 billion, an increase of 21.5% from October last year and an increase of 8.4% from October 2022. Housing loan drawdowns remained below the long-term average level, however, and were 14.8% lower in October 2024 than the average level taken out in October in 2011–2023.

Drawdowns of new owner-occupied housing loans in October 2024 totalled EUR 1.2 billion, an increase of 21% from October a year earlier. Drawdowns of buy-to-let mortgages amounted to EUR 127 million, up 27% from October 2023.

The average interest rate on new housing loan drawdowns stood at 3.44% in October. The interest rates fell for both owner-occupied and buy-to-let mortgages. The average interest rate on owner-occupied housing loans was 3.43% in October, and the average interest on buy-to-let mortgages was slightly higher, at 3.56%. Both average rates have dropped by 1.3 percentage points from the peak recorded last year, following declining Euribor rates.

Due to the low level of drawdowns, the stock of housing loans started to contract in annual terms in 2023. The trend continued in October 2024, albeit at a slower pace: the annual growth rate of the housing loan stock was -0.5% in October 2024, compared with -1.9% in October a year earlier. At the end of October 2024, the stock of owner-occupied housing loans stood at EUR 97.1 billion, and the stock of investment property loans was EUR 8.7 billion. The average interest rate on the housing loan stock (EUR 105.9 billion) was 3.77% in October.

Loans

At the end of October 2024, Finnish households’ loan stock comprised EUR 17.8 billion in consumer credit and EUR 17.5 billion in other loans (excl. housing loans).

Drawdowns of new loans granted to Finnish non-financial corporations in October totalled EUR 2.3 billion, of which loans to housing corporations amounted to EUR 516 million. The average interest rate on new drawdowns declined from September, to 4.72%. At the end of October, the stock of loans to Finnish non-financial corporations stood at EUR 108.1 billion, of which loans to housing corporations accounted for EUR 45.0 billion.

Deposits

At the end of October 2024, the stock of Finnish households’ deposits stood at EUR 110.5 billion, and the average interest rate on the deposits was 1.33%. Overnight deposits accounted for EUR 67.1 billion and deposits with agreed maturity for EUR 15.1 billion of the deposit stock. In October, households concluded EUR 1.5 billion of new agreements on deposits with agreed maturity, at an average interest rate of 3.16%.

For further information, please contact:

Ville Tolkki, tel. +358 9 183 2420, email: ville.tolkki(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 7 January 2025.

Related statistical data and graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/statistics/.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Inlåningen från hushållen ökar8.5.2025 10:00:00 EEST | Pressmeddelande

Vid utgången av mars 2025 var inlåningen från de finländska hushållen (112,1 miljarder euro) 3 miljarder euro större än vid motsvarande tid för ett år sedan. Inlåningen har senast varit större 2022. I juli 2022 var inlåningen den största genom tiderna, dvs. nära 114 miljarder euro. Vid utgången av mars 2025 var 68,4 miljarder euro av inlåningen från hushållen inlåning över natten[1], 14,9 miljarder euro tidsbunden inlåning och 28,8 miljarder euro placeringsdepositioner[2].

Kotitalouksien talletuskanta kasvussa8.5.2025 10:00:00 EEST | Tiedote

Maaliskuun 2025 lopussa suomalaisten kotitalouksien talletuskanta (112,1 mrd. euroa) oli 3 mrd. euroa suurempi kuin vuosi sitten vastaavana aikana. Talletuskanta oli viimeksi suurempi vuonna 2022. Vuoden 2022 heinäkuussa se oli kaikkien aikojen suurin eli lähes 114 mrd. euroa. Maaliskuun 2025 lopussa kotitalouksien talletuksista 68,4 mrd. euroa oli yön yli -talletuksia[1], 14,9 mrd. euroa määräaikaistalletuksia ja 28,8 mrd. euroa sijoitustalletuksia[2].

Growth in household deposit stock8.5.2025 10:00:00 EEST | Press release

At the end of March 2025, the stock of Finnish households’ deposits (EUR 112.1 billion) was EUR 3 billion higher than at the same time a year earlier. The last time the deposit stock was higher was in 2022. In July 2022, it had reached its all-time high at almost EUR 114 billion. At the end of March 2025, EUR 68.4 billion of households’ deposits were overnight deposits[1], EUR 14.9 billion were deposits with an agreed maturity and EUR 28.8 billion were investment deposits[2].

Utbetalningarna av företagslån ökade från i fjol30.4.2025 10:00:00 EEST | Pressmeddelande

I mars 2025 utbetalades nya företagslån (exkl. bostadsbolag) mer än det dubbla jämfört med motsvarande tidpunkt för ett år sedan. Genomsnittsräntan på nya företagslån sjönk jämfört med mars året innan.

Yrityslainanostot piristyneet viime vuodesta30.4.2025 10:00:00 EEST | Tiedote

Maaliskuussa 2025 uusia yrityslainoja (pl. asuntoyhteisöt) nostettiin yli kaksi kertaa enemmän kuin vuosi sitten vastaavana aikana. Uusien yrityslainojen keskikorko laski edellisvuoden maaliskuuhun verrattuna.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom