Household bank loans almost unchanged year-on-year in December 2025

30.1.2026 10:00:00 EET | Suomen Pankki | Press release

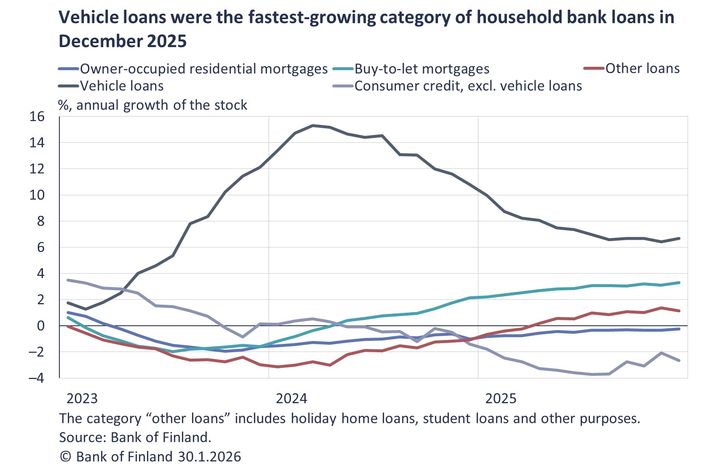

Finnish households’ aggregate stock of bank loans remained almost unchanged from a year earlier, at EUR 140.9 billion in December 2025. However, developments in loan volumes by different purposes vary.

At the end of December 2025, Finnish households had EUR 140.9 billion of loans granted by banks operating in Finland. The annual rate of change in the loan stock turned to growth during 2025 and stood at 0.2% in December. Households drew down new bank loans worth EUR 1.8 billion in December 2025 and EUR 22.5 billion over the whole of 2025. Drawdowns in December were 5.3% higher than in the corresponding period a year earlier, and drawdowns over the whole of 2025 exceeded those made in 2024 by 8.2%.

Of the stock of household bank loans, 75% consisted of housing loans. The year-on-year change in the housing loan stock also turned to a slight 0.1% growth in December 2025. Prior to this, the housing loan stock had contracted continuously since April 2023. At the end of December, EUR 9.1 billion of the housing loans were buy-to-let mortgages and EUR 96.7 billion were owner-occupied residential mortgages. During 2025, the annual growth in the stock of buy-to-let mortgages accelerated and was at its fastest in December at 3.3%. The stock of owner-occupied housing loans contracted throughout the year, albeit at a slowing pace. In December, the annual change in the stock of owner-occupied residential mortgages was -0.2%, as opposed to -1.0% in the same period a year earlier.

December 2025 saw growth also in the stock of student loans (5.8%), holiday home loans (1.1%) and vehicle loans (6.7%). The stock of vehicle loans granted by banks grew at a fairly brisk but decelerating pace throughout 2025. However, the volume of new vehicle loan drawdowns in 2025 (EUR 2.4 billion) was exactly the same as in the previous year. The growth in the loan stock stemmed particularly from vehicle loans with maturities of 5–10 years, whose drawdown volumes increased already in 2023–2024. In December 2025, the stock of vehicle loans granted by banks was EUR 5.0 billion and accounted for nearly 60% of Finnish households’ vehicle loan stock. The remainder of vehicle loans are granted by other financial institutions. The annual rate of change in the stock of vehicle loans granted by OFIs was -5.4% at the end of September 2025.

The average interest rate on the stock of household bank loans was 3.32% in December 2025, compared with 4.14% a year earlier. In December 2025, the average interest rate on new household loan drawdowns was 3.51%, which was also lower than a year earlier (3.87%). The euro amount of non-performing1 household bank loans and the share of non-performing loans in the loan stock declined slightly during 2025. At the end of December, non-performing loans amounted to EUR 3.2 billion, or 2.3% of the loan stock.

Loans

Drawdowns of new housing loans by Finnish households in December 2025 amounted to EUR 1.2 billion, which was EUR 70 million more than in the same period a year earlier. Of the newly drawn housing loans, buy-to-let mortgages accounted for EUR 120 million. The average interest rate on new housing loans declined from November, to stand at 2.85% in December. At the end of December, Finnish households’ loans comprised EUR 17.5 billion of consumer credit and EUR 17.6 billion of other loans.

Drawdowns of new loans by Finnish non-financial corporations in December 2025 totalled EUR 4.1 billion, including EUR 850 million of loans to housing corporations. The average interest rate on new corporate-loan drawdowns declined from November, to 3.63%. At the end of December, the stock of loans granted to Finnish non-financial corporations totalled EUR 108.8 billion, with loans to housing corporations accounting for EUR 45.9 billion.

Deposits

At the end of December 2025, the total stock of Finnish households’ deposits was EUR 115.2 billion, with an average interest rate of 0.80%. Overnight deposits accounted for EUR 70.0 billion and deposits with an agreed maturity for EUR 15.9 billion of the total deposit stock. In December, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 1.4 billion. at an average interest rate of 2.18%.

Further information

- Olli Tuomikoski, tel. +358 9 183 2925, email: olli.tuomikoski(at)bof.fi,

- Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 27 February 2026.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/statistics/.

The statistical data are also available via an API from the Bank of Finland’s open data portal. For details, see https://www.suomenpankki.fi/en/statistics/open-data/

---

1 A loan is defined non-performing when it is more than 90 days past due or there is evidence indicating the customer's inability to perform on its obligations.

Keywords

Links

Bank of Finland

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Alternative languages

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Internationella valutafonden ger ut en landrapport om Finlands ekonomi19.1.2026 10:10:00 EET | Nyheter

Internationella valutafonden (IMF) har slutfört sin årliga utvärdering av det ekonomiska läget och de ekonomiska utsikterna för Finland. Utvärderingen grundar sig på diskussioner som IMF:s delegation i oktober-november 2025 förde i Finland med myndigheter, forskningsinstitut, privata finansinstitut, arbetsmarknadsparter och andra instanser. Den nu utgivna rapporten representerar IMF:s experters bedömningar och åsikter och den godkändes av IMF:s direktion den 9 januari 2026.

Kansainvälinen valuuttarahasto julkaisee maaraportin Suomen taloudesta19.1.2026 10:10:00 EET | Uutinen

Kansainvälinen valuuttarahasto (IMF) on saanut päätökseen vuosittaisen arvionsa Suomen talouden tilasta ja näkymistä. Arvio perustuu keskusteluihin, joita Suomessa loka-marraskuussa 2025 vieraillut IMF:n asiantuntijaryhmä kävi viranomaisten, tutkimuslaitosten, yksityisten rahoituslaitosten, työmarkkinaosapuolten ja muiden tahojen kanssa. Nyt julkaistu raportti edustaa IMF:n asiantuntijoiden arvioita ja näkemyksiä, ja se hyväksyttiin IMF:n johtokunnassa 9.1.2026.

Finlands Bank har ställt upp nya klimatetappmål för investeringsverksamheten och uppdaterat sina principer för ansvarsfulla investeringar16.1.2026 10:00:00 EET | Nyheter

Finlands Banks direktion har fattat beslut om nya klimatetappmål som styr bankens investeringsverksamhet mot nettonollutsläpp senast 2050. De uppdaterade målen ligger i linje med tidigare uppnådda etappmål, som var vägledande för verksamheten fram till 2025.

Suomen Pankki asetti sijoitustoiminnalle uudet ilmastovälitavoitteet ja päivitti vastuullisen sijoittamisen periaatteet16.1.2026 10:00:00 EET | Uutinen

Suomen Pankin johtokunta on päättänyt uusista ilmastovälitavoitteista, jotka ohjaavat pankin sijoitustoimintaa kohti hiilineutraalisuutta viimeistään vuoteen 2050 mennessä. Päivitys jatkaa aiempien välitavoitteiden linjaa, jotka saavutettuina ohjasivat toimintaa vuoden 2025 loppuun saakka.

Bank of Finland sets new interim climate targets for its investment activities and updates its responsible investment principles16.1.2026 10:00:00 EET | News

The Bank of Finland Board has adopted new interim climate targets to guide its investment activities towards carbon neutrality by 2050 at the latest. This update continues the approach of the previous interim targets, which guided activities up to the close of 2025 and which have been attained.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom