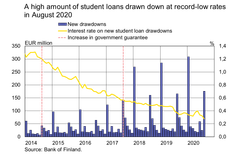

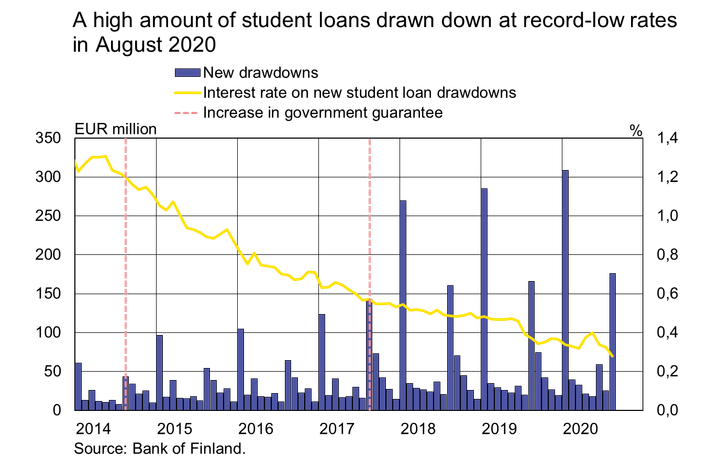

A high amount of student loans drawn down at record-low rates in August 2020

30.9.2020 13:00:00 EEST | Suomen Pankki | Press release

Drawdowns of student loans in August 2020 [1] totalled EUR 176 million, an increase of 6% on August a year earlier. The average interest rate on student loan drawdowns was record low in August, at 0.28%. Thanks to government guarantees, student loans pose a low risk for banks, which is reflected in the low margins on these loans.

The impact of the coronavirus crisis was particularly evident in drawdowns of student loans in June 2020: the total amount taken out was EUR 59 million, almost twice the amount compared with June a year earlier. One of the factors explaining this increase could be that there have been fewer summer jobs available during the coronavirus crisis. In addition to the greater popularity on student financial aid for the summer, many students may also have taken out their student loan for the academic year 2019–2020 as late as June this year. This was also the first time when most of the summer aid recipients could take out their student loan instalment for the autumn term already in June, which contributed to reducing the amounts drawn down in August more than in previous years. In summer 2020, student loan drawdowns were 20% higher than in the corresponding period a year earlier.

Fuelled by the high amount of drawdowns in the summer, the stock of student loans grew to EUR 4.5 bn in August 2020. The annual growth rate of the student loan stock was still brisk in August (16.1%), even though it has moderated over the past two years. Since the student financial aid reform of 2017, the student loan stock has grown by EUR 2 bn. This growth stems not only from larger loans granted as a result of the reform, but also from a higher number of borrowers, which in turn partly reflects the low level of interest rates.

Despite the brisk growth in the student loan stock, the stock of claims on government guarantees [2] contracted slightly in 2019. The repayment of student loans usually begins after the completion of studies, and the interest is capitalised as long as a student receives financial aid. Hence, any problems with loan repayment may be reflected in the stock of claims on government guarantees with a delay.

Loans

Households’ drawdowns of new housing loans in August 2020 amounted to EUR 1.7 bn, the same as in August a year earlier. At the end of August 2020, the stock of euro-denominated housing loans totalled EUR 102.1 bn and the annual growth rate of the stock was 2.7%. Household credit at end-August comprised EUR 16.8 bn in consumer credit and EUR 18.2 bn in other loans.

Drawdowns of new loans by non-financial corporations (excl. overdrafts and credit card credit) in August amounted to EUR 1.5 bn. The average interest rate on new corporate loan drawdowns declined from July, to 1.77%. The stock of euro-denominated corporate loans at end-August totalled EUR 97.4 bn, of which loans to housing corporations accounted for EUR 36.7 bn.

Deposits

The stock of Finnish households’ deposits at end-August 2020 amounted to EUR 101.4 bn and the average interest rate on the deposits was 0.07%. Overnight deposits accounted for EUR 88.8 bn and deposits with an agreed maturity for EUR 4.3 bn of the deposit stock. In August, households concluded EUR 450 million of new agreements on deposits with an agreed maturity, at an average interest rate of 0.07%.

For further information, please contact:

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

The next news release will be published at 1 pm on 30 October 2020.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

I december 2025 hade hushållen nästan lika mycket banklån som ett år tidigare30.1.2026 10:00:00 EET | Pressmeddelande

Beloppet av de finländska hushållens sammanlagda utestående banklån var nästan oförändrat från året innan och uppgick till 140,9 miljarder euro i december 2025. Det förekommer emellertid skillnader i utvecklingen av utbetalningarna av lån för olika ändamål.

Kotitalouksilla oli joulukuussa 2025 pankkilainaa lähes saman verran kuin vuosi sitten30.1.2026 10:00:00 EET | Tiedote

Suomalaisten kotitalouksien yhteenlaskettu pankkilainakanta pysyi lähes muuttumattomana vuodentakaisesta; se oli 140,9 mrd. euroa joulukuussa 2025. Eri käyttötarkoituksiin otettujen lainamäärien kehityksessä on kuitenkin eroja.

Household bank loans almost unchanged year-on-year in December 202530.1.2026 10:00:00 EET | Press release

Finnish households’ aggregate stock of bank loans remained almost unchanged from a year earlier, at EUR 140.9 billion in December 2025. However, developments in loan volumes by different purposes vary.

Internationella valutafonden ger ut en landrapport om Finlands ekonomi19.1.2026 10:10:00 EET | Nyheter

Internationella valutafonden (IMF) har slutfört sin årliga utvärdering av det ekonomiska läget och de ekonomiska utsikterna för Finland. Utvärderingen grundar sig på diskussioner som IMF:s delegation i oktober-november 2025 förde i Finland med myndigheter, forskningsinstitut, privata finansinstitut, arbetsmarknadsparter och andra instanser. Den nu utgivna rapporten representerar IMF:s experters bedömningar och åsikter och den godkändes av IMF:s direktion den 9 januari 2026.

Kansainvälinen valuuttarahasto julkaisee maaraportin Suomen taloudesta19.1.2026 10:10:00 EET | Uutinen

Kansainvälinen valuuttarahasto (IMF) on saanut päätökseen vuosittaisen arvionsa Suomen talouden tilasta ja näkymistä. Arvio perustuu keskusteluihin, joita Suomessa loka-marraskuussa 2025 vieraillut IMF:n asiantuntijaryhmä kävi viranomaisten, tutkimuslaitosten, yksityisten rahoituslaitosten, työmarkkinaosapuolten ja muiden tahojen kanssa. Nyt julkaistu raportti edustaa IMF:n asiantuntijoiden arvioita ja näkemyksiä, ja se hyväksyttiin IMF:n johtokunnassa 9.1.2026.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom