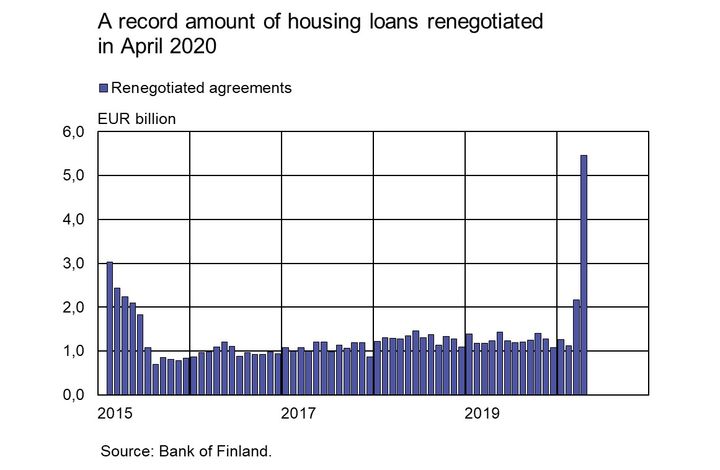

A large amount of loan agreements renegotiated in April

In April 2020, households and non-financial corporations renegotiated more loans than ever before [1]. The record volume of renegotiated loans [2] reflects the interest-only periods [3] offered by many banks to households and non-financial corporations due to the current exceptional situation.

In April 2020, renegotiated household loans [4] totalled EUR 6.2 bn, representing 4.6% of the household loan stock as at the end of April. Renegotiated housing loans [4] totalled EUR 5.5 bn, which is 5.5% of the housing loan stock [5]. Renegotiations of student loans, holiday cottage loans and consumer loans were also record high in April.

Households’ drawdowns of housing loans [6] in April 2020 amounted to EUR 1.4 bn, a decline of 10,8% on the corresponding period a year earlier. The stock of housing loans at end-April totalled EUR 100.9 bn and the annual growth rate of the stock was 2.8%.

Renegotiated loans to non-financial corporations (excl. housing corporations) in April 2020 totalled EUR 2.3 bn, which is 3.9% of the end-April corporate loan stock. The renegotiated volumes were record high in all size categories of corporate loans. Drawdowns of corporate loans were also high in April, at over EUR 1.9 bn.

In connection with the April statistical press release, the loans and deposits dashboard was supplemented with new visualisations of renegotiated loan agreements and industry-specific corporate loan stocks.

Loans

At the end of April 2020, household credit comprised EUR 16.6 bn in consumer credit and EUR 17.7 bn in other loans. The average interest rate on new drawdowns of loans by non-financial corporations rose slightly from March, to 1.83%. The stock of euro-denominated corporate loans at end-April totalled EUR 96.2 bn, of which loans to housing corporations accounted for EUR 36.0 bn.

Deposits

The stock of deposits by Finnish households at end-April totalled EUR 98.4 bn and the average interest rate on the deposits was 0.09%. Overnight deposits accounted for EUR 86.0 bn and deposits with an agreed maturity for EUR 4.2 bn of the deposit stock. In April, households concluded EUR 0.2 bn of new agreements on deposits with an agreed maturity, at an average interest rate of 0.11%.

For further information, please contact:

Anu Karhu, tel. +358 10 183 2228, email: anu.karhu(at)bof.fi

Olli Tuomikoski, tel. +358 9 183 2146, email: olli.tuomikoski(at)bof.fi

The next news release will be published at 1 pm on 30 June 2020.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

1 The collection of statistical data on renegotiated loan agreements was commenced in 2014.2 Renegotiated loan agreements refer to new loan agreements concluded as a result of renegotiations of the terms of existing loans.

3 Interest-only periods included in the terms of original loan agreements are excluded from the volume of renegotiated agreements.

4 Loans granted by credit institutions to households (excl. non-profit institutions serving households) in Finland.

5 See the news release on the impact of the interest-only periods of 2015 on the housing loan stock.

6 Euro-denominated loans granted by credit institutions to households and non-profit institutions serving households in the euro area.

Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Kutsu medialle: Suomen Pankin tiedotustilaisuus 19.12.2025 Suomen talouden näkymistä12.12.2025 13:41:01 EET | Kutsu

Elpyykö Suomen talous? Miten kauppasota ja maailmantilanteeseen liittyvä epävarmuus vaikuttaa talouskehitykseemme? Mitkä ovat julkisen talouden näkymät?

Bulgarisk lev kan växlas till euro i Finland 1.1.–2.3.202612.12.2025 11:00:00 EET | Pressmeddelande

Bulgarien övergår till euro den 1 januari 2026. För att valutautbytet ska gå så smidigt som möjligt växlar euroländernas centralbanker in lev till euro under tiden 1.1–2.3.2026.

Bulgarian levat voi vaihtaa Suomessa euroiksi 1.1.–2.3.202612.12.2025 11:00:00 EET | Tiedote

Euro otetaan käyttöön Bulgariassa 1.1.2026. Nopeuttaakseen Bulgarian levojen kotiuttamista euroalueen keskuspankit vaihtavat levoja euroiksi 1.1.–2.3.2026.

Bulgarian levs can be exchanged for euros in Finland from 1 January to 2 March 202612.12.2025 11:00:00 EET | Press release

The euro will be introduced in Bulgaria on 1 January 2026. To accelerate the repatriation of Bulgarian levs, the central banks of the euro area will exchange levs for euros from 1 January to 2 March 2026.

ECB-rådet föreslår förenkling av EU:s bankregelverk11.12.2025 11:04:31 EET | Beslut

Europeiska centralbanken (ECB) publicerade i dag de rekommendationer som tagits fram av ECB-rådets högnivågrupp för förenkling i syfte att förenkla regelverket för reglering, tillsyn och rapportering i Europa.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom