Bank of Finland invests in Bank for International Settlements’ green bond fund

4.6.2021 10:00:00 EEST | Suomen Pankki | Press release

The Bank of Finland has invested USD 300 million in the green bond fund of the Bank for International Settlements (BIS). This mutual central bank fund (USD BISIP) invests in e.g. renewable energy and projects relating to improvements in energy efficiency, and its activity supports the EU’s climate goals. The European Central Bank has previously invested in a similar euro-denominated fund.

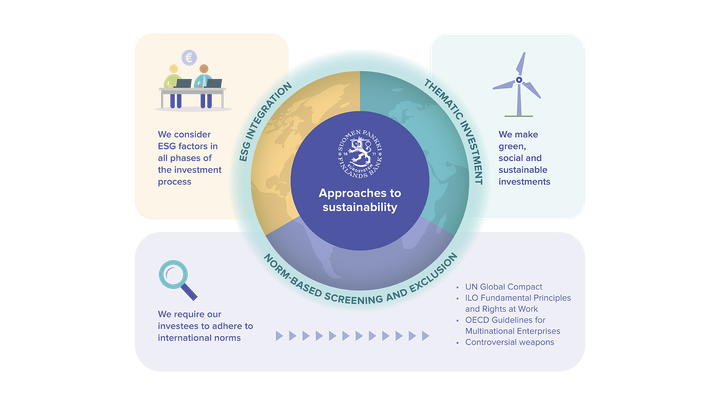

In addition to investing in the fund, the Bank of Finland has also invested directly in green, sustainable development and socially sustainable bonds. Thematic investments, of which the current fund is an example, are one of the Bank of Finland’s chosen approaches to responsible investment.

The aim of the Bank of Finland’s investment activities is to generally meet the liquidity, safety and yield requirements set for central bank assets. The Bank’s responsibility perspectives in managing its assets are based on one hand on the objective of sustainable investment and on the other hand on the better management of the various investment risks.

The changes brought by a warming climate generate risks that could alter the value of investments. On the other hand, combating climate change could open opportunities and new types of investment objects for investors. Companies investing in renewable energy sources and companies preparing better for tightening legislation and the coming climate challenges offer investors good opportunities.

By preparing in advance for the effects of climate change, we reduce the risks related to investment activities and target a better return-on-investment ratio for our investments. In practice, combating climate change will require the channelling of investment funds into low-carbon investments, whereby the carbon footprint of the portfolio will also be reduced. The Bank of Finland’s own climate goals will be published during the course of 2021.

Additional information: Principal Responsible Investment Specialist Anna Hyrske, tel. +358 9 183 2070.

The Bank of Finland’s principles of responsible investment: Responsible investment principles (suomenpankki.fi)

The Bank of Finland’s annual investment report: Management of financial assets – Bank of Finland's Annual Report 2020

Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

I Finland påträffades 483 förfalskade eurosedlar under 202527.2.2026 11:00:00 EET | Pressmeddelande

Bland de utelöpande sedlarna i Finland påträffades 483 förfalskade eurosedlar under 2025. Under 2023 påträffades 653 förfalskade eurosedlar i omlopp och 714 stycken under 2024.

Suomessa löytyi viime vuonna kierrosta 483 euroseteliväärennöstä27.2.2026 11:00:00 EET | Tiedote

Suomessa setelien kierrosta löydettiin vuoden 2025 aikana 483 euroseteliväärennöstä. Vuonna 2023 kierrosta löytyi 653 euroseteliväärennöstä ja vuonna 2024 niitä löytyi 714.

Total of 483 counterfeit euro banknotes found in circulation in Finland last year27.2.2026 11:00:00 EET | Press release

In 2025, a total of 483 counterfeit euro banknotes were detected among banknotes in circulation in Finland. The number of counterfeit euro banknotes detected in 2023 and 2024 was 653 and 714, respectively.

Genomsnittsräntan på bostadslån har stabiliserats27.2.2026 10:00:00 EET | Pressmeddelande

I januari hade 94 % av de nya bostadslånen Euribor som referensränta. Det senaste året har intresset för 12 mån. Euribor som referensränta för nya bostadslån minskat och intresset för kortare Euriborräntor ökat. Av de utestående bostadslånen har 95 % av lånen Euribor som referensränta och endast 5 % av lånen löper med fast ränta eller har bundits till bankernas egna referensräntor.

Asuntolainojen keskikoron kehitys tasaantunut27.2.2026 10:00:00 EET | Tiedote

Tammikuussa uusissa asuntolainoissa 94 prosentissa käytettiin viitekorkona euriborkorkoa. Viimeisen vuoden aikana 12 kuukauden euriborkoron suosio uusien asuntolainojen viitekorkona on vähentynyt ja vastaavasti lyhempien euriborkorkojen kasvanut. Asuntolainakannasta 95 prosentissa lainoista on käytetty viitekorkona euriborkorkoja, ja vain 5 % lainoista oli kiinteäkorkoisia tai pankkien omiin viitekorkoihin sidottuja.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom