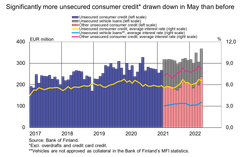

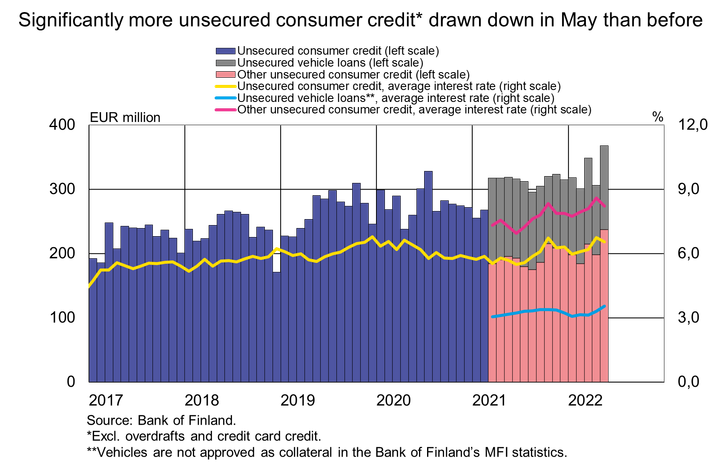

Considerably higher new drawdowns of unsecured consumer credit in May than before

The amount of unsecured consumer credit drawn from credit institutions in May 2022 was EUR 368 million, which is 15% more than a year earlier and the highest number ever recorded in any single month. The majority (EUR 237 million) of the new unsecured consumer credit consisted of non-vehicle loans[1]. The year-on-year growth in May was mainly due to these loans.

The average interest on new unsecured consumer credit[2] declined from April to stand at 8.2% in May. A little more than half of new consumer credit was linked to Euribor rates. The most frequently used Euribor was the 3-month rate. Fixed interest rates and other reference rates are more common as reference rates on unsecured consumer credit in comparison to other household loans.

The use of card credit has also increased in recent months. At the end of May 2022, the households’ stock of card credit amounted to EUR 3.4 billion, having grown almost 10% from a year earlier. In May, 81% of card credit was extended credit card credit, the remainder being convenience credit. The average interest rate on extended credit card credit rose from April to 9.6% in May. A little over 87% of those were linked to Euribor rates.

Consumer credit granted by credit institutions operating in Finland accounted for 69% of households’ all consumer credit (EUR 24.3 billion[3]).

Loans

New drawdowns of housing loans by Finnish households amounted to EUR 1.9 billion in May 2022, which is EUR 180 million less than in the same period a year earlier. Investment property loans accounted for EUR 143 million of the newly drawn housing loans. The average interest rate on new housing loans rose from April to stand at 1.13% in May. At the end of May 2022, the stock of housing loans totalled EUR 107.7 billion, and its year-on-year growth was 3.2%. Investment property loans accounted for EUR 8.8 billion of the housing loan stock. At the end of May, Finnish households’ loan stock included EUR 16.9 billion of consumer credit and EUR 18.1 billion of other loans.

In May, Finnish non-financial corporations drew down new loans worth EUR 2.2 billion, including EUR 460 million of housing corporations’ loans. The average interest rate on newly drawn corporate loans rose from April to 1.9%. At the end of May, the stock of loans granted to Finnish non-financial corporations was EUR 100.8 billion, of which loans to housing corporations accounted for EUR 40.6 billion.

Deposits

At the end of May 2022, the total stock of Finnish households’ deposits was EUR 112.2 billion, and the average interest on these deposits was 0.03%. Overnight deposits accounted for EUR 103.1 billion and deposits with agreed maturity for EUR 2.1 billion of the total deposit stock. In May, Finnish households made new deposit agreements with an agreed maturity in the amount of EUR 42 million, at an average interest of 0.30%.

For further information, please contact:

Markus Aaltonen, tel. +358 9 831 2395, email: markus.aaltonen(at)bof.fi,

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi.

The next news release on money and banking statistics will be published at 10:00 on 1 August 2022.

Related statistical data and ‑graphs are also available on the Bank of Finland website at https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/

[1] In the Bank of Finland MFI statistics, unsecured consumer credit also includes consumer credit secured for example by vehicle collateral. Only such collateral is accepted that is recognised as eligible collateral under the Regulation of the European Parliament and of the Council on prudential requirements for credit institutions and investment firms. Such collateral includes for example real estate.

[2] Excl. vehicle loans, overdrafts and credit card credit.

[3] As at end-March 2022.

Keywords

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Inlåningen från hushållen var den största genom tiderna i november 20257.1.2026 10:00:00 EET | Pressmeddelande

Inlåningen från hushållen har ökat 2025 samtidigt som inlåningsräntorna har sjunkit. Inlåningen har ökat i alla inlåningsformer. Dessutom ingick finländska företag i november rikligt med nya avtal om tidsbunden inlåning.

Kotitalouksien talletuskanta oli kaikkien aikojen suurin marraskuussa 20257.1.2026 10:00:00 EET | Tiedote

Kotitaloudet ovat kasvattaneet talletuksiaan vuonna 2025 samaan aikaan kun talletusten korot ovat laskeneet. Talletukset ovat kasvaneet kaikissa talletusmuodoissa. Lisäksi suomalaiset yritykset solmivat marraskuussa runsaasti uusia määräaikaistalletussopimuksia.

Households' deposit stock at all-time high in November 20257.1.2026 10:00:00 EET | Press release

Households have increased their deposits in 2025 while interest rates on deposits have declined. Deposits have grown in all deposit categories. In addition, Finnish corporations concluded a high volume of new agreements on deposits with agreed maturity in November.

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom