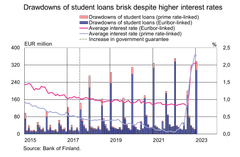

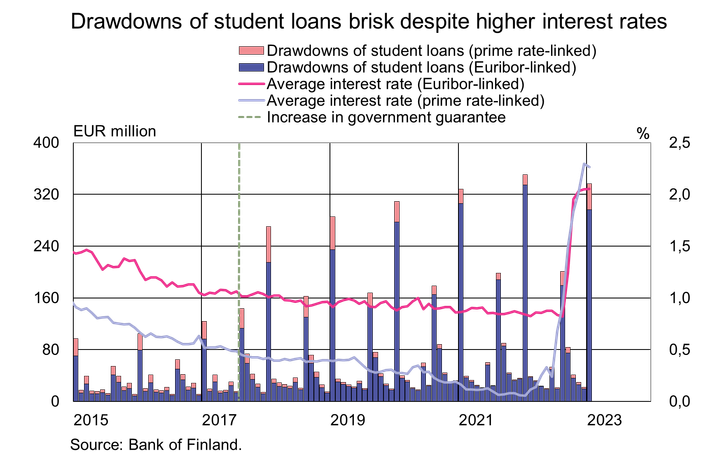

Drawdowns of student loans brisk despite higher interest rates

In January 2023[1], drawdowns of student loans totalled EUR 335 million, a decline of 4% on January last year. The average interest rate on the student loans drawn down in January 2023 was 2.24%. The interest rates on new student loan drawdowns have risen since January 2022, when the average interest was 0.09%. Loans linked to Euribor rates accounted for 88% of all the new drawdowns, and the average interest on these was 2.26%. Out of the new drawdowns of Euribor-linked student loans, 75% were tied to the 6- or 12-month Euribor.

The stock of student loans has grown at a brisk pace in recent years, although the annual growth rate has moderated steadily. At the end of the January 2023, the stock of student loans stood at EUR 6.0 billion, with an annual growth rate of 9.0%. This was the lowest annual growth rate since November 2014. The stock of student loans has almost doubled since the reform of student financial aid that came into effect in 2017.

In addition to larger loan tranches as a result of the student financial aid reform, the stock of student loans has also been augmented by an increase in the number of borrowers. The total number of people with outstanding student loan debt has grown rapidly in recent years. According to the statistics of the Social Insurance Institution, in the academic year 2021–2022 there were 515,000 people with student debt, when three years earlier there were 80,000 less.

Loans

Finnish households drew down new housing loans in January 2023 to a total of EUR 0.8 billion, or EUR 570 less than in January last year. Of the total, EUR 80 million were housing loans for investment property. The average interest rate on new housing loans rose from December, to 3.58%. At the end of January 2023, the stock of housing loans stood at EUR 108.1 billion, and the annual growth rate of the loan stock was 0.0%. Investment property loans accounted for EUR 8.7 billion of the housing loan stock. At the end of January 2023, the stock of loans to Finnish households comprised EUR 17.0 billion in consumer credit and EUR 18.2 billion in other loans.

Finnish non-financial corporations drew down new loans[2] in January 2023 to a total of EUR 1.9 billion, of which EUR 420 million were loans to housing corporations. The average interest rate on the new drawdowns rose from December, to 4.26%. At the end of January 2023, the stock of loans to Finnish non-financial corporations stood at EUR 104.9 billion, of which loans to housing corporations accounted for EUR 42.5 billion.

Deposits

At the end of January 2023, the stock of deposits of Finnish households amounted to EUR 110.9 bn, and the average interest rate on the deposits was 0.29%. Of the total, overnight deposits accounted for EUR 100.6 billion and deposits with agreed maturity for EUR 4.4 billion. In January, households made EUR 860 million of new agreements on deposits with agreed maturity, at an average interest rate of 1.98%.

For further information, please contact:

Usva Topo, tel. +358 9 183 2056, email: usva.topo(at)bof.fi

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi

The next news release on money and banking statistics will be published at 10:00 on 30 March 2023.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/mfi-balance-sheet/.

[1] The loan amount for the spring semester became available for drawdown in January.

[2] Excl. overdrafts and credit card credit.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Marja Nykänen utnämnd till medordförande i Finansiella stabilitetsrådets regionala konsultativa grupp för Europa1.7.2025 17:00:00 EEST | Pressmeddelande

Utnämningen stärker Finlands aktiva roll som främjare av global finansiell stabilitet.

Marja Nykänen nimitetty kansainvälisen rahoitusvakausneuvoston Euroopan alueellisen ryhmän toiseksi puheenjohtajaksi1.7.2025 17:00:00 EEST | Tiedote

Nimitys vahvistaa Suomen aktiivista roolia kansainvälisen rahoitusvakauden edistäjänä.

Marja Nykänen appointed as Co-Chair of Financial Stability Board’s Regional Consultative Group for Europe1.7.2025 17:00:00 EEST | Press release

This appointment reinforces Finland’s active role in fostering international financial stability.

Hushållen har mycket konsumtionskrediter – tillväxttakten har mattats av1.7.2025 10:00:00 EEST | Pressmeddelande

I maj 2025 uppgick det utestående beloppet av konsumtionskrediter som banker med verksamhet i Finland beviljat hushåll till 17,6 miljarder euro och utlåningen minskade med −0,7 % från året innan. Minskningen i det utestående beloppet av konsumtionskrediter är en följd av att utnyttjandet av konto- och kortkrediter och utbetalningarna av konsumtionskrediter utan säkerhet har minskat. Konsumtionskrediter beviljade av banker står för 63 % av hushållens totala utestående konsumtionskrediter. I maj 2025 minskade hushållens utestående kortkrediter[1] (3,6 miljarder euro) med −1,0[2] jämfört med ett år tidigare, då de utestående kortkrediterna vid motsvarande tidpunkt året innan ökade med nästan 6 %. Vid utgången av maj var 19 % av kortkrediterna räntefri betaltidskredit och 81 % äkta kortkrediter, dvs. kortkredit med ränta. I januari–maj 2025 utbetalades från bankerna 9 % mindre sedvanliga konsumtionskrediter utan säkerhet[3] jämfört med motsvarande tidpunkt ett år tidigare. Också det utestå

Kotitalouksilla runsaasti kulutusluottoja –kasvuvauhti hidastunut1.7.2025 10:00:00 EEST | Tiedote

Toukokuussa 2025 Suomessa toimivien pankkien kotitalouksille myöntämien kulutusluottojen kanta oli 17,6 mrd. euroa ja se supistui vuodentakaisesta −0,7 %. Kulutusluottokannan supistumiseen vaikuttavat tili- ja korttiluottojen vähentynyt käyttö ja vähäisemmät vakuudettomien kulutusluottojen nostomäärät. Pankkien myöntämät kulutusluotot kattavat 63 % kotitalouksien kokonaiskulutusluottokannasta. Toukokuussa 2025 kotitalouksien korttiluottokanta[1] (3,6 mrd. euroa) supistui −1,0 %[2] vuodentakaiseen verrattuna, kun vuosi sitten vastaavana aikana korttiluottokanta kasvoi lähes 6 prosentin vauhdilla. Toukokuun lopussa korttiluotoista 19 % oli korotonta maksuaikaluottoa ja 81 % pidennettyjä korttiluottoja eli korollista korttiluottoa. Tavanomaisia vakuudettomia kulutusluottoja[3] nostettiin pankeista tammi-toukokuun 2025 aikana 9 % vähemmän kuin vuosi sitten vastaavana aikana. Myös vakuudettomien kulutusluottojen kanta supistui toukokuussa. Suomessa toimivien pankkien myöntämistä kulutusluot

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom