Finnish Economic Policy Council background report: Lump-sum transfers are the most effective way to address unequal fuel tax burdens to low-income households

Excise taxes on fuels are the most effective way to mitigate road transport emissions in Finland, as they create continuous incentives to reduce annual mileage. However, the burden of the tax is higher on low-income car-owning households. The new background report for the Economic Policy Council analyses various models of compensation. The report is written by doctoral researcher Selina Clarke and the empirical analysis conducted by researcher Kimmo Palanne.

“To sum it up, a lump-sum transfer would compensate costs to low-income households, while not encouraging more driving,” says Clarke.

Low-income car-owners carry relatively high fuel tax burden

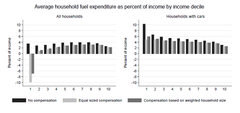

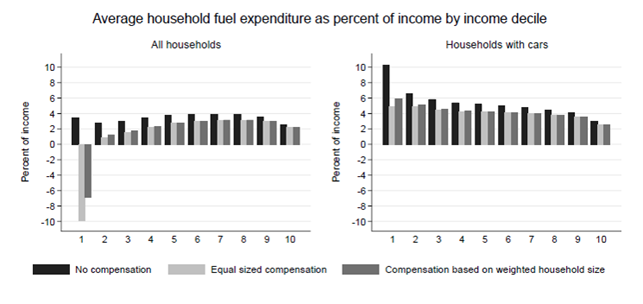

When looking at all households, fuel expenditure as a share of income is relatively small, approximately below 4 percent, and is the highest for households in the 6th-8th income deciles. However, when we only look at car-owning households, fuel expenditure as a share of income is considerably higher for low-income households – fuel expenses are over 10 percent for the lowest income decile and below 3 percent for the highest income decile.

A lump-sum transfer is the most effective way to reduce fuel costs

Compensation can effectively even out differences in tax burdens between income deciles. A lump-sum transfer is the most effective way to reduce the burden of taxation in the lowest income deciles. Furthermore, lump-sum transfers are expected to generate fewer environmentally harmful incentives compared to, for example, reductions in fuel taxes. The latter would make driving relatively cheaper.

Conversely, reductions in income or fuel taxes would disproportionately benefit high-income households who drive more and pay more tax.

Based on a comparison of different compensation measures, lump-sum transfers to households appear to be slightly better at reducing distributional effects across income deciles compared to transfers proportional to household size. The more strongly the compensation is tied to household size, the more households in higher income deciles benefit, because they tend to be larger. Furthermore, lump-sum transfers are also likely to involve lower administrative costs.

“As an example of the lump-sum transfer, households in some Canadian provinces receive a state tax refund four times per year. The refund is paid from the province's carbon dioxide tax revenue,” says Palanne.

The analysis utilises the Finnish Transport Safety Agency Traficom’s data (2016) to determine vehicle owners and each car’s annual distance driven in kilometres. Secondly, using Statistics Finland’s FOLK-dataset, it was possible to assign car owners to households and calculate each household’s total fuel costs and their ratio to household disposable income. In 2016, a total of €1,295 million petrol excise taxes and €1,362 million diesel excise taxes were collected. The estimated revenue from the carbon tax components was 809.7 million euros.The tax refunds modeled in the report are based on distributing this carbon tax revenue.

The Council publishes an annual report for 2022 evaluating recent economic policy decisions on Wednesday February 1st. Green transition is one of the of the topics of the report seminar.

Contacts

Kimmo PalanneResearcherVATT / Energy, climate and environmental policy

Tel:+358 295 519 521kimmo.palanne@vatt.fiSelina ClarkeDoctoral researcherUniversity of Helsinki / Economics

selina.clarke@helsinki.fiImages

Documents

About Talouspolitiikan arviointineuvosto (TPAN)

The Finnish Economic Policy Council was established in 2014 to provide independent evaluation of the objectives of economic policy and the effectiveness of the policy measures chosen. Through its work, the Council aims to improve the quality of economic policy decision-making and preparatory work, and to bring an independent and research-based perspective to the public discussion on economic policy.

Subscribe to releases from Talouspolitiikan arviointineuvosto (TPAN)

Subscribe to all the latest releases from Talouspolitiikan arviointineuvosto (TPAN) by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Talouspolitiikan arviointineuvosto (TPAN)

Talouspolitiikan arviointineuvoston uusin raportti nyt saatavilla suomeksi5.3.2025 13:45:15 EET | Uutinen

Talouspolitiikan arviointineuvoston tammikuussa julkistetun raportin suomenkielinen käännös on nyt julkaistu.

Rådet för utvärdering av den ekonomiska politiken: Välfärdsområdena inledde sin verksamhet under utmanande förhållanden – mer flexibilitet behövs för att täcka underskotten28.1.2025 10:00:00 EET | Pressmeddelande

Besluten som fattades under vårens ramförhandlingar stöder regeringens ekonomiska mål, men den svaga ekonomiska utvecklingen och de stigande kostnaderna inom välfärdsområdena försvagar utsikterna för de offentliga finanserna. På kort sikt bör ytterligare anpassningar som försämrar den samlade efterfrågan undvikas. Det vore rimligt att ge välfärdsområdena mer tid att genomföra besparingarna.

Talouspolitiikan arviointineuvosto: Hyvinvointialueet aloittivat haastavissa olosuhteissa – alijäämien kattamiseen tarvitaan lisää joustoa28.1.2025 10:00:00 EET | Tiedote

Kevään kehysriihen päätökset tukevat hallituksen taloustavoitteita, mutta heikko talouskehitys ja hyvinvointialueiden kasvavat kustannukset heikentävät julkisen talouden näkymiä. Lyhyellä aikavälillä tulisi välttää kokonaiskysyntää heikentäviä lisäsopeutuksia. Hyvinvointialueille olisi järkevää antaa lisäaikaa säästöjen toteuttamiseen.

The Finnish Economic Policy Council: Wellbeing services counties started in challenging circumstances – More flexibility needed to address deficits28.1.2025 10:00:00 EET | Press release

The fiscal policy decisions made last spring support the government’s economic objectives. However, weak economic performance and the rapidly rising costs faced by wellbeing services counties have worsened the fiscal outlook. Additional measures that weaken aggregate demand should be avoided in the short term. Wellbeing services counties should be given additional time to implement savings measures.

Talouspolitiikan arviointineuvoston taustaraportti: Helsingissä palkat muuta maata korkeammat – kertoo tuottavuudesta4.12.2024 07:00:00 EET | Tiedote

Tuoreen talouspolitiikan arviointineuvoston taustaraportin mukaan Helsingin työssäkäyntialueella palkat ovat selvästi muuta Suomea korkeammat. Helsingissä kerrytetty työkokemus myös nostaa palkkoja muuta maata nopeammin. Taustalla on raportin mukaan suuresta kaupunkikoosta johtuva korkea tuottavuus, joka mahdollistaa korkeammat palkat.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom