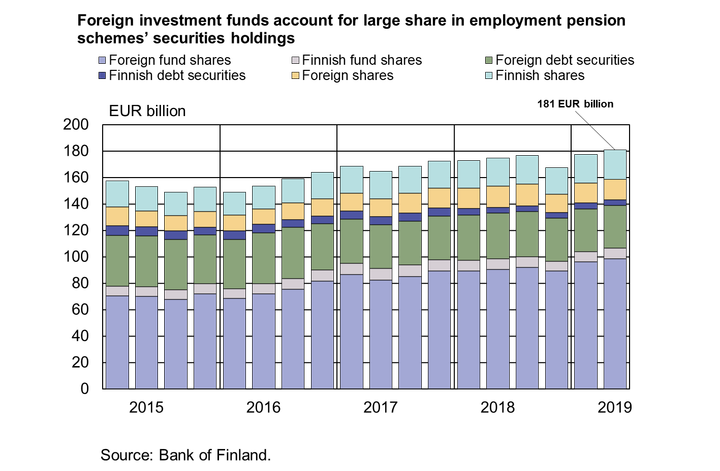

Foreign investment funds account for larger share in employment pension schemes’ securities investments

Employment pension schemes’ debt security investments down by EUR 1.9 bn in January–June 2019

At the end of June 2019, employment pension schemes held EUR 36.4 bn of debt securities [3], which is EUR 0.3 bn less than in December 2018. The value of debt security holdings grew in January–June by EUR 1.5 bn. In net terms, however, debt securities were sold in the amont of EUR 1.9 bn. At end-June 2019, the majority of debt security investments was in foreign government bonds (EUR 16.1 bn). The largest share was in US government bonds (EUR 3.3 bn), followed by French (EUR 2.5 bn), German (EUR 1.8 bn) and Italian and Belgian (EUR 1.0 bn, both) government bonds. Investments in Finnish government bonds at end-June totalled EUR 0.7 bn.

Employment pension schemes also held EUR 7.0 bn of debt securities issued by non-financial corporations [4] (Finnish companies, EUR 2.5 bn) and EUR 12.6 bn of debt securities issued by other sectors [5].

Employment pension schemes’ holdings of investment fund shares totalled EUR 106.7 bn at end-June 2019

Employment pension schemes’ investments in funds grew in January–June 2019 by EUR 9.9 bn. Over the same period, the value of fund shares increased by EUR 7.4 bn, and employment pension schemes made EUR 2.6 bn of new investments in investment funds.

A significant proportion (EUR 98.7 bn) of employment pension schemes’ fund investments were in foreign funds. Of these, investment funds registered in Ireland, the United States, Luxembourg and the Cayman Islands accounted for 89%.

At the end of June 2019, employment pension schemes also held EUR 8 bn of shares of Finnish investment and private equity funds. The majority of these investments was in bond (EUR 3.4 bn) and equity funds (EUR 2.1 bn).

The value of listed shares held by employment pension schemes up by EUR 3.2 bn in January–June 2019

In January–June 2019, employment pension schemes invested a net EUR 0.1 bn of new capital in non-financial corporations’ listed shares. At the end of June 2019, employment pension schemes’ holdings of listed shares of Finnish companies totalled EUR 16.3 bn and of unlisted shares EUR 3.4 bn. Holdings of foreign companies’ listed shares totalled EUR 13.2 bn. The majority (EUR 1.8 bn) of investments in foreign shares was in listed shares of US companies. At end-June 2019, employment pension schemes held listed shares of Nordic [6] companies amounting to EUR 2.1 bn, of which most (EUR 1.4 bn) consisted of listed shares of Swedish companies.

Related statistical data and graphs are also available on the Bank of Finland website: https://www.suomenpankki.fi/en/Statistics/saving-and-investing.

The next news release on saving and investing will be published at 1 pm on 11 November 2019.

[1] The news release only covers statutory employment pension schemes (S.13141) and excludes data on pension funds (S.129) and savings for pension purposes via insurance corporations (S.128).

[2] Investments in shares, bonds and fund shares.

[3]The majority was in bonds.

[4] Sector S.11.

[5] Sectors other than central government (S.1311) and non-financial corporations (S.11).

[6] Sweden, Denmark, Norway and Iceland.

Avainsanat

Yhteyshenkilöt

Antti Alakiuttu, tel. +358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Markus Aaltonen, tel. +358 9 183 2395, email: markus.aaltonen(at)bof.fi.

Kuvat

Linkit

Tietoja julkaisijasta

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Tilaa tiedotteet sähköpostiisi

Haluatko tietää asioista ensimmäisten joukossa? Kun tilaat tiedotteemme, saat ne sähköpostiisi välittömästi julkaisuhetkellä. Tilauksen voit halutessasi perua milloin tahansa.

Lue lisää julkaisijalta Suomen Pankki

Referensränta och dröjsmålsräntor enligt räntelagen för tiden 1.1–30.6.202622.12.2025 13:30:00 EET | Pressmeddelande

Referensräntan enligt 12 § i räntelagen (633/1982) är 2,5 % för tiden 1.1–30.6.2026. Dröjsmålsräntan för denna period är 9,5 % per år (referensräntan med tillägg för sju procentenheter enligt 4 § i räntelagen). Den dröjsmålsränta som tillämpas i kommersiella avtal är 10,5 % per år (referensräntan med tillägg för åtta procentenheter enligt 4 a § i räntelagen).

Korkolain mukainen viitekorko ja viivästyskorot 1.1.–30.6.202622.12.2025 13:30:00 EET | Tiedote

Korkolain (633/1982) 12 §:n mukainen viitekorko ajanjaksona 1.1.–30.6.2026 on 2,5 %. Viivästyskorko tänä ajanjaksona on 9,5 % vuodessa (viitekorko lisättynä korkolain 4 §:n mukaisella 7 prosenttiyksikön lisäkorolla). Kaupallisiin sopimuksiin sovellettavaksi tarkoitettu viivästyskorko on 10,5 % vuodessa (viitekorko lisättynä korkolain 4 a §:n mukaisella 8 prosenttiyksikön lisäkorolla).

Reference rate and penalty interest rates for 1 January – 30 June 202622.12.2025 13:30:00 EET | Press release

The reference rate under section 12 of the Interest Act (633/1982) for the period 1 January – 30 June 2026 is 2.5 %. The penalty interest rate for the same period is 9.5 % pa (under section 4 of the Act, the reference rate plus seven percentage points). The penalty interest rate applicable to commercial contracts is 10.5 % pa (under section 4 a of the Act, the reference rate plus eight percentage points).

Det är inte läge att skjuta upp lösningarna för Finlands offentliga finanser19.12.2025 11:00:00 EET | Pressmeddelande

Finlands offentliga finanser befinner sig alltjämt långt från balans. För att vända skuldsättningsutvecklingen krävs en betydande konsolidering av de offentliga finanserna och investeringar i tillväxt. Höjningen av de nödvändiga försvarsutgifterna försvårar den offentligfinansiella konsolideringen. Inflationen i euroområdet ligger på målet och ekonomin har vuxit något snabbare än förutsett.

Suomen julkisen talouden ratkaisuja ei kannata lykätä19.12.2025 11:00:00 EET | Tiedote

Suomen julkinen talous on edelleen kaukana tasapainosta. Velkaantumiskehityksen kääntäminen vaatii merkittävää julkisen talouden sopeuttamista ja investointeja kasvuun. Välttämättömien puolustusmenojen kasvattaminen vaikeuttaa tasapainottamista. Euroalueella inflaatio on tavoitteessa ja talous on kasvanut hieman ennustettua paremmin.

Uutishuoneessa voit lukea tiedotteitamme ja muuta julkaisemaamme materiaalia. Löydät sieltä niin yhteyshenkilöidemme tiedot kuin vapaasti julkaistavissa olevia kuvia ja videoita. Uutishuoneessa voit nähdä myös sosiaalisen median sisältöjä. Kaikki tiedotepalvelussa julkaistu materiaali on vapaasti median käytettävissä.

Tutustu uutishuoneeseemme