Growth in corporate lending through crowdfunding platforms

26.3.2020 13:00:00 EET | Suomen Pankki | Press release

P2P lending to foreign countries increased

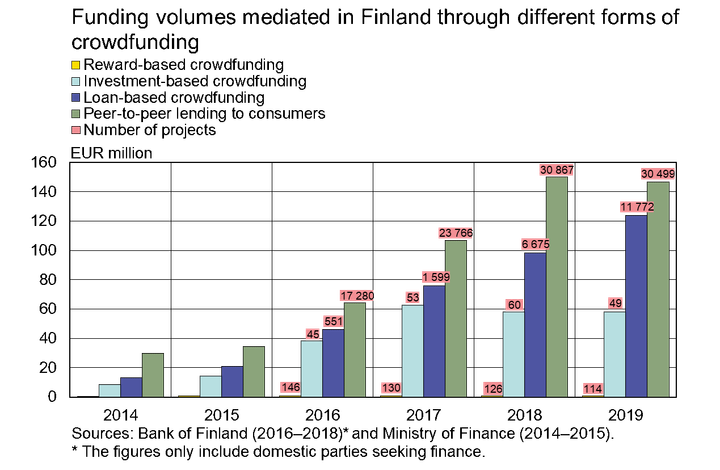

The volume of peer-to-peer (P2P) loans mediated has continued to grow. In 2019, the volume of P2P lending mediated to consumers amounted to EUR 160.8 million. P2P loans [2] mediated to foreign countries increased. In 2019, they amounted to EUR 11.5 million more than in 2018. The value of P2P loans mediated domestically decreased 2%, amounting to EUR 146.7 million in 2019. Although the volume of P2P loans mediated through service platforms has shown strong growth in recent years, their share in the total stock of Finnish households’ consumer credit [3] has remained low at about 1%.

Almost 38,000 successful P2P lending rounds were conducted in 2019 on service platforms. Domestic consumers conducted somewhat fewer P2P lending rounds in 2019 compared to 2018. However, the number of successful cross-border P2P lending rounds increased significantly in 2019.

The share of loan-based crowdfunding grew

In 2019, the volume of funding mediated by crowdfunding platforms [4] totalled EUR 182.5 million. The popularity of crowdfunding as a source of finance for companies has increased in recent years. However, funds raised through crowdfunding platforms only amounted to 1% of the corporate loan stock borrowed from credit institutions.

Loan-based crowdfunding is a more important source of finance for Finnish companies than investment-based [5] crowdfunding. In 2019, loan-based crowdfunding mediated to Finnish companies amounted to EUR 124.1 million, which is more than double the amount of investment-based crowdfunding raised by companies. The volume of loan-based crowdfunding was also 26% higher than in 2018.

Finnish companies conducted almost 12,000 successful loan-based crowdfunding rounds in 2019. The number of successful funding rounds almost doubled from 2018. However, the average loan size in loan-based crowdfunding continued to decrease due to the higher growth of the number of successful funding rounds relative to the total volume of loans received. The average loan size was slightly below EUR 11,000 in 2019. The reduction in loan size is primarily explained by the increasing popularity of loans mediated for factoring.

The volume of funding mediated through investment-based crowdfunding increased slightly in 2019 from 2018. The volume of investment-based crowdfunding mediated to Finnish companies in 2019 was EUR 58.3 million. The popularity of investment-based crowdfunding is limited in part by the high level of risk of the investments, the difficulty of assessing the value of the target companies and the lack of opportunities to exit the investments.

The number of successful funding rounds in investment-based crowdfunding was lower than in loan-based crowdfunding, as reflected in the higher average amount of funding raised. In 2019, the average amount of capital raised by Finnish companies through investment-based crowdfunding was EUR 1.2 million.

Of the different forms of crowdfunding, the lowest volume mediated was through reward-based crowdfunding. The volume of funding mediated through reward-based crowdfunding totalled EUR 0.8 million in 2019, up 8% from 2018.

Funding volumes mediated in Finland through different forms of crowdfunding

|

2017, EUR million |

2018, EUR million (12-month change) |

2019, EUR million (12-month change) |

|

|

Loan-based crowdfunding |

76.0 (64 %) |

98.3 (29 %) |

124.1 (26 %) |

|

Investment-based crowdfunding |

62.8 (64 %) |

58.0 (-8 %) |

58.3 (1 %) |

|

Reward-based crowdfunding |

1.0 (4%) |

0.7 (-27%) |

0.8 (8%) |

|

Peer-to-peer lending to consumers |

106.9 (67%) |

150.1 (40%) |

146.7 (-2%) |

|

Total |

246.7 (65%) |

307.2 (24%) |

329.9 (7%) |

* The figures include domestic parties seeking finance.

For further information, please contact:

Antti Alakiuttu, tel. + 358 9 183 2495, email: antti.alakiuttu(at)bof.fi,

Miska Jokinen, tel. +358 9 183 2122, email: miska.jokinen(at)bof.fi.

1 Comprises investment-, loan- and reward-based crowdfunding as well as peer-to-peer lending to consumers. The figures only include successful projects of domestic parties seeking finance. The figures also include anchor investors and co-investors.

2 Both in terms of value and number of contracts.

3 Consumer credit drawn from credit institutions.

4 Investment- and loan-based crowdfunding.

5 Direct equity investment in a non-listed company through a crowdfunding platform.

Images

Links

About Suomen Pankki

The Bank of Finland is the national monetary authority and central bank of Finland. At the same time, it is also a part of the Eurosystem, which is responsible for monetary policy and other central bank tasks in the euro area and administers use of the world’s second largest currency – the euro.

Subscribe to releases from Suomen Pankki

Subscribe to all the latest releases from Suomen Pankki by registering your e-mail address below. You can unsubscribe at any time.

Latest releases from Suomen Pankki

Hushållens aktieinvesteringar avkastade mycket bra 20259.2.2026 10:00:00 EET | Pressmeddelande

Hushållens aktieinvesteringar avkastade under året starkt i och med värdeökningen på inhemska aktier och vid årets slut var investeringarnas värde det högsta genom tiderna. Också hushållens fondinvesteringar var vid årets slut större än någonsin.

Kotitalouksien osakesijoitukset tuottivat erittäin hyvin vuonna 20259.2.2026 10:00:00 EET | Tiedote

Kotitalouksien osakesijoitukset tuottivat vuoden aikana vahvasti kotimaisten osakkeiden arvonnousun myötä, ja sijoitusten arvo oli vuoden lopussa kaikkien aikojen suurin. Myös kotitalouksien rahastosijoitukset olivat vuoden lopussa kaikkien aikojen suurimmat.

Household equity investments performed exceptionally well in 20259.2.2026 10:00:00 EET | Press release

Households’ equity investments performed strongly during the year, driven by the appreciation of domestic shares, and the value of investments reached an all-time high at the end of the year. Households’ mutual fund investments also closed the year at an all-time high.

Eurosystemets penningpolitiska beslut5.2.2026 15:23:03 EET | Pressmeddelande

ECB-rådet beslutar om penningpolitiken i euroområdet. ECB-rådet beslutade idag att hålla de tre styrräntorna oförändrade.

EKP:n rahapoliittisia päätöksiä5.2.2026 15:23:03 EET | Tiedote

EKP:n neuvosto päättää euroalueen rahapolitiikasta.8 EKP:n neuvosto päätti tänään pitää EKP:n kolme ohjauskorkoa ennallaan.

In our pressroom you can read all our latest releases, find our press contacts, images, documents and other relevant information about us.

Visit our pressroom